Trust Awards 2014: Asia Pacific

11th July 2014 09:31

by Fiona Hamilton from interactive investor

Share on

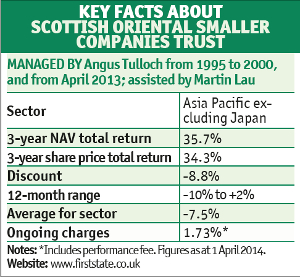

Winner: Scottish Oriental Smaller Companies

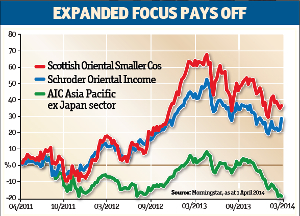

Having led their markets up during the post-2008 bull market, smaller companies in Asia proved vulnerable in last year's regional downturn. However, ' strong performance in the two preceding years won the trust our award once again.

achieved better three-year NAV returns, but did not make the grade in the past year because it was less defensively positioned.

Edinburgh-based Angus Tulloch, who heads First State Stewart's 30-strong Asia Pacific and emerging markets team, is lead manager at SOSC. He is assisted by Martin Lau, a senior Hong Kong-based manager.

The trust's relative resilience over the past year owes much to the managers' caution - 14.5% of assets were held in cash at the trust's 28 February financial year-end. Exposure to China and Asia Pacific was trimmed in the first half of 2013, as were holdings in the consumer discretionary sector, where valuations looked stretched.

The main portfolio additions were in India, where First State is backing companies it expects to do well in most economic conditions or to benefit from rupee weakness, such as Tata Global Beverages, Marico and CMC. These positions have worked well, and India is now the trust's largest country weighting at about 20%.

Tulloch favours an absolute return approach and therefore looks to limit downside risks. They identify well-managed, financially strong companies with solid long-term growth prospects. Family ownership is viewed favourably because it fosters a risk-aware culture and longer-term horizons.

SOSC's country weightings are benchmark-agnostic, but geographic and sectoral diversity is maintained. Tulloch is cautious. He says the performance of Asian equities will be influenced by monetary policy globally. "The stimulus programme being undertaken is unprecedented and the long-term consequences unknown," he adds.

He is wary of asset bubbles among smaller companies in certain sectors and countries. "Only a few companies in the trust's investment universe offer significant upside over the longer term," he says.

Highly commended: Schroder Oriental Income

was the only other contender for the award to achieve an above-average performance in each of the past three years.

The fund's NAV total returns have been among the best in the Asia Pacific ex Japan sector over three years - and five years. Its yield of 4.2% and five-year average annual dividend growth of 6.3% a year make it highly recommended.

Manager Matthew Dobbs has followed Asian markets since 1987 and has managed this Guernsey-registered fund since its 2005 launch. Although London based, he has spent a lot of time in the Far East and is well-supported by Schroder's team of Asia-based analysts.

Dobbs says Asia accounts for more than a third of companies in the MSCI AC World index that yield more than 4%, so it's a good choice for income investors. Income has provided a hefty slice of total returns in Asia over the longer term, and many Asian firms could pay higher dividends.

Dobbs believes the macroeconomic picture in Asia is improving, but expectations remain low, so it is one of the few places in the world where rising earnings have not been fully reflected in share prices. He sees plenty of "pockets of value", and the trust is around 6% geared.

He says: "China is the elephant in the room, but lots of companies are more dependent on the US and other developed economies than on China, while the leadership in China recognises the need for change."

The trust's basic fee is 0.75%. Its performance fee has a less demanding hurdle than SOSC's but is capped at 1% of net assets.