Shares to buy, hold and sell

15th April 2014 10:27

by Holly Black from interactive investor

Share on

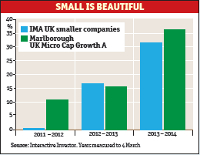

Giles Hargreave, manager of the , focuses on companies capitalised at less than £250 million when purchased.

The fund returned 38% in the past year and is one of our 2014 Rated Funds. Holly Black finds out which shares he is buying, holding and selling.

Buy - Proxama

Giles Hargreave is keen to point out that the fund is not a technology-only venture, with technology stocks comprising just 26% of the portfolio. Still, two of the companies he discusses are technology-focused and have been picked out by his co-manager Guy Feld, who is an expert in the field.

is a software company "operating in the area of proximity payments and marketing". The business uses NFC - near field communication - which allows your smartphone to direct you to, say, the nearest Pizza Express restaurant, should you so wish, and give you access to a discount voucher to dine there.

Given the impact of smartphones, Hargreave thinks the company, which is already a market leader, has huge potential for growth. He bought the shares at 2.5p and the price has been as high as 9p since; he thinks it has a long way to go yet.

Hold - Amerisur

Hargreave originally bought shares in Columbian-based oil exploration and production company back in May 2006 for 15p. But it was a bad time and he sold the shares at the end of that year without making any money. A few months later, in May 2007, he bought back in for 6p; he now owns four million shares. Since then the shares have soared to a current price of around 59p.

Amerisur has discovered a substantial oil field and owns 100% of it. The issue it faces, however, is in the logistics of moving the oil from the wells to the ships waiting for the cargo.

Hargreave says Amerisur will almost certainly be building a pipeline through Ecuador, which will improve capacity massively from the current 7,000 barrels per day to around 25,000. But in the meantime Amerisur faces the problem of moving its oil, compounded by threats from the guerrilla movement in Columbia.

What he is particularly attracted to about the business is its strong cash flow, which it is using to self-finance its improvements and develop its resources and capacity. He says that once the new pipeline is in place, it "will provide the catalyst to take the share price to a whole new level".

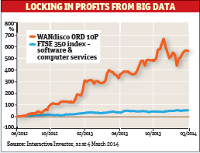

Sell - WANdisco

Turnover in the fund is "not enormous", about 42%. "We don't buy shares today to sell them tomorrow," says Hargeave. Yet software company has been in the portfolio for only 18 months. Another technology share, WANdisco floated in June 2012 at a share price of 180p and was bought by Feld and Hargreave at that point.

WANdisco is all about big data, and uses its proprietary Hadoop platform to guarantee customers 100% protection against losing their data. But Hargreave says there is too much hype around the company now, even though "it is at the heart of the big data revolution".

He sold his position when the share price topped 1000p, when "a valuation of £300 million for £10 million of sales looked stretched". The shares have since hit 1300p so he admits he may have sold a little early, but Feld points out: "It is best to lock in a gain now than risk being caught in a negative perception change that would smash the valuation."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.