Three myth-busting charts to ponder

1st September 2014 09:44

by Lee Wild from interactive investor

Share on

US economic data has been largely positive and analysts there remain upbeat, if not uber-bullish. And why not? The S&P had its best August in 14 years - up almost 4% - and earnings are growing at a reasonable rate.

Geopolitical concerns aside, the immediate outlook, then, would appear to be almost rosy. But while the likelihood of a market collapse seems a little more remote right now, investors would do well to check out this excellent blog from the guys at Zero Hedge, repeated in its entirety here:

Recovery? 3 "Uncomfortable Truth" Charts

Presented with little comment aside to suggest one scratch beneath the thinning veneer of record nominal stock prices every once in a while to take the temperature of the ugly reality that no one is talking about...

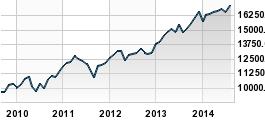

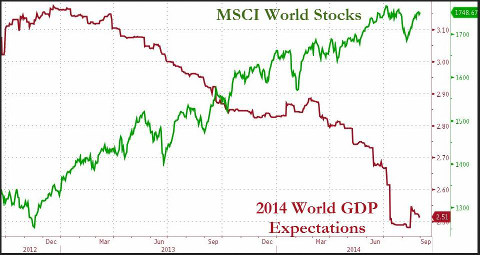

FACT: There is a record divergence between the 'market' and plunging growth expectations

2) Stocks are at record highs because employment is 'improving'...

FACT: There is a record divergence between the 'market' and the employed population in America.

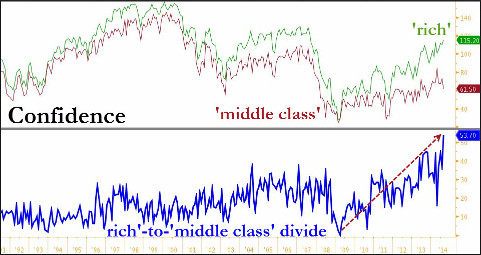

3) Stocks are at record highs because animal spirits are 'improving'...

FACT: There is a record divergence between the exuberant 'rich' and crushed 'middle class'

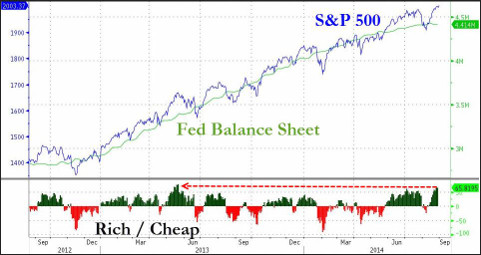

Bonus Chart:

Stocks are at record highs because... of The Fed!

And stocks have not been this far ahead of the Fed Balance Sheet since May 2013's Taper Tantrum correction began...

zerohedge.com/news/2014-08-30/recovery-3-uncomfortable-truth-charts

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.