Fund Awards 2014: Japan

24th June 2014 16:10

by Helen Pridham from interactive investor

Share on

Larger fund winner: Legg Mason Japan Equity

Since December 2012, when Japanese prime minister Shinzo Abe launched his "three arrows" plan aimed at kick-starting the country's flailing economy, funds invested in the region have been enjoying a welcome tailwind.

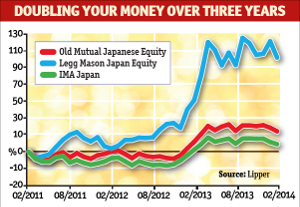

Top of the pile over three years is second-time Money Observer award winner , which has doubled investors' money, compared to a rather more pedestrian 8.5% return from the Japan sector.

Manager Hideo Shiozumi attributes much of this stellar performance to his fund's focus on small and mid-cap Japanese companies, which he says are often neglected by his peers in favour of bigger names.

In this "New Japan", Shiozumi believes services-related companies rather than manufacturers will thrive, particularly those serving Japan's increasingly aged population.

Accordingly, Shiozumi has over 30% of his fund invested in healthcare stocks including Ship Holdings, which is involved in the sale and leasing of medical equipment and facilities, as well as the construction of facilities such as nursing homes.

More recently, sentiment has turned negative on Japan as investors have begun to lose patience with Abe and the slow pace of reforms. Legg Mason Japan Equity has suffered as a result, producing fourth-quartile returns over six months.

Nonetheless, Shiozumi is confident that Abe's plan will come through. "After more than 15 months in office, prime minister Shinzo Abe remains as popular as ever and if growth falters, he can step up the stimulus dose any time he wants. We expect the Japanese equity market to move in a narrow range for the time being but to strengthen in the latter half of this year," he says.

The fund returned 101.2% in the three years to 1 March, compared to an average of just 8.5% for the Japan sector. In the past year its ongoing charges figure was 1.9%.

Smaller fund winner: Old Mutual Japanese Equity

Normally the managers of winning country-focused investment funds have an intimate and specialist knowledge of the country concerned, and strong views on where the economy is going.

However, the managers behind our best smaller Japan fund award, , are proving to be men of many talents. They have scored a hat-trick in this year's awards. Ian Heslop and his co-managers, Amadeo Alentorn and Mike Servent, have also won awards in the global and North American categories.

They have developed a process that allows them to react quickly to existing investment trends and seek out the stocks that are likely to benefit.

The team employs a rigorous process in order to select stocks across a variety of sectors. Companies are assessed against criteria including stock price valuation, balance-sheet quality, growth characteristics, efficient use of capital, analyst sentiment and supportive market trends.

The process does take into account some local factors. Heslop explains: "We don't expect management structures in Japan to be the same as those in North America. We know that accounting rules and how investors react differ."

However, he adds: "We have not tried to forecast what effect prime minister Abe's policies would have at a macroeconomic level, but investors who had been cautious up to the change in government suddenly developed an extreme risk appetite, which required us to rotate the portfolio quickly. So we don't predict. It is what the market is doing that tells us what investors are doing and we then aim to maximise the returns available from this trend."

Heslop acknowledges that the system is reactive so that when there is a sudden change of direction in markets the fund may underperform for a short time while the portfolio is readjusted. It also means there is a reasonably high turnover in his funds, but he is aware of the cost implications and says that changes are made in small tranches in order to keep transaction costs down.

The fund returned 22% in the three years to 1 March, compared to an average of 8.5% for the Japan sector. The past year's ongoing charges figure was 1.9%.