Investment trusts heading in the right direction

9th May 2014 11:09

Investment trust shareholders have had a great run for their money. Figures produced by Canaccord Genuity demonstrate that, on average, trusts in 14 out of 16 sizeable sectors outperformed open-ended funds in terms of share price total returns over both five and 10 years to the end of 2013 - in many cases by a wide margin.

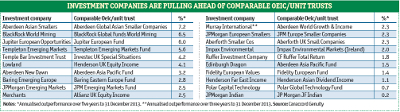

Further analysis by the stockbroker, comparing five-year share price total returns on 20 trusts with those of funds with the same manager and mandate, indicate that the trust outperformed the fund in every case.

The question is whether trusts can maintain such outperformance over the next decade, or whether their share price returns have been boosted by factors that are now less favourable.

One of these factors has been the contraction in the average discount to a 40-year low of 4%. With a third of trusts and closed-ended funds currently on premium ratings, it is hard to envisage discount-narrowing going much further. On the contrary, the trend seems bound to be at least partially reversed when equity markets come off the boil.

Costs gap narrows

Another important factor has been the historically lower costs associated with trusts. This has been significantly eroded by the virtual halving of fees on a wide swathe of open-ended funds since the introduction of the retail distribution review (RDR) at the start of 2013. This too will undermine the difference in performance between the open- and closed-ended sectors, unless more trusts join the 35 or so that have cut or simplified their management charges over the last 12 months.

Although these developments mean trusts will have to work harder to maintain their superiority, Brierley believes they have intrinsic structural advantages that should help them to do so over the longer term. The most important is arguably their independent boards, who will be responsible for implementing the measures he considers necessary.

On the discount front, Brierley says boards must be ready to buy back shares when discounts start to widen, and they must keep their promises to defend certain discount levels even if markets become difficult. He applauds the chairman of for saying that, having capitalised on the trust's premium rating by issuing new shares, "we have an obligation not to let the discount widen".

On the costs front, he wants boards to keep pushing for better terms from their managers. "Boards must act in the interests of shareholders - whom they are there to represent - not the management," he comments. He adds that he would like to see far more trust directors with "skin in the game".

Brierley wants boards of dull or underperforming trusts to be more willing to change management groups, not just managers within the same group; and he "would welcome the introduction of high-calibre managers currently outside the closed-ended industry."

The appointment of Andrew Bell to manage is arguably an example of how well the latter can work, while the former is illustrated by the transformation of since its mandate was moved from F&C to First State Stewart.

In the post-RDR world they [trusts] have to compete for business with open-ended funds"James Budden

Simon Elliott, who heads the investment trust research team at Winterflood Securities, agrees that boards must push for more competitive charges.

"They have been making progress, but there is still some way to go. As sizeable institutional investors, they must seek to negotiate the best possible commercial deal," he says.

Several big trusts have shown the way, with cutting its already low annual fee to 0.3%, and trimming its fee to 0.55%. At least six of the trusts managed by Henderson Global Investors have reduced their fees, while the City of London and Bankers trusts have removed their performance fees in return for small increases in their basic fees, to 0.365 and 0.45% respectively.

"As large trusts with a broad appeal to the retail markets, both are now very competitively priced," says HGI's head of investment trusts, James de Sausmarez. De Sausmarez is not too fussed about discounts, however.

"They are bound to fluctuate, but over the long term the difference between the buying and selling discount is much less important than the quality of the investment management. If discounts worry you, keep away from trusts," he advises.

As investment director of Bristol-based investment managers Rowan Dartington, Tim Cockerill has made regular use of trusts for many years. He thinks worries about costs can be overdone, suggesting that if you have to pay a little more for a better-quality manager, over five years you are likely to come out ahead. He points out that widening discounts can work both ways, offering attractively priced opportunities to those keen to buy well-managed trusts when they are temporarily out of favour.

However, he notes that ratings can prove remarkably range-bound, with Murray International for instance remaining on a premium despite its recent problems. He attributes this to the long-term approach of many trust devotees, combined with the comparatively limited choice of trusts, which makes it easier to spot the class acts.

Yield is an area where trusts enjoy an ongoing structural advantage, since their ability to allocate up to 15% of income to revenue reserves in a good year allows them to deliver much steadier dividend increases than funds, which must distribute their income in the year it arises.

"The closed-ended structure is also a key advantage for trusts investing in less liquid sectors, from smaller companies to private equity, direct property, infrastructure and all sorts of new alternative asset classes. Many of these would be impossible with an open-ended structure," Elliott says.

A closed-ended structure is also preferred by the managers of many traditional growth-oriented equity products, he adds. "If they manage both open- and closed-ended products, almost all say they prefer the latter because it makes it easier to make long-term, high-conviction decisions. They do not have to maintain liquid investments to meet redemptions. It allows them to go further down the size scale, and it also allows them to gear."

Above the crowd

Tim Cockerill reiterates the need for trusts to offer something that makes them stand out from the crowd, as does James Budden, marketing director of Edinburgh-based Baillie Gifford.

"In the post-RDR world they have to compete for business with open-ended funds that present no liquidity issues for even the largest wealth managers. On that basis, their costs must be competitive, they must be prepared to do buybacks or issue more shares as the situation demands, and above all they must have a mandate which stands out and which people want to buy," says Budden.

To illustrate his point, he points to the contrasting approaches of Baillie Gifford's global trusts. Scottish Mortgage, the largest, has a famously long-term "blue skies" approach, while Monks takes more of a top-down view and is more opportunistically managed with a lot of special situations; , meanwhile, has changed its remit to global smaller companies, where it has a much more integrated approach than the main incumbent. They also differ in their attitudes to gearing, with Scottish Mortgage generally one of the most highly geared trusts in the global sector.

Gearing has undoubtedly contributed to the closed-ended sector's outperformance over the past 10 years, and is another factor that may prove less helpful in a falling market over the next year or two.

However, Alan Brierley disagrees: "The simple maths is that if long-term returns exceed the cost of borrowing, then total returns are enhanced by gearing. At the end of the day, investors make equity investments because they expect total returns to exceed cash markets over the long term."

Editor's Picks