Fund Awards 2013 winners revisited

30th June 2014 09:48

by Rebecca Jones from interactive investor

Share on

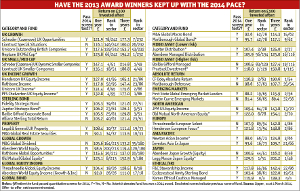

The Money Observer fund awards (MOFAS) aim to recognise and reward funds that deliver strong returns on a regular and consistent basis, which is why it is particularly satisfying to see so many of last year's victors retain their crowns.

Of last year's 43 award winners, 14 have maintained their strong performance, and hence held on to their titles, which equates to just over 33%, while an impressive 31 out of 43, or 72%, at least made it through to this year's shortlist.

Such consistent performance stands testament to the MOFA selection process, which places a strong emphasis on the risk involved in the returns generated by a fund. To compile our shortlist, we first filter out those funds that have delivered particularly poor returns or suffered excessive volatility over any one of the past three years.

Risk-adjusted basis

Among this year's repeat winners are MOFA stalwarts , , and , all of which have kept their places in the Money Observer hall of fame for more than three years.

A number of funds switched their best smaller-fund awards for best larger-fund awards as their strong performance led to rapid growth. These include one of this year's hotly tipped funds, , which has grown a staggering 321%, from £146 million to £615 million, over the past 12 months.

Because of the fund's small-cap bias, many analysts expect it to soft close imminently. However, co-manager Fraser Mackersie insists there is still "plenty of capacity" left for new investment into the fund.

has also enjoyed a period of stellar growth - swelling from just £68 million when it scooped the 2013 MOFA for best smaller North American fund to more than £300 million today, buoyed by its top-quartile performance over one, three, five and 10 years. In fixed income, graduated from best ethical bond fund to highly commended small UK Bond fund.

Commenting on his year, manager Chris Hiorns says: "Very low yields in government bonds, particularly a year ago when inflation was significantly higher than gilt yields, made for a difficult time. We mitigated this by keeping our duration short and, where we did go long, ensuring we were benefiting from a significant uplift in yield."

Funds we said goodbye to included , , and , all of which suffered a dip in performance over the past 12 months. This is not altogether surprising in the case of the latter funds, as both emerging markets and Japan suffered a turbulent year. However, all these funds also share a focus on quality stocks, which have been largely out of favour of late.

"The past 12 months have seen a market environment that provided some head winds for our investment style," explains Clare Hart, manager of the JPMorgan US Equity fund. "In particular, the lowest-quality stocks rallied strongly, outperforming the highest-quality stocks, while low- or no-dividend stocks outperformed dividend paying stocks," she adds.

UK recovery

Co-manager of Julian Fosh, whose fund was highly commended in the large UK growth category in 2013 but didn't quite make the grade this year, says the picture was much the same in the UK.

"Last year marked the beginning of the UK recovery, and in a recovery lower-quality companies bounce quite violently while higher-quality stocks, such as those our investment process identifies, lag," he says.

Fosh claims a large number of his peers in the IMA UK all-companies sector vastly outperformed their benchmark, the FTSE All-Share index, by switching into mid-cap stocks, especially "lower-quality" house builders and retailers. In contrast, Fosh and co-manager Anthony Cross stayed largely invested in the FTSE 100 (UKX).

For other funds that failed to repeat their past achievements this year, volatility rather than performance let them down slightly. These include last year's best higher-risk large mixed-asset fund, , which has returned a top-quartile 27.4% in the three years to 1 March, but whose Sharpe ratio put it out of the running for the prize this year.

However, according to director of marketing and distribution James Budden, this is no cause for concern, as Baillie Gifford tends to "embrace" volatility. "As truly long-term investors, we do not view volatility as a measure of risk," he says. "Conversely, we actively embrace it, as it allows us to add or buy stock we like at attractive valuations. Long-term returns are what we think matter most to shareholders."

Emerging markets star performer was another fund that, despite making first-quartile returns, was pipped to the winning post by rival on its Sharpe ratio.

However, First State also soft closed the fund last May, which took it out of the running anyway. Soft closing was a strong theme last year, as record inflows forced several funds to close, including last year's best large UK growth fund, Julie Dean's , and .

Many of our award winners have enjoyed stellar returns over each of the past three years, as their style and approach has worked well in global markets, which have rallied strongly since late 2011.

However, as interest rates rise and western governments continue to withdraw the flood of central bank money that has supported markets, managers are likely to find producing returns in future much more challenging. Next year may well put the MOFA selection process to a particularly rigorous test.

JPMorgan US Equity Income

Last year's best large North American fund, JPMorgan US Equity Income, has had a tough time of late, with returns around half those of this year's winner, Old Mutual North American Equity, in the 12 months to 1 March.

According to lead manager Claire Hart, this is largely due to the fund's "quality bias", which has fallen out of fashion recently as investors have flocked to lower-quality, higher-growth stocks. However, despite this, Hart insists she won't be changing her style.

"Our investment philosophy emphasises investing in high-quality, conservative companies with relatively stable patterns of earnings. Currently, we feel some of the biggest dividend payers are expensive or don't meet our quality bias; we stay committed to our approach, focusing on what we believe are visible earnings patterns and sensible valuations," she says.

It hasn't been all bad news for the fund over the past year, with holdings in US financial companies such as Prudential Financial, McGraw Hill and retail bank Wells Fargo providing a welcome boost as many firms continue to benefit from an improving US housing market.

On the outlook for the North American economy as a whole, Hart remains sanguine: "So far we've seen little evidence to suggest we should change our view that US equities are a reasonable but not undervalued investment. We still see a year of modest gains ahead, with a little more volatility than we've experienced of late," she says.