Trust Awards 2014: High Income

14th July 2014 09:04

by Fiona Hamilton from interactive investor

Share on

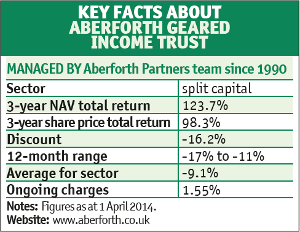

Winner: Aberforth Geared Income Trust

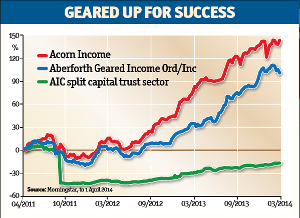

Well-structured gearing can be used to enhance a trust's yield. It will also accelerate its returns in a rising market. The ordinary shares of are around 40% geared by its zero dividend preference shares, and it has benefited on both counts over the past three years.

The UK stockmarket as a whole has been relatively buoyant over that period, but the Numis Smaller Companies index (NSCI), which is the trust's benchmark, has been even stronger with a three-year gain of 64.6%.

The increase in the trust's total asset value has been better still at 80.5%. The trust's gearing has added the icing on the cake, lifting the net asset value (NAV) total returns on the ordinary shares to 123.7%.

In contrast, companies lower down the size spectrum were widely ignored for several years following the 2008 crisis, regardless of their quality or their yield.

This appealed to Aberforth's value-oriented investment team, and it worked well for them in 2013 after an unusually long run during which a growth-oriented approach was more successful.

Investment selections are based on in-house bottom-up research and are benchmark-agnostic. As a result the portfolio is heavily overweight in industrials at 46%, a bit overweight in consumer services at 22.5%, but in line with technology at 8%.

It is underweight or has negligible exposure to almost everything else. The average historic price/earnings ratio for holdings is substantially lower than that of the Numis index, the average yield is higher, and the portfolio also looks good value in terms of enterprise value to EBITDA (earnings before interest, tax, depreciation and amortisation).

At the start of 2014 the partners were worried that smaller company profits had fallen slightly in 2013, which meant rising stock prices were largely due to higher valuations.

They have therefore been relieved to see the UK economy picking up. A third of the trust's holdings have net cash on their balance sheets and the partners would like to see this put to work, ideally via organic growth or sensibly priced takeovers.

However, they warn that the long-term outperformance of the value investment style can "come in violent bursts and be easy to miss, as in 2009 and 2013".

Investors must also remember that highly geared trusts show at their best in rising markets, but can underperform when markets fall.

Highly commended: Acorn Income Fund

The geared ordinary shares of achieved a NAV total return of 97.7% over the past three years, and share price total returns of 141.5%. It won this award last year, but could not match Aberforth Geared Income's returns over the past year.

They are similar trusts in that Acorn Income invests primarily in well-managed, smaller UK companies, is around 40% geared by zero dividend preference shares, and aims for a high yield plus growth of income and capital.

However, it differs in two important aspects. First, its equity portfolio is more concentrated (40 holdings) and includes a lot of AIM-quoted holdings. Second, at least 20% of its assets are invested in an "income portfolio" of fixed-interest securities and higher-yield investment trust shares.

The fixed income portfolio is managed by Paul Smith of Premier Fund Managers and has significantly outperformed benchmarks such as the Merrill Lynch Sterling Non-gilts index. It enhances the fund's yield and the trust's chairman, Helen Green, says that its inclusion serves to "dampen down the volatility that might otherwise be a feature of the geared structure".

However it can also restrain the trust's upside, as in calendar 2013, when the equity portfolio gained more than 36% and the income only 12%.

The fixed income portfolio served Acorn Income well in the opening months of 2014, but it could be a drag again if the equity manager's hopes for further gains come to fruition.