Raven Russia too risky in Active Income Portfolio

12th August 2014 10:44

by Heather Connon from interactive investor

Share on

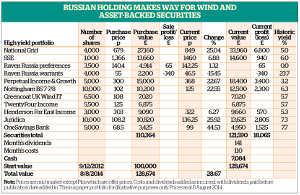

With interest rates likely to start rising both here and in the US within the next year, and Nick Louth deciding to stand down from the active income portfolio to pursue a career as a novelist, this is an opportune time for a general review of the performance and holdings.

The key decision from the review is to dispose of the preference shares and warrants in . While the company has not yet reported any negative impact following events in Ukraine, the political temperature is rising with President Putin responding to EU and US sanctions with its own embargo on food imports.

Russia's currency and stockmarkets have fallen and companies such as , which has a joint venture with Russia's Rosneft, admitted that further sanctions could damage its interests even before Putin announced his retaliatory embargo.

To view the active income portfolio's holdings and trading chronology, click here.

Foreign demand

The warrants have no income and, while there is no suggestion that the coupon on the preference shares is at risk, the political temperature is rising and so is the risk of doing business in Russia. Selling now will incur a small loss but we feel it is better to get out now.

We will keep the holdings in , and under review. Juridica, which helps to finance legal claims, announced a number of successes in its litigation portfolio earlier this year and that may mean a healthy dividend payment with its interim results, which are due to be announced shortly.

Both SSE and National Grid confirmed their commitment to raising dividends at least in line with inflation in their interim management statements. With stockmarkets starting to look fully valued, companies like these, with robust income streams and dependable dividends are particularly attractive.

The coupons on the and the are so attractive - and so difficult to replicate without significant risk in the current market - that we are happy to maintain our holdings, although we will monitor the impact of interest rate expectations on the price of these instruments.

The two investment trusts - UK-dominated and - continue to play a steady role in the portfolio and the shares of both are trading at around par - a reasonable entry price given that many of the better-performing investment trusts trade at premiums to net asset values (NAVs).

The Henderson trust went ex-dividend at the start of August and the 4.7p a share will be banked as the magazine hits the newsstand while Perpetual Income and Growth is expected to pay a further dividend next month.

Non-toxic income addition

We are adding two new holdings to the portfolio this month, both purchased with an eye to offering some defence against rising interest rates. The first is , a closed-ended investment company launched last year, by niche credit manager TwentyFour Asset Management.

Those who are familiar with asset-backed securities (ABSs) from the financial crisis will think TwentyFour's portfolio looks toxic, as these instruments were at the heart of the crisis. Asset-backed securities are formed by bundling up mortgages, loans or other assets into an instrument which can then be traded.

Parcelling up sub-prime mortgages in the run up to the financial crisis, which were then sliced and diced to provide a variety of types of return, meant the impact of mass defaults on these loans ricocheted across the financial sector and write-offs and provisions against them laid banks and insurers low.

But, as with all areas of the market, pockets of value can be found in even the most troubled of areas and the team of four managers at TwentyFour has proved pretty adept at finding them. The NAV total return on the fund, of more than 23% over the past year, was well ahead of its target of 6-10% a year.

Its latest update acknowledged that issues remain in the European banking sector - as witnessed by the fact that Portugal's Banco Espirito Santo was split into a good and bad bank as part of a rescue package - but added that its residential mortgage-backed securities had been largely unaffected by the crisis.

One of the key attractions of ABSs is that, as they are generally floating rate notes, they are a hedge against the rate rises that are looming ever-closer. While new issues in the market have increased to a mixed reception, the managers say: "The drivers of performance for the rest of the market over the medium and long term are still in place.

"These are not affected by the glut of supply that has been seen in the CLO [collateralised loan obligation] market, and in particular the benefit of holding floating rate securities as the market's expectations of a rate rise edges ever closer."

Shares in TwentyFour Income stand at a premium of around 5% and it has a discount-control mechanism. At its three-year anniversary, it can split its portfolio in two should some shareholders be keen to realise their investment at NAV plus costs, with one pool gradually being wound up and the other continuing. With a yield of 5.7%, it should be an attractive addition to the active income portfolio.

Wind to power returns

The second addition is also a closed-ended investment company, but in a completely different industry. As its name suggests, operates wind farms in the UK. Floated in March 2013, the company now has 12 wind farms, with a generating capacity of 226.5MW (megawatts) and gross assets of about £500 million.

Greencoat does not take the risk of building its own farms but acquires them only when they are fully operational. It was seeded with wind farms from fellow portfolio member SSE, which retains a stake in the business, but has been adding wind farms regularly since and continues to investigate opportunities.

There should be plenty of these. The big utility operators still own around two thirds of wind-farm capacity across the UK and Greencoat aims to be a neutral third-party buyer as these utilities look to recycle their renewables investments into new capacity.

While some operators have pulled back on plans for offshore wind farms, there remains plenty of capacity onshore and, despite the government playing to the backbenches by playing down its commitment to renewable energy, the long-term future for alternatives such as wind remains good. The trust intends to focus primarily on onshore capacity, although it retains the ability to invest up to 40% of its assets offshore.

Stephen Lilley, partner at Greencoat Capital, acknowledges that some schemes have been delayed but believes support for wind, as part of a renewable energy programme, remains strong.

"Given we only buy operational UK wind farms, there remains a huge pool of assets from which Greencoat UK Wind will hope to add to its current generating capacity. Over the next few years, we estimate the pool (without adding in any of the additional capacity) is over £50 billion in value," he says.

"We have a strong pipeline of potential acquisitions to grow our portfolio further, and we believe that there are a number of projects across the UK, both onshore and offshore, which offer attractive investment opportunities."

Stockbroker Winterflood says its client has "adopted characteristics, such as no gearing at the asset level and an acquisition debt facility, which the managers believe make the fund an attractive counterparty for utility companies looking to sell assets and recycle capital in new development."

The trust's aim is "to provide investors with an annual dividend that increases in line with Retail Prices Index inflation, while preserving the capital value of its investment portfolio in the long term on a real basis". It has succeeded so far with a total return in its first year of trading of 8.7% on an annualised basis. The current yield is 5.7%. The trust currently trades at a 2% premium to NAV.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.