Legg Mason Japan Equity a volatile choice

20th May 2014 09:23

by Rebecca Jones from interactive investor

Share on

has returned 80% over three years, nearly 50% more than any other fund in its sector. However, performance has turned negative in the past 12 months as its bias towards small and mid-cap growth stocks has fared poorly in current conditions.

Managed by Hideo Shiozumi, who has over 30 years' experience in investment, the Money Observer Rated Fund is unique within its sector, IMA Japan, for its focus on what Shiozumi describes as companies of "the new Japan".

"Our investment philosophy, and investment strategy, has been the same for the past 20 years. It is grounded in the search for companies that should benefit from structural changes in the Japanese economy. By this we mean moving from a regulated to a deregulated economy and from a manufacturing to a service-oriented economy," Shiozumi says.

Volatility

This combined with Shiozumi's 100% growth approach means that the portfolio is highly concentrated in small-cap domestic and service-driven businesses as well as in healthcare providers that stand to gain from Japan's ageing population.

One of the darlings of the Japanese tech boom, GungHo enjoyed rapid share price gains in 2013, rising 133% in April and a further 80% in May, finally reaching a peak of 1,090p in July. However, it plummeted 13% overnight following a negative financial report on 29 July and continued to do so - Shiozumi sold out on 3 Febuary this year at a price of 610p per share. The price currently stands at 528p.

Legg Mason Japan Equity is a highly volatile fund that is vulnerable to shifts in investor sentiment on Japan as well as currency movements as it is unhedged; over 12 months it has lost 23% as both of the above factors have weighed against it.

"Legg Mason Japan Equity is not a fund for orphans and widows. It is notoriously volatile and when Shiozumi's style of investing is in vogue, the returns can be spectacular. However, if the higher-risk businesses in which he invests fall out of favour the losses can be severe," explains Gavin Haynes, managing director of Whitechurch Securities.

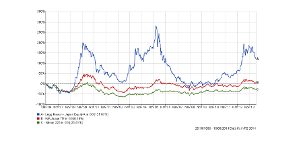

As such, Legg Mason Japan Equity has bounced between best and worst sector performer since its launch in 1996, gaining 70% one year, losing 50% the next - as it did in 2005 and 2006.

Yet, while this can be a wild ride, overall Shiozumi's gains tend to outweigh his losses with the fund up 122% since 1996 compared to a gain of just 6% from the IMA Japan sector and a loss of over 22% from the Nikkei 225 index in the same time period.

At the moment, the fund's prospects hinge on the success or failure of Japanese prime minister Shinzo Abe's "three arrow" economic reform package, which includes a $1.5 trillion (£892.25 billion) injection of liquidity from the Bank of Japan and a number of structural and economic reforms.

Abenomics

While this plan, dubbed "Abenomics" was met with market euphoria in 2013, many, including Old Mutual Global Investors economist Abbas Owainati, are losing faith in Abe.

"Prime minister Shinzo Abe's 'third arrow' was expected to introduce the structural reforms to simultaneously engineer growth in the economy. In our opinion this 'third arrow' disappointed, with a lack of labour market reform to correct for the vast misallocation of labour in Japan's industrial engine," he says.

Perhaps unsurprisingly Shiozumi disagrees with naysayers like Owainati, stating that he believes Abe will succeed in "overcoming deflation by creating a strong economic cycle", adding that the prime minister remains as popular in Japan as he was when elected.

Shiozumi says he expects market sentiment to turn positive in June or July when Abe unveils a new package of growth measures, which should provide a boost to the portfolio.

"Small-cap growth stocks have discounted too much pessimism and have far more upside than downside at this level. When the market sentiment improves we are confident that our stocks will benefit very well and recover aggressively," he says.

However, whether this happens or not may be of little consequence to a manager who has battled crisis after Japanese crisis and still managed to come out on top. In the long term, Abenomics could prove nothing more than another peak and trough on Legg Mason Japan Equity's performance chart.