Longer-term model income portfolio hits 57% gain

8th April 2014 15:53

by Helen Pridham from interactive investor

Share on

There seems to have been general agreement among investment experts this year that investing in shares is the best option for longer-term investors because of continuing low interest rates.

Yet stockmarkets are not rising smoothly. Although the FTSE 100 (UKX) index of the UK's biggest companies hit 6865 at the end of February, almost reaching its all-time high of 6930 recorded in December 1999, it subsequently suffered another wobble due to the problems in the Ukraine and general concerns about the health of the world economy.

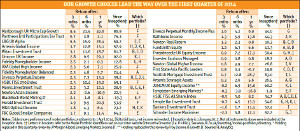

Despite the wobbles, all of our model portfolios continued to make progress over the first quarter of the year. In both the income and growth portfolios, it was the higher-risk versions that averaged slighter higher returns than the medium-risk models.

To find out why a Marlborough fund is the best-performing growth holding, read:Growth and income portfolios - leaders and laggards April 2014.

But investors who class themselves as medium risk-takers should not regret their choice, because stronger moves upwards can be followed by larger dips. Our goal, when constructing the portfolios, was that the medium-risk versions should provide a smoother ride.

Click here to viewthe constituents and factsheets of all 12 Money Observer Model Portfolios.

Income portfolios forge onGenerally speaking, the model income portfolios have continued to outperform those designed for capital growth over the year to date - as they have done for most of the time since inception. However, the gap is not as great as it has been in some previous quarters.Among the medium-risk income portfolios it was the balanced version that achieved the best return. Only one of its holdings, , fell slightly while two, Artemis Global Income and , achieved returns of over 4%. It is rather pleasing to see these two holdings, which are also included in three other income portfolios, do so well since the beginning of the year. was brought into the portfolios at the beginning of the year to replace a similar Schroder fund that had seen a change of manager to someone we regarded as relatively untested.

By contrast we decided to stick with Invesco Perpetual Income after Neil Woodford's departure was announced, as we rated the existing track record of his replacement, Mark Barnett. However, there have been considerable redemptions from the fund since the announcement, and there have been some fears that this could throw its performance off course. So far this has not happened. Barnett officially took the reins of the fund on 6 March.Among the higher-risk income portfolios, it was the immediate income version that produced the best performances over the quarter. It is also our highest-yielding portfolio currently, with a yield of 4.26%. Its good return was also mainly due to the presence of Artemis Global Income and Invesco Perpetual Income among its holdings. and also contributed.

Portfolio switchJO Hambro has decided, for the second time, to "soft-close" the to new investors for capacity reasons. This means that the managers do not believe that they will be able to achieve the same results if the fund gets any bigger. It is currently included in two of our higher-risk income portfolios. We have therefore decided to replace this fund in order to accommodate new investors. But we are not dissatisfied with its performance so existing investors could continue to hold it and monitor its future progress for themselves.

Capital preservation is another of the managers' goals. It is a relatively small trust with nearly £150 million of assets and it currently has just 50 holdings. Its rather defensive investment policy means that it can underperform in rising markets, but we believe it will perform well over the longer term. The managers describe their style as unconventional, cautious and driven by fundamentals. The trust's zero discount policy also helps to reduce the risk of volatility from this source.Troy Income & Growth is a Money Observer 2014 Rated Fund.