Stocks to buy and sell in summer

8th August 2014 14:46

by Lee Wild from interactive investor

Share on

If you're reading this article it's likely you're either tied to your desk in a sweaty office, on the train home, or sat on the sofa with one eye on the box. You're unlikely to be in your speedos on a sandy beach with a good book in hand, or Phil Collins on your headphones. Unfortunately, lots of people are which means share dealing volumes are well below average. That can be responsible for wild swings in financial markets, and can make August a tricky month for investors.

It's probably best not to expect much from the next few weeks in terms of stockmarket returns. These days, it's only the eighth best month of the year, according to The UK Stockmarket Almanac. The average return is 0.6% and there's a 59% chance of a positive return in the month. Analysis by the bible for seasonal stockmarket statistics reveals the market tends to drift lower during the first few weeks of August before recovering in the second half of the month. The last day is especially strong.

This year, the pattern appears to be repeated. The FTSE 100 (UKX) ended July at 6,730. At the time of writing it's down over 2% at 6,577. Given geopolitical tension between the west and Russia over Ukraine, and an ongoing flare-up in Gaza, further falls cannot be ruled out. Demand for EU goods in many export markets is already being affected, and lingering structural issues pose serious problems for European Central Bank president Mario Draghi, says Rebecca O'Keeffe, Interactive Investor's own head of investment.

And August has certainly thrown up some nasty surprises in the past. Coincidentally, it was Russia that caused a stockmarket crash in August 1998 - the so-called Russian financial crisis that saw Moscow devalue the rouble and default on its debt. Then, in August 2011, the European sovereign debt crisis caused the FTSE 100 to slump by over 1,000 points between late July and 9 August to under 4,800. Then, on 18 August it lurched another 4% lower. In the US, the Dow had two of its worst days ever - it fell 513 points, or 4.3% on 4 August 2011 and by 513 points, or 6.4% on 31 August 1998.

Stocks that just love summer

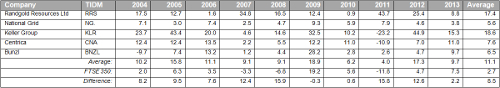

Despite the risks, there are some companies that thrive in the summer months. Research carried out by The UK Stockmarket Almanac (see table below) reveals the FTSE 350 stocks that do best between 21 June and 22 September.

Click on table to enlarge

All have risen in at least nine of the last ten summers - for and utility it's 10 out of 10. , a ground engineering contractor, is best of the best with an average gain of almost 19%, closely followed by Randgold.

Between them, these five have risen on average by 11.1% over the past ten summers, and outperformed the FTSE 350 in eight of the past 10 by an average of 8.5%. August's star performers are marine engineer - up 1% so far this month - and under-fire supermarket , although the latter is currently letting the side down, having slumped by 4% already this month.

So far this year, only Randgold and National Grid are outperforming the FTSE 350, but remember, the rest have got until 22 September to get back on track and keep the trend alive.

Stocks that hate the heat

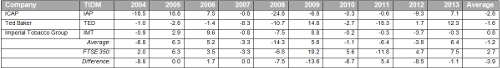

Not everyone likes the warm weather. Some stocks don't, either. There's a trio - interdealer broker , upmarket fashion retailer and - that are hit especially hard during the summer.

Click on table to enlarge

They've fallen in at least seven of the past ten summers and fallen on average by 1.2% in each one. Bank and asset manager , water company and mining heavyweight tend to do particularly badly in August.

So far this summer, all have reverted to type and are deep in negative territory compared with a pretty flat performance from the FTSE 350. The August trio are down, too.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.