Strategic approach makes the most of bullish bond markets

27th August 2014 16:30

by Rebecca Jones from interactive investor

Share on

Despite predictions to the contrary, UK bond funds have enjoyed an outstanding start to the year. A surprise drop in the benchmark 10-year government bond yield in January translated into an unexpected rally in the asset class.

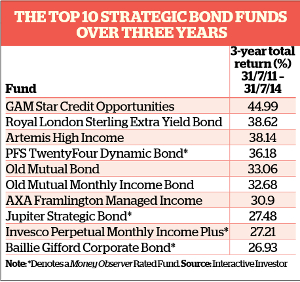

Sterling strategic bond funds fared particularly well. More than a third of funds in the sector returned more than 5% in the six months to the end of June. This compares with negative returns in a number of equity sectors, including the big-hitting UK all-companies sector, which lost an average of 0.22% during the same period.

However, while the fixed-income picture may be looking significantly rosier today than it did six months ago, fears over rising interest rates combined with a lack of liquidity in corporate high-yield bond markets may prove significant headwinds in coming months.

Un-fixed income

Of the top 10 performing sectors in the Investment Management Association (IMA) universe between 1 January and 30 June, five are UK bond sectors. The IMA sterling strategic bond sector boasted the third-strongest performance overall, with a return of 4.28% during the period.

"Coming into the year, everyone was extremely bearish on bonds. Almost all investment bank strategist recommendations were underweight. You couldn't have got more consensual," says Jenna Barnard, deputy head of retail fixed income at Henderson Global Investors.

However, a few left-field events, including weaker than expected inflation in Europe, caused a surprise fall in the 10-year UK gilt yield from 3.02% to 2.70% during January, leading to a rally in the asset class, particularly in longer-dated bonds, where bonds were paying a higher coupon.

"A lot had been priced in and investors were underweight the asset class, which was the perfect storm for a painful outperformance of bonds compared with equities this year," says Barnard.

Strategic outperformer

The sterling strategic bond sector, a six-year-old collection of more than 70 funds investing in everything from less risky government bonds to more racy high-yield debt, boasts some particularly strong first-half performers.

Among these is , a 2014 Money Observer Fund Awards winner, which returned an impressive 7.32% between January and June. The fund is also a long-term outperformer, returning a sector-topping 188% over five years.

According to manager Eric Holt, the fund's strong performance is largely due to its "supportive" 6.8% annual yield, which is generated by a portfolio of more than 180 individual holdings.

On a sector basis, Holt says his holdings in financial firms, which account for nearly 30% of the portfolio, have proved a significant boon for the fund. These include investments in UK banks such as that Holt is quick to defend.

He says: "What has happened in the banking sector has been quite radical. Pre-credit crunch, the business model was very low capital and very highly geared balance sheets.

"We've now moved into an environment where, from a bondholder perspective, the increase in regulation has been very much to our benefit. Valuations have also normalised as the pricing of assets in the sector has risen from extraordinarily low levels."

Quality not quantity

Another strategic bond fund with a high weighting in financials is Money Observer Rated Fund , which returned 6.35% in the six months to 30 June, while over three years it has netted a laudable 36% - the fourth-best return in the sector.

Manager Gary Kirk has 33% of his fund in financials, including, like Holt, Lloyds Bank, alongside fellow high street names Nationwide and Coventry Building Society. Unlike Holt, however, Kirk has a far more concentrated portfolio, believing that quality rather than quantity pays in today's fixed-income markets.

He says: "An old-fashioned corporate bond fund would have a large, diverse portfolio in which no single position has prominence, so if there were some pitfalls or defaults, it wouldn't have a major bearing. We prefer to be in the camp where we have a more limited number of investments. But within those we have done an extensive amount of due diligence, and we know not just the fundamentals of those bonds but the technical drivers too."

Kirk also favours asset-backed securities such as mortgage-backed securities and collateralised debt obligations. He adds that mezzanine ABS - a hybrid of debt and equity - has been a particularly strong driver of performance and remains an undervalued asset class.

Rate-rise reality

Fixed income has defied market expectations over the past six months as the likelihood of a rise in interest rates has increased - which means higher gilt yields and, subsequently, lower returns for existing investors locked into more expensive, lower-yielding issues. But will this continue?

Perhaps not to the same extent. However, bond managers, including Barnard, insist that much of the impending rate rise has already been priced into the asset class.

She says: "There is a superficial belief that I hear voiced all the time: 'Interest rates will rise, therefore government bonds will sell off.' Well, no. This is a hyper-efficient asset class; we get economic data on a daily if not hourly basis. So interest rate hikes are not a surprise."

At the moment, the market is pricing in a rise in the Bank of England base interest rate of around 0.25% at the beginning of next year and further incremental rises amounting to around 2.5 or 2.75% by the end of 2017.

Barnard says she expects rates to peak a little higher than this. However, neither she nor any other market pundits expect interest rates to touch the 5.75% highs seen in 2007 anytime soon, if ever. Thus, she argues, there is little to fear by way of a bottoming out of the bond market.

High-risk yield

Another potential curve ball is a lack of liquidity in the corporate bond market, as the progressive exit of investment banks from this space since 2008 has removed much of the free-flowing cash from the sector, leaving investors vulnerable to sell-offs.

This is especially true in the high-yield space, where supply has been outstripping demand as lower-quality borrowers move in to take advantage of investors' current "hunt for yield".

"A lot of companies are coming into capital markets that shouldn't be; they should be in the bank space. Some are very small, with limited or negative cash flow and very high leverage. In the past six months, I have turned down more new high-yield issues than I ever have before," says Kirk.

As with rising interest rates, however, the lack of liquidity in the high-yield space comes as no surprise to managers, including Kirk. Kirk reduced his allocation to the sector by nearly half, well before the Financial Conduct Authority issued its warning on corporate bond liquidity in July.

Holt is also bearish on the sector, claiming that little of his portfolio is in "traditional' high yield. However, he adds that while the sector may be experiencing a blip, it is unlikely to last.

"Bond prices move to where buyers meet sellers. Markets have been buoyant, especially in high yield, but prices will fall back to a point where sellers are put off and buyers are attracted again. That's just the way all bond markets work," Holt observes.