Shares to buy, hold and sell

18th August 2014 10:06

by Rebecca Jones from interactive investor

Share on

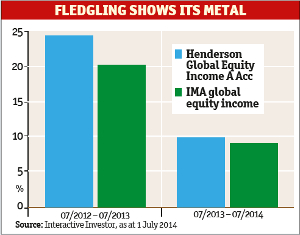

Ben Lofthouse is manager of the and co-manager of the , launched in 2011 and 2012 respectively.

Rebecca Jones asks him which shares he has been buying, holding and selling in his fledgling funds.

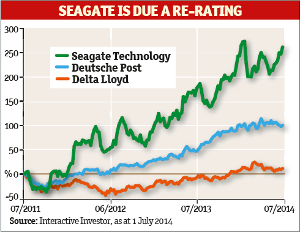

Buy - Seagate Technology

With a market capitalisation of over $19 billion (£11 billion), is the world's second-largest hard disk drive (HDD) manufacturer. Along with number one manufacturer Western Digital, Seagate occupies 80% of the HDD market and has enjoyed recent success in mass data, providing hard drives for remote "cloud storage" centres across the globe.

"Seagate has a very strong balance sheet with not very much debt on it, plus a 3.3% dividend that is three times covered by earnings, and it's trading on a forward price/earnings (P/E) ratio of 10 times, yet it has been overlooked."

This, however, is all the better for Lofthouse, whose investment process is centred on identifying "underappreciated, undervalued companies" that have attractive dividend yields, strong market positions and good free cash flow.

Seagate certainly ticks all the above income boxes, but perhaps more importantly it also has the potential for strong growth in the medium term, which Lofthouse also focuses on.

He believes it will be driven by the expanding need for data storage alongside a pick-up in PC sales, which he says is beginning to come through.

Seagate currently accounts for 1.5% of both the International Income Trust and the Global Equity Income fund. However, Lofthouse is not averse to increasing his holding, claiming he will use any weakness in the share price - $58.95 at the beginning of July - to buy more.

Hold: Deutsche Post

Like other mail services across the globe, Deutsche Post faces uncertainty over the future of its postal service, with volumes continuing to decrease as customers take to the internet to send and receive correspondence.

Nonetheless, Deutsche Post is a top 10 holding in both the International Income Trust and Global Equity Income fund at a weighting of 2.5% and 2.8% respectively, and since purchase in May 2012 it has returned 116%.

However, the firm is still living down some bad business decisions, including a "disastrous" expansion into the US that Lofthouse claims has created an "overhang of negative sentiment" toward the firm, while a shaky European economic recovery raises questions about future growth.

"Deutsche Post is not widely held as people aren't sure about its growth outlook. We have quite a large position, but we're waiting to see whether the German economic recovery continues; however, if the share price weakens at all we'll buy some more," says Lofthouse.

Sell - Delta Lloyd

Lofthouse bought into Dutch insurer Delta Lloyd in August 2012, when former owner was selling it at a knock-down price of €10 (790p) per share in an effort to shore up its balance sheet. Since then, Delta Lloyd's share price has performed well, rising to €18.93 by the beginning of July.

However, Lofthouse has concerns about the future of the company and sold out of his 1.5% holding on 30 May at a share price of €18.50, securing profits of 85%.

"When we bought Delta Lloyd, it was trading at half its book value and on a P/E of 4 times while paying a 10% dividend yield.

"Now it's trading more around book value and at 8 times P/E, so it's still not expensive, but it has quite a subdued growth outlook. It pays out a very high percentage of its earnings in dividends and so its ability to grow that dividend is less likely from here," he says.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.