Shell vs BP - who wins?

25th July 2014 15:40

by Harriet Mann from interactive investor

Share on

European oil majors begin their second-quarter results season soon and while opinions vary on the pace of earnings growth, most agree that a tight grip on costs has greatly improved prospects for free-cash flow over the next few years. Share prices should benefit, too.

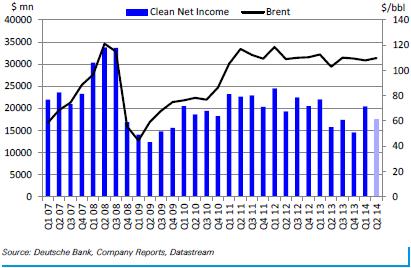

Of course, with geopolitical uncertainty over the West's sanctions on Russia and fighting in the Middle East oil prices are back in the news. Brent crude traded at $109.7/barrel in the second three months of the year, up $6.7 on a year ago and nearly $2 up on the quarter, according to Barclays data. And prices are widely tipped to hit $113 in the third quarter, their highest quarterly figure since at least 2011.

But opinion on the outcome of quarterly numbers differs widely. Deutsche Bank predicts sector earnings will rise 11% year-on-year, but Barclays expects only flat headline earnings.

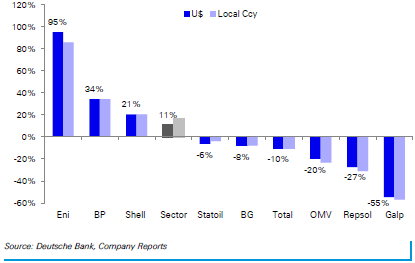

Deutsche Bank sees a wide dispersion in Y/Y earnings with only BP, Shell and Eni positive

"Dull would be desirable," says Deutsche. "After material earnings downgrades during the past 18 months and strong recent price performance what matters is these results simply underpin existing multiples." That will at least allow investors to keep focusing on the theme most likely to extend the re-rating - "the medium term prospect for improving free cash flow."

And growth here is critical to the investment case for the oil majors. Providing evidence that they can handle their cash, they are showing they can create real value from their assets. and , two of the biggest dividend payers around, have both embarked significant free cash flow growth programmes.

"We forecast free cash flow to continue to improve in each of the next three years and in our view this, when combined with attractive valuations relative to the wider market should continue to drive the shares higher," says the research team at Barclays.

Exploration and production projects - known as upstream - is expected to drive organic free cash flow cover of the dividend back above one times, although it's likely that downstream projects - refining and marketing the product - will suffer further weakness.

"Perceiving risk/reward to the upside in crude and downside in capex suggests that perceptions of free cash flow generation could evolve to assume a more rapid recovery than presently forecast," says Deutsche. "As belief that free cash flow cover of dividend can reach more than one times strengthens, we think the majors' current 4.8% dividend yield will look increasingly attractive relative to history, equity market and yield curve," it adds.

Shell

Royal Dutch Shell has had three volatile quarters, but new chief executive Ben Van Beurden has been clear that his strategy focuses on improving free cash flow, operating cash flow and return on average capital employed (RoACE).

Driven by higher oil prices and lower maintenance, Barclays expects Shell's net income to rise by 5% year-on-year in the period, despite production falling by 7% to 2.9 million barrels of oil equivalent per day (mmboed). This will have fallen by over 30% on the quarter, however, suggesting that although positive, last quarter's rate of growth is not yet sustainable.

Deutsche Bank see earnings growth supported by a $7/bbl rise in Brent crude

With full-year group earnings per share (EPS) expected to reach 384 cents from 310 cents a year ago, Shell is trading on a forward price/earnings (P/E) multiple of 11, a discount to the sector, with a 4.7% dividend yield.

Although Barclays expects Shell to report the weakest quarterly momentum in the sector, driven by weak European natural gas prices, he City is largely bullish, with Deutsche Bank rating the stock 'buy' and JPMorgan and Barclays rating it 'overweight'.

"With Shell's financial rehabilitation seemingly underway our sense is that the portfolio and prospects means that the name is, once again, set to be (rightly) viewed as the premium Euro super-major. As the cash cycle moves back towards balance and investors gain confidence in income funding we expect the yield premium at which Shell trades to come," Deutsche says.

The global and finance firm forecasts "depressingly consensual" income of $5.5. billion (£3.23 billion), down from the $7.3 billion in the first quarter. Barclays is slightly more conservative of the figure, pencilling in $5 billion, down 31% on the quarter. But the analysts highlight that confirmation that the new chief executive's strategy is going as planned is what is needed most. Shells warnings that further charges from write-downs in the US are on the cards could come into fruition in the quarter.

"With the ability to cover both capex and dividends from operating cashflow, Shell is in the position most of its peer group would love to be. We accept that Shell does not offer the same rate of production growth as others in the sector but what growth it does have is low risk on our assessment," concludes Barclays, rating the company its "preferred Mega Cap" stock.

BP

Unlike Shell, BP appears to have less to prove in these results. However, analysts do not seem as excited about BP, and Deutsche Bank expects that although the share price may have significant upside, it is more likely to lag behind its contemporaries. Also, free cash flow, the current statement trend of the oil sector, is only likely to enjoy "limited growth." However, Barclays does anticipate free cash flow growth will be "material" in the coming four years.

"The challenge from an investment perspective is that BP is far from the only company to be offering free cash flow growth in the coming years and as such is not differentiated compared to the peer group on our forecasts," the broker says.

"We expect this to prove a relatively straight forward quarter for BP. The absence of upstream charges and strong improvement at Rosneft suggest some uptick in E&P profit despite seasonal maintenance activity and the absence of sizeable trading income seen at the first-quarter stage."

Deutsche Bank currently expects BP will generate EPS of 90 cents this year, putting the shares on a forward PE ratio of less than 10. Production could drop as far as 8% thanks to the loss of low margin barrels in Abu Dhabi, divestments and high maintenance, predicts Barclays. It’s also experiencing weaker earnings, partially offset by the ramp-up of the Whiting refinery in the US. Deutsche Bank is less concerned, pencilling in a 3% drop.

Although production is forecast to be down for both super majors, with Shell taking the biggest hit, BP is expected to see positive growth by the end of 2015, with Shell following suit in 2016.

With the penalty phase of the Macondo trial coming into focus - a reference to the 2010 oil spill in the Gulf of Mexico - investors are understandably concerned.

Although BP should deliver the greatest earnings momentum, Barclays is bearish on prospects compared with rivals. "We see BP as disadvantaged relative to peers in terms of the pace and cost of securing new growth opportunities following Macondo," it says. "A recovery will take time and money. The relative upside on valuation metrics does not compensate for risks relating to a potential US trial."

"We still see better value elsewhere in European energy," it adds, rating the shares 'underweight' with a 600p price target.

At 497p, BP trades with a 1% premium to net asset value, whereas Shell trades with a 5% discount at 2,527p.

Shell has some wooing to do in the City following a disappointing 2013. But if new management gets it right - and they should - there is serious upside potential here. True, it will take time to close the valuation gap to US peers, but if it does, Barclays reckons the shares could be worth 3,250p. That doesn't look overly ambitious.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.