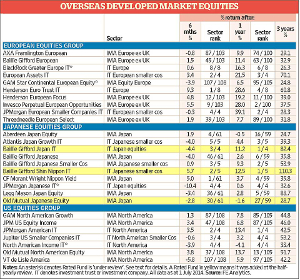

Rated Funds update: Overseas developed market

27th August 2014 10:09

by Andrew Pitts from interactive investor

Share on

US equities: Long-term potential

There has been one name change in our list of Rated Funds, due to a manager move. Robert Siddles, the long-running manager of F&C US Smaller Companies investment trust, moved to Jupiter Asset Management and the board decided that the trust would move as well.

Apart from the name change to , it is very much business as usual.

Although the worst performance among our US rated funds over the past six months was produced by , it still has a good long-term record - indeed it was the winner of our best smaller North America fund award this year - so we are prepared to give it another chance.

We are less sure about , which has lost ground over the past six months. We have put this trust under review. It changed from being a passive to an active fund in 2012.

European equities: Challenging times

European markets have been hit recently by the latest crisis in the Ukraine. However, in general our Rated Funds have made positive progress over the past six months.

The star performer among our ranked funds over the period is , managed by Tim Stevenson. It invests in large and medium-sized companies and its top country exposures at present are to Germany, Switzerland and France.

Henderson is well represented in this category. The , managed by John Bennett, was already on our Rated Funds list and the winner of our best larger Europe fund award this year.

At the same time, the Henderson European Focus trust received the "highly commended" accolade in our investment trust awards.

The two vehicles are very similar, but one of the main differences is that the trust has gearing of around 10%. Because of their similarity, we have not added the investment trust to our rated list on this occasion, although trust fans may prefer it.

Two European funds have been put on our under-review list, and .

The GAM fund was the worst of three Rated Funds in this category that lost ground over the past six months. Its manager, Niall Gallagher, believes the fund could do well in the second half of this year, so there is hope that it can recover.

BlackRock Greater Europe can invest to a limited extent in eastern as well as western markets, so its exposure to Russia has been adversely affected by recent tensions over the Ukraine.

Moreover, some of the manager's stock and sector selections have detracted from its performance.

Japanese equities: Uncertainty prevails

International investors still seem undecided about whether or not the current Japanese government's strategy for revitalising the economy will be successful.

For more optimistic investors, three extra choices have been added to our Rated Funds list. One is our award-winning , managed by Ian Heslop and his team. They follow market trends and seek out the stocks likely to benefit.

The other additions are two Baillie Gifford investment trusts, the winner and highly commended Japan trusts in this year's awards.

We already have two Baillie Gifford open-ended Japan funds in our Rated Funds list and they are all managed by the same people. But in the case of the Baillie Gifford Japan investment trust (BGFT) the portfolio is somewhat different.

It invests mainly in small to medium-sized companies. Only three of its top 10 holdings are the same as those in the fund and its sectorial emphasis is different.

The crossover between and is greater, but the investment trust has 10% gearing. It is currently standing at a premium to net asset value.

Our under-review fund in this sector is . Its six-month performance is poor, but it has bounced back again recently, so we hope this trend will continue.