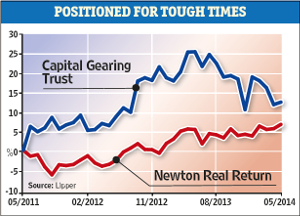

Face-off: Newton Real Return vs Capital Gearing Trust

13th August 2014 10:11

by Cherry Reynard from interactive investor

Share on

It is fair to say that the absolute return sector has, in aggregate, underwhelmed. Many funds have failed to produce any positive return, let alone an absolute one.

However, that weakness does not invalidate the aim of absolute return funds, which is to produce a positive return, ahead of inflation, regardless of market conditions. And there are a number of funds that have succeeded in delivering exactly this type of return to investors.

The trouble is that even these funds have not done well recently. This is perhaps to be expected: markets have been buoyant, economic growth resurgent, and in these conditions an absolute return mandate is always likely to lag.

Equally, there has been an over-reliance by many funds on "safe haven" assets such as gold, which have proved anything but. However, securities markets are now at a point where almost all look expensive - from bonds to equities to property - and absolute return-focused funds, the better ones at least, may start looking more attractive.

The Newton Real Return fund had very strong years in 2009 and 2010, when it was substantially ahead of its Investment Management Association targeted absolute return sector peer group. However, it dropped a little in 2011 - not as much as the wider sector, but then the performance of the wider sector has been an undemanding comparator.

The fund rose 3.1% and 6.7% in 2012 and 2013 respectively, and has been somewhat eclipsed by the . However, it is enjoying a good 2014, ahead of the peer group and delivering solid returns in difficult market conditions.

The Capital Gearing Trust has risen 50.7% over the past five years, compared to the Newton fund's 37.4%, but has been positioned more defensively recently, which has dented performance and reduced the significant premium to net asset value at which the trust traded. It was at a 15% premium and now sits at 3.2%.

The trust NAV is unchanged over the past 12 months, but the share price is down 7%, and up just 10% over three years to 10 July.

The trust's board does not manage the discount - there is no buyback policy and a relatively small free float in the shares, so investors need to be careful when they buy. This can also create some volatility in performance, as the past few years have seen.

Stephen Peters, analyst at Charles Stanley, says: "Peter Spiller's long-term track record is exceptional, but it is not a fund for the mainstream... It has had a difficult period, but then it is designed not to work in periods like this.

"It is not his market stylistically. It is the same with Troy, which runs : these are managers that perform well in difficult times, not the type of environment we have seen over the past year."

The question for investors is whether now is becoming a difficult time and, if so, who is best equipped to manage it?

Newton Real Return

The Newton Real Return fund brings together the not inconsiderable brainpower of much of Newton's investment management team. Ian Stewart manages the asset allocation. James Harries, manager of the , manages the equity portion of the portfolio.

All of the managers plug into Newton's overall "thematic" investment process, which aims to identify dominant global trends and invest to take advantage of those trends. Themes include, for example, "the networked world", focusing on the rise of technology.

Newton Real Return

Size: £9.07 billionManager: Iain StewartLaunch date: January 1998Sector: IMA targeted absolute returnAMC: 1% (max)Yield: 2.9%Contact: 0500660000bnymellonam.co.uk

Stewart has more flexibility than most of his competitors: the fund can invest across most major asset classes, including equities, bonds, commodities and less mainstream asset classes such as infrastructure, floating rate notes or convertible bonds.

He has had no fixed-income exposure at some points and as much as 50% at others. He says his key mantras are to be active, to be flexible, to keep it simple and to reduce volatility where possible.

The fund will always have a core of "return-seeking" assets. Around that is, as Stewart styles it, an "insulating layer" hedging various scenarios, such as inflation or deflation. The fund will shift depending on how Stewart sees the world.

At the moment, he is relatively gloomy: "The policy measures have not been that effective at creating real economic growth and have been good at inflating asset prices... The key to returns is what you pay, and however you look at it, the starting point doesn't look very auspicious." He says that there is increasing risk with lower return expectations - "not a great combination, and we need to figure out a way to navigate this backdrop".

As might be expected with a relatively pessimistic outlook, the fund looks defensive. Telecoms are its biggest holding, with healthcare also a significant position. These are areas that have lagged the wider market since the credit crisis.

Gold is still a meaningful position, despite its negative impact on fund performance over the past 18 months. Stewart believes that gold still provides a reasonable hedge in the current market climate, even though he admits it hasn't worked to date. He has 3% in gold ETFs.

On the fixed-income side, Stewart's cash exposure is rising and his high-yield exposure is falling. The fund has around 15% in government bonds, primarily from "safe haven" areas such as Norway or Australasia. He retains holdings in infrastructure, though he is careful where he chooses to invest, believing infrastructure projects in China have the scope to go wrong.

Capital Gearing Trust

Peter Spiller's Capital Gearing Trust has a lengthy track record of growing and protecting capital, with 2013 the notable exception. The main problem was that Spiller thought equities highly valued at the start of 2013, preferring to focus on inflation-linked bonds, special situations and "extended cash" products, and therefore missed out on much of the rally in equities over the year.

Spiller sees no reason to change his position now that equities have rallied: "We thought equities were pretty expensive and still do."

This is not a structural position. The trust is completely flexible in its asset allocation and had a near 100% weighting to equities in the early 1980s when valuations were low and corporate balance sheets looked very strong.

For now, however, Spiller believes that on all long-term measures equities look expensive. He holds hedge funds, private equity and other "special situations" type funds. This is mostly via investment in closed-ended funds with a liquidation date.

Capital Gearing Trust

Size: £93.8 millionManager: Peter SpillerLaunch date: May 1963Sector: AIC UK all companiesMin. initial: £50AMC: 0.6%Yield: 0.54%Contact: 02078324900capitalgearingtrust.com

Spiller still has around a third of the portfolio in inflation-linked bonds and a further 30% in "extended cash" such as zeros, preference shares and convertibles.

"We believe that inflation is the greatest threat to the real value of invested capital. If there isn't inflation, there will be a very extended period of little growth because there is such excessive debt. It will be inflated away or it will default."

So far, inflation has only been seen in asset prices, but Spiller believes that it will extend to RPI inflation: "It may not be a 2014 event, but we are very happy to own things where values look good long term."

Overall the trust is positioned as defensively as it has ever been in its 41-year history. Spiller says: "Assets of all types have been boosted by quantitative easing. Preserving real value is the job here. We will stay very defensive until the valuations change."

The trust has also recently cut its fees from 0.85 to 0.6%. Spiller says: "We have seen some asset growth, and prospective returns are relatively poor. We believe investors should get more than the fund manager."

Conclusion

Capital Gearing is the more defensive fund, though both are positioned for tough times. If there is further progress in equity markets, the Newton fund is likely to be the better performer, but Capital Gearing will defend capital more effectively in a significant market sell-off.