Royal Mail gets stamp of approval in Nifty Thrifty portfolio

6th June 2014 09:35

by Richard Beddard from interactive investor

Share on

On the fourth anniversary of the first Nifty Thrifty selection the portfolio is up 59%, but performance has been flat since the last update three months ago. A benchmark investment in an index-tracking fund has made up some ground, rising 3% in value since the last update and 46% since June 2010.

£30,000 invested in the Nifty Thrifty portfolio four years ago would be worth £47,623 with dividends reinvested. £30,000 invested in an index tracking fund on the same basis would be worth £43,933.

To view the Nifty Thrifty's holdings and trading chronology, click here.

Good companies at cheap prices

Only companies in the FTSE 350 index - the London-listed companies with the highest market capitalisations - are included, and then only if they have F_Scores of five out of nine or more. The F_Score is a measure of financial strength.

The algorithm ranks the candidates according to two factors: return on capital, and earnings yield. These are proxies for quality and value, identifying statistically good companies at cheap prices.

Every quarter we schedule approximately one quarter of the companies - those the algorithm selected a year or more previously - for ejection, and replace them with the highest ranked companies available, employing simple rules to maintain the number of shares in the portfolio and its diversity.

This time eight shares were due for ejection, but two, and , received a reprieve because they are sufficiently highly ranked to be selected again.

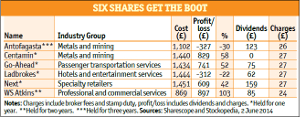

The six shares no longer ranked highly enough to remain did very well as a group, although , a mining company held for three years, and , which operates betting shops and websites, disappointed.

Centamin Egypt, which runs a gold mine, made a total return after broker fees and stamp duty of 58%. Train and bus operator did almost as well and retailer returned 42%. Shares in engineering consultancy produced a total return after charges of 103% over two years.

The cash available for investment every month is determined not only by the amount raised when shares are ejected from the portfolio, but also by dividends paid by the companies in the Nifty Thrifty since the last quarterly update. These dividends are reinvested, adding to the portfolio's return.

Once ineligible shares, those already in the portfolio and those from industries already fully represented are identified and excluded, the algorithm selects the highest remaining ranked shares. Apart from the two survivors Kentz and British Sky Broadcasting, six new companies join the portfolio.

Royal Mail

With a market capitalisation of £440 million, is one of the smallest companies in the portfolio. It operates online poker, casino, bingo and sports betting sites. £3 billion , which was ejected from relegated from the FTSE 100 (UKX) on Wednesday, is the UK's largest bookmaker, operating 2,400 betting shops. Like 888, it also has an impressive international online betting operation.

is a software house specialising in programs and services for small and medium-sized businesses. It's most famous for its accountancy and payroll software, but has grown its product range to facilitate most business functions.

The algorithm has snared highly profitable international exhibition organiser ITE after a sharp fall in its share price due to the troubles in Ukraine and the wider implications for Russia. The company earns 6% of revenue in Ukraine and 63% of revenue in Russia, where recession exacerbated by conflict, plus sanctions imposed by the EU, the US, and other nations, are already impacting international trade and sales of exhibition space.

Picking out-of-favour stocks like ITE might seem risky, but the algorithm is just doing what it is designed to do: identify the profitable companies that other investors don't want to buy. Their unpopularity makes the shares cheap, which is why over the long term the algorithm should produce market-beating returns.

It's not guaranteed to beat the market every year, though, which is one of the reasons why it works. If there were a foolproof way of beating the market, everybody would follow it and drive up the prices in the very shares we hope to buy cheaply. Following a contrarian strategy like the Nifty Thrifty requires a stubborn mentality and the strength to buy stocks when instinct might lead you to avoid them.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.