Support for European stocks wanes while Japan finds favour

30th July 2014 12:13

by Jim Levi from interactive investor

Share on

Unfortunately, the performance of European equities as a whole has disappointed. The FTSE Eurofirst 300 Ex UK index has barely changed over the past three months, although it has risen by a fifth in the past year, whereas the Italian, Greek and Spanish indices gained nearly 40%. Recently, however, the momentum has evaporated. Only in Spain, Denmark and Norway has there been some progress lately.

Chris Wyllie, who was the earliest member of our panel to spot the potential for recovery in European equities, acknowledges the need for a weaker currency to help provide that essential momentum for corporate earnings and the markets.

The asset allocation panellists are positive on US equities but they worry about how far and how fast interest rates could rise, in:Asset allocation panellists bullish on US stocks.

Precarious recovery

"Mario Draghi at the European Central Bank must be hoping higher interest rates in the US will boost the dollar. Europe really does need a softer euro as well as the new monetary stimulants he has introduced." Wyllie keeps his score at seven because he feels an uplift in earnings will make share valuations look very reasonable.

Keith Wade, chief economist and strategist at Schroders, admits: "Schroders is now less enthusiastic about European equities. They are not as cheap as they were, and on a price/earnings (P/E) ratio basis valuations are comparable with the constituents of the S&P 500 in the US.

"Yet there has been no follow-up in terms of earnings growth as yet. We are no longer saying they are going to outperform the US markets." He lowers his score from seven to six.

Robert Talbut, chief investment officer at Royal London Asset Management, maintains a six on the region, but thinks prospects are "not as good as elsewhere".

He now regards Japan as the "cheapest of the major equity markets", maintaining his score of eight. Japan's stockmarket made a spectacular recovery in the first half of 2013, but there was no real follow-through in subsequent months.

Lately there has been more resilience, bringing hope to our bullish panellists. Rob Burdett, co-head of multi-manager funds at Thames River Capital, sees increasing pressure on corporate Japan to improve efficiency from powerful government pension fund investors.

"Straws in the wind encourage me to take my score back up from five to seven," he says. His tactics on equities now are to switch funds out of the US and into Japan.

Japan optimism

Michael Turner, head of global strategy and asset allocation at Aberdeen Asset Management, is also more optimistic. "Japan as a market has the advantage of offering extra diversity by not always moving with other major markets," he says.

"The economy is no longer languishing, but it is not growing fast enough. So the central bank is expected to offer more stimulus." He keeps overweight at six. Wyllie also keeps his score for Japan at six. "The recent consumption tax has not derailed the recovery," he claims. "That is positive."

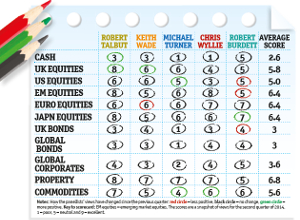

The five panellists

Chris Wyllie is the former chief investment officer at Iveagh Private Investment House. He is shortly expected to announce a new post at a leading discretionary fund management group.

Rob Burdett is co-head of multi-manager funds at Thames River Capital, with £1.5 billion under management. It is a largely autonomous business within the F&C group, managing funds of more than £100 billion.

Michael Turner is head of global strategy and asset allocation at Aberdeen Asset Management, with £330 billion under management.

Robert Talbut is chief investment officer at Royal London Asset Management, with £75 billion of assets under management.

Keith Wade is chief economist and strategist at Schroders, which has £268 billion of assets under management.

Wade provides a discordant note. He downgraded his score back in February from seven to five, and leaves it at that neutral position. "When you look at real wages in Japan they are being severely squeezed by that consumption tax," he says. "Spending may have recovered since April, but wage growth is virtually zero while inflation is at 3%. That's a worry."

UK equities have emerged as an intriguing sector - swinging back into favour with an average score up from 5.4 to 5.8 since May. "There are quite a few bulls around," says Wyllie, though he keeps his score at four. "It seems to be a target area for people who are not comfortable with Europe or emerging markets and are concerned about high US valuations."

Such investors, he says, see the UK market as "a bit like the US - only cheaper. The trouble with that is the strength of sterling. UK equities tend to underperform when the currency is strong. Mid-caps got murdered by the strength of the pound in the 1990s."

Wade tends to agree: "UK corporates have a lot of overseas earnings and the translation of those overseas earnings tends to work against them when sterling is strong."

But Talbut has become even more upbeat on the UK market, raising his score from seven to eight on the basis that our domestic market has been lagging other equity markets while we are increasingly benefiting from global growth.

Asia enthusiasm

If one key to the future performance of financial markets lies with the US economy and stock markets, the other lies with China. Wade reminds us that a so-called "hard landing" is still a risk for the Chinese economy. "It is in fact priced into Chinese equities," he says.

"So if the hard landing does not happen, then Chinese equities could take off." Such an outcome would of course have a profound impact on emerging markets generally. But Wade, along with Burdett, remains cautious on this sector. Both now score five.

Elsewhere, enthusiasm for emerging markets remains. Wyllie and Talbut both keep their scores at eight, while Turner remains overweight here. The clear-cut election outcome in India has left that market up nearly 40% in the past year, encouraging their bullishness. "Long-term investors should definitely be looking at emerging Asian markets," Wyllie insists, "and I feel there is some hope again for Chinese markets."

The property sector remains the panel's favourite, with the highest average score of 6.8. All the panellists apart from Burdett are enthusiastic about prospects, and even he finds it difficult to be bearish.

Scores in the commodities section are creeping up on hopes that continued steady global growth will eventually deliver higher base metal prices. Indeed commodity indices that measure broad spectrum price performances are close to one-year highs.