Quindell & Co in AIM blame game

31st July 2014 08:52

by Andrew Hore from interactive investor

Share on

In the past there have been complaints that the large number of tiny companies on AIM has held back the junior market. This year it is more a case of the largest companies holding back AIM.

Online fashion retailer is still the largest company on AIM but its value has more than halved since the beginning of the year and other large AIM companies, such as and , have performed poorly.

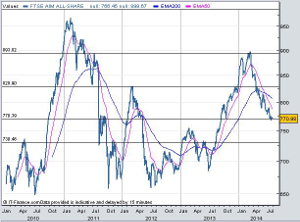

Most indices are based on the constituents having a weighting that relates to their market capitalisation. That means that the performance of an index can be dominated by a limited number of companies if their share prices move significantly.

The third-quarter profit warning in June by ASOS resulted in the share price falling by 31% on the day. This led to a 1.5% decline in the FTSE AIM All Share index and a 4.5% slump in the FTSE AIM 50 index. Of course, there are always other factors on any single day but ASOS undoubtedly had the main influence on these declines.

To find out more about four exciting companies that could pull a surprise or two in the months ahead, read:Four small-caps primed to outperform.

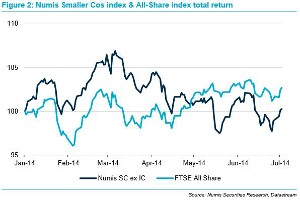

The Numis Smaller Companies index is based on quoted companies that are valued at less than £1.51 billion. This calculation is based on the bottom 10% of the market based on total market value of the Main Market. There are also versions of the index that include AIM.

The Numis Smaller Companies index plus AIM (excluding investment companies) has declined by 2.6% since the beginning of the year. This compares with a 2.4% decline in the equivalent index excluding AIM companies. Over that same period, the FTSE AIM index has dropped by 9.2%, while the FTSE 100 (UKX) index has risen by nearly 1%.

And how fortunes change. In the first quarter of 2014, insurance outsourcer Quindell was the largest single positive contributor to the so-called +AIM index. By the end of the second quarter it had become the fourth worst. Other highlights (or lowlights) of the half include interdealer broker dramatic slump, a spectacular profits warning from inkjet technology play and a bear raid at online video advertising firm .

However, stockbroker Numis notes in its second quarter report that the companies at the smaller end of the index have outperformed larger companies. The Numis 1000 index, which includes the smallest 1,000 companies (valued at £500 million or less), increased by 3% in the first half of 2014 - although this is only Main Market companies, not AIM. There are even signs of an improved performance by the resources sector. , and stood out in the first half, while on AIM both and did well.

Because there is a market capitalisation cut-off for the companies in the Numis index, it meant that at the beginning of the year ASOS, Igas and Kurdistan-focused oil and gas company were not included. The Gulf Keystone share price had already declined prior to its move to a standard listing.

Igas is now small enough to be included, but changes relating to the market size of the constituents are only made once a year. Numis says that if the cut-off point were calculated at the end of June 2014 then companies with a market capitalisation of less than £1.32 billion would be eligible for the index. This would exclude ASOS and Canary Wharf property investor .

Broker finnCap has launched three indices - finnCap 40 Exploration & Production, finnCap 40 Mining and finnCap 40 Tech - that are not weighted by market capitalisation. Each index has a combination of AIM and Main Market constituents and will be rebalanced and redefined every three months by the investment committee.

The idea is that the more focused nature of each index will provide a more representative view of the sector and they will not be dominated by a limited number of companies.

Each index has fallen over the five months or so since they were launched with the Tech 40 nearly 12% lower over the period. It is difficult to assess how effective these indices will be over such a short time frame.

The second-half outlook for smaller companies appears better and, assuming that there is not more bad news from the likes of ASOS, this should be reflected in the performance of the market. A number of AIM companies are showing indications of improving performance in the rest of this year and further ahead.

Andrew Hore is a small-cap company expert and former AIM Journalist of the Year.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.