European equities continue to perform in Tactical Asset Allocator

17th April 2014 11:44

by Ceri Jones from interactive investor

Share on

The experts are almost unanimous: that the UK is in for a solid bull market. Sarasin & Partners says annual equity returns of 12% are not unrealistic over the next few years.It bases its model on conservative assumptions, such as a dividend yield of 2.5% (an estimate that excludes share buybacks, which reduce the number of shares in circulation and therefore boost payout per share), real dividend growth of 3.5% (also understated compared with the IMF's forecast GDP growth of 3.8%) and inflation using forecasts based on a figure of 2.5%.The final factor fed into the Sarasin model is the market re-rating, for which it used 9%, much less than the typical average of 13% in bull runs.To view the tactical asset allocator portfolio's holdings and trading chronology, click here.

UK recovery

European equities

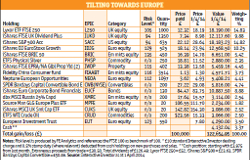

The rosy outlook for European equities also continues, as the peripheral countries enjoy spectacular growth - and there could be more to come from this direction, with earnings growth as high as 20% in 2014. While Germany is expensive, most countries in the periphery have been improving more swiftly than anticipated, with Ireland and Spain both early back into the market. In the past few weeks even the Greek banks have been issuing sizeable bonds, but it is Spain and Italy that have further to run.In October we suggested readers buy an Italian i-Share, and the FTSE Italia All-Share has risen nearly 30% in the five months since. Our portfolio is supposed to be moderate, however, so we will take a small position in the £300 million , run by Edinburgh Partners, which has maintained its bias towards the Continent's more depressed regions.Manager Dale Robertson is overweight Italy at 13% and Spain at 8%, compared for example with less troubled markets such as Switzerland and Sweden, as he believes their valuations still have some catching up to do. His biggest two holdings are France at 18.3% and the Netherlands at 14.4%.Other perhaps better-known concentrated European trusts are and , but with already in the portfolio, we hope the new holding delivers the particular bias we are after.To fund this we have sold down some of our holding in convertible bonds. The rationale for convertibles still passes muster, but the holding was rather a large one.