Continental recovery lifts European trusts

9th May 2014 11:54

by Fiona Hamilton from interactive investor

Share on

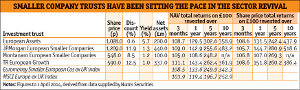

The European smaller companies trust sector was the top-performing sector in the first quarter of 2014, achieving an average gain of 9.2% in its net asset value (NAV) per share. This lifted its average one-year NAV total returns to an impressive 36.5%, while one-year share price total returns were even better at 39.7%.

The sector's strong recovery from its previously depressed state reflects growing confidence that the European economy is returning to health and the easing of fears that the eurozone might break up. This has boosted European shares in general, while smaller companies have also benefited particularly from growing enthusiasm for more domestically oriented companies.

A revival of hope for a number of badly beaten-up companies in peripheral European markets has been another plus for the smaller and medium-sized company arenas, as has the belief that a number of its constituents will benefit from a much-needed pick-up in capital expenditure.

This view is endorsed by Sam Cosh of . However, both managers expect companies to be much more profitable this year.

Cosh says European smaller-company profits are about a third below their peak levels, whereas those of US smaller companies have recovered much more strongly. On that basis, "there is significant potential for a reversion of profits from cyclically low levels", which should support further share price increases. He also hopes larger companies will respond to the improving environment by spending more of their substantial cash balances on taking over some of the smaller fry.

Francesco Conte, joint manager of , is even more upbeat. He agrees that earnings growth is badly needed to push share prices higher, but says he is hearing plenty of good news directly from cyclically sensitive companies across Europe.

Conte adds that many have had such a torrid time since their 2007 peak that they are scared to sound too bullish, so he expects earnings upgrades throughout the year.

One big attraction of European smaller companies is the wide pool of more than 1,500 quoted entities spread across a range of countries, cultures and geographies. Because Europe does not have a strong equity culture, they are not well researched. This means specialist managers can unearth undervalued opportunities, even when the sector has had a strong run.

However, the region could be rapidly deserted if the outlook clouds over, as it might if worries about US or Chinese growth undermine worldwide growth prospects, the political situation in Eastern Europe deteriorates sharply or fear of deflation escalates.

Another caveat is that the strengthening euro has contributed to the rise in the sterling value of trust portfolios, and that this will be reversed if the euro softens.

Different profiles

The four European smaller company specialists are interestingly varied, as is indicated by the disparity in their returns and ratings. JPMorgan European Smaller Companies trust (JESC) has an outstanding long-term record but has lagged in recent years, so its strong recovery over the past 12 months is welcome. The trust's gearing is very actively managed and is currently the highest in the European sector, at 15%.

Despite being much the largest trust in the sector, JESC generally has less than 80 holdings. Conte says he and fellow manager Jim Campbell tend to cut back to less than 50 holdings and move up the size spectrum when they are nervous, but they have increased the number of holdings and included more smaller companies because of the positive outlook.

The average market capitalisation of the holdings is £1.3 billion. JESC suffered in 2011/12 from venturing too early into more cyclical parts of the market and more peripheral countries, but this paid off handsomely in 2013. Its largest weighting is Italy at 21%, followed by Germany and then France, where Conte believes there are "a lot of great buying opportunities". He thinks cyclicals continue to offer the most upside.

"We buy when we think things are getting better, and the best returns come from things that are getting less bad, as in Greece in 2013," he says. "In comparison we think most quality/defensive growth stocks look expensive. Europe is very successful at exporting around the world, but at this stage we are focused on companies that make the bulk of their sales in Europe, because that is where the excitement is."

Montanaro European Smaller Companies lagged last year because of its very different approach. It looks to invest over the long term in good-quality companies, mainly from core European countries, and it is prepared to pay a premium for them. The trust admits it is likely to underperform when companies "at the cheaper, lower-quality and more cyclical end of the market" are in fashion. However, the trust's returns have been almost twice as good as its benchmark since Montanaro won the mandate in 2006.

The trust's managers say they see signs of a style rotation back to higher-quality growth stocks. The trust's latest factsheet states: "It is premature to call the end of the “dash for trash”, but we are starting to see the light at the end of the tunnel."

European Assets trust is differentiated by its high yield, but investors should note that this is funded largely from capital and will rise or fall with the NAV per share.

Total returns have been impressive since Paras Anand took charge in 2010, and his successor, Sam Cosh, has maintained a similar approach since mid 2011. Cosh has just 44 holdings, focused on companies capitalised at more than €1 billion (£824 million).

He is prepared to pay a premium for those with above-average earnings stability and strong balance sheets, since these hold up best in a setback. However, he has done well from searching in areas others have abandoned, such as Ireland in 2012. At 19%, Ireland is still the trust's second largest regional exposure after Germany, followed by Italy at 12%.

Generalist European trusts

Most generalist European trusts have some exposure to small and medium-sized companies, which has helped their recent performance.

has just over 15% invested in companies with a market capitalisation of less than $10 billion (£5.9 billion). has 23% in companies capitalised at less than £10 billion, including 5% in companies capitalised at less than £1 billion, whereas the figures for are 38 and 7% respectively.

Sam Morse, who manages , says small and medium-sized companies can be particularly rewarding. However, in mid 2013 he warned that they had enjoyed a fantastic run and were looking relatively expensive. He likes to confine his portfolio to 55 companies. He says this makes it hard to include smaller companies without running into liquidity problems.

tends to have more smaller-company exposure than stablemate . John Bennett, manager of the Focus trust, says its exposure to smaller companies is normally limited to 10% of NAV and was only 4.5% at the end of March.

says size is a residual consideration in company selection, but over the years an average of 25% has been in small and medium-sized companies, many of which have developed into larger companies.

European Investment Trust is the most positive. Manager Dale Robertson says its smaller-company exposure can vary from 10 to 70% – it is currently at 30%. He says there tends to be most value in small companies when the market is in recession, but it decreases as the recovery develops.

has been the top-performing generalist European trust over the past year because its long-term value approach has come good. It started buying into peripheral countries and depressed sectors such as telecoms, shipping and automotive suppliers in 2011 and has reaped the benefits.

Robertson thinks Europe still looks decent value in a global context, as does Japan.