Mining sector recovery boosts Income Growth Portfolio

15th August 2014 09:44

The past quarter saw growing uncertainty about the resilience of the economic recovery and when the Bank of England is likely to increase interest rates.

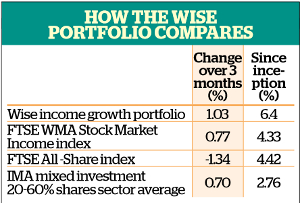

These concerns together with increasing tension in the Middle East and Russia made the stockmarket anxious. The end of the quarter was marked by a fall in the FTSE All-Share index. It ended the three months down 1.34%.

The portfolio, by contrast, made progress. This was partly due to the fact that it was not particularly exposed to medium and smaller companies, which were worst hit by deteriorating sentiment. Tony Yarrow, chairman at Wise Investments, regarded this area of the market as too expensive when he was constructing the portfolio earlier this year.

To view the income growth portfolio's holdings and trading chronology, click here.

Mining growth

"China had been using vast quantities of natural resources, which led to a so-called commodity super-cycle and resulted in considerable expansion in the mining sector," he says.

"Mining then fell out of favour, but I think most of the negative news is now behind us. Also mining companies have adopted a different attitude and become more shareholder friendly."

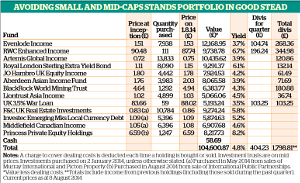

Surprisingly, the second-best performer in the portfolio over the past quarter was the War Loan holding - sadly, the impact of its success was limited by the fact that is the second smallest constituent in the portfolio.

Yarrow admits he didn't expect it to do so well. He explains that it benefited from the continuing popularity of government bonds.

He adds: "There is not much value in gilts, so either investors have taken leave of their senses or they are concerned by what is going on in the world and think interest rates won't rise because growth will be sluggish, so there will be no capacity issues and there could even be deflation."

He is much keener on equities. He bought War Loan for diversification and its yield of nearly 4%. If the stockmarket falls, it will also provide some cushioning.

Another holding that did well over the quarter was F&C UK Real Estate Investments. Yarrow says that, after a period of little or no commercial property development, following the financial crisis, shortages are now leading to rising prices and rents.

He had worried that the trust was too expensive, but he says its net asset value (NAV) is now rising faster than its price. The trust's premium is now down to 3%. Yarrow thinks that the net asset value could rise by another 3-4% over the next quarter and that the premium could disappear.

However, he has decided to take action in the case of infrastructure fund , which invests in schools, hospitals and toll roads, and currently stands at a premium to NAV of 10%. He has decided to sell. 'A 10% premium doesn't say value to me. It says too expensive,' he says.

In stark contrast, the holding he is buying instead, , a Guernsey-based investment company that invests in unquoted companies, is trading at a 20% discount.

"They are also changing it from a fund of private equity funds to direct investment. It wouldn't surprise me if it didn't go from a 20% discount to a premium over the next couple of years. In the meantime, it is yielding 8%."

Sold on equities

Equities is the asset class Yarrow likes best. He believes there is a lot more value in equities than many people think.

He says: "Of all the asset classes, we think shares are the one to be in, as long as you can cope with their volatility. Certain areas have become overvalued, though, so the recent correction is quite good from that point of view."

That said, some of the portfolio's holdings suffered as a result of that correction, including its largest stake, in , a fund managed by Yarrow's son, Hugh. It fell by 4.2% over the quarter.

Yarrow senior explains: "The reason [it fell] is that the fund focuses on quality stocks, and quality has been out of fashion this year. In some years this approach works well and in others it doesn't.

"One stock that dragged Evenlode down recently was . However, Hugh is not nearly as worried about the company as he is about the market in general. He believes its long-term prospects are good. The problem is that analysts tend to have very short time horizons."

Another holding that lost ground was , which was also affected by Glaxo's fall. "This fund is cautious and holds blue-chip stocks and quite a bit of cash," Yarrow senior says. "But it has been affected by stock-specific problems."

He doesn't think the stockmarket is about to fall off a cliff. "We are pragmatic," he says. "We don't like or dislike the stockmarket. But we think shares look cheap compared with gilts and that it's risky to bet that gilts will outperform over the next five years."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks