2014 the year for UK smaller companies

14th March 2014 17:41

by Helen Pridham from interactive investor

Share on

Smaller companies often have higher growth and are more dynamic than their larger peers, though they may be more volatile in the short term.

For investors with a longer term perspective, investing in smaller companies-oriented funds can therefore be very rewarding, as the following funds have proven.

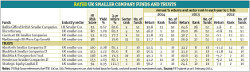

Our rated UK equity funds are split into three sections, with growth-oriented holdings and income-oriented funds completing the line up. You can also read the methodology behind how we chose our Rated Funds, which number over 160 in total.

Aberforth Smaller Companies IT

The six partners manage the trust as a team. They are somewhat different from other managers in this sector, as they have a "value" rather than a "growth" style. That meant that their short-term performance did suffer after the financial crisis; however, it has picked up again and they also have a strong long-term performance record.

Discretionary

The is a current member of our Premier League. It has been managed for over 20 years by the low-profile Simon Knott, who also runs the . Indeed Discretionary Fund Unit Managers are a wholly-owned subsidiary of the investment trust, which also focuses on investing in smaller companies.

Knott believes that by undertaking a rigorous risk analysis of the fund's investments, its overall risk profile can be controlled despite its concentrated portfolio. He also keeps turnover low, which helps to minimise costs and achieve investment consistency.

Henderson Smaller Companies IT

The won our best UK smaller companies trust award last year. Manager Neil Hermon has achieved steady outperformance of the Numis Smaller Companies index since taking over the fund in late 2002. He takes a long-term investment approach, holding stocks on average for around five years.

He tends to run his winners, and this has contributed to the trust's bias towards medium-sized companies as small-company holdings have expanded. He also feels mid-cap companies offer greater stability than smaller businesses, as well as good growth prospects.

Liontrust UK Smaller Companies

was the winner of our UK smaller/mid cap smaller fund award last year. It is managed by Anthony Cross and Julian Fosh. They invest in stocks in the FTSE Small Cap, Fledgling and AIM indices, and use an investment approach that they call the "economic advantage".

Through this process they seek out small companies that possess intangible assets; these help to provide barriers to competition and long-term pricing power. A key criterion is that the directors of the companies must own at least 3% of the listed equity. The fund is spread across different industry sectors.

Marlborough UK Micro Cap

The is included in Money Observer's higher risk long-term growth model portfolio. It is run by the very experienced Giles Hargreave, assisted by Guy Field, and invests in companies with a market capitalisation of £250 million or less at the time of purchase; a considerable proportion of the portfolio is invested in companies of less than £150 million.

Although companies of this size are traditionally thought to be at higher risk of failure than more established firms, Hargreave offsets this risk by holding a diversified portfolio of over 200 holdings.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.