Get great odds on these four gaming stocks

12th September 2014 14:33

by Harriet Mann from interactive investor

Share on

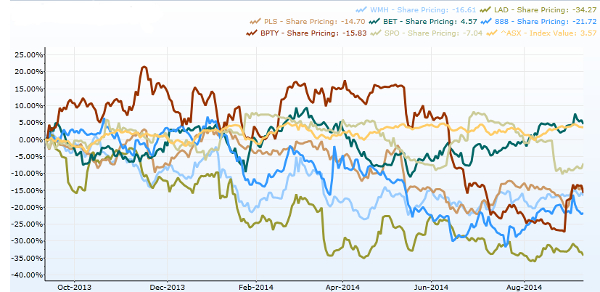

The past year has been anything but easy for the gambling sector; with the companies researched by Interactive Investor underperforming the FTSE 100 (UKX) and FTSE All-Share Index by a wide margin. And the future, both from an operational and regulatory perspective, is laced with uncertainty.

There has been a lot of change already - management shake-outs, tougher regulation and consumers interacting with companies in new ways.

In the 2014 Budget, George Osborne decided to raise the duty on digital betting terminals to 25% from 20%. This came after the industry had been lobbying the government to limit any restrictions on the machines due to their potential link the gambling addiction. The Responsible Gaming Trust reports back this autumn.

Barclays expects investors to focus on five main issues over the next year - the five Ms; market share opportunities, merger and acquisitions, mobile betting growth, machine regulation and "Miliband's manifesto" - basically, any promises he makes in the run up to the General Election.

At the broker's recent European Leisure Conference, half of all investors who turned up reckoned that 5% of the UK online gambling companies will have left the market by 1 December 2015 and 25% thought 10% of the market would exit. Over a third of those questioned expected the UK to see the most M&A activity and two thirds thought the regulatory outlook will worse for UK gambling companies next year.

The three biggest risks to the sector are the Responsible Gaming Trust's report, the fallout from proposed changes to machine stakes and the potential for new Labour proposals ahead of next year's General Election. But above all, the panel at Barclays' gambling conference, which included companies, regulatory bodies and compliance, reckoned the involvement of politicians rather than regulators poses the biggest risk to the sector.

The Point of Consumption tax (POC), a 15% charge on profits made from UK consumers over the internet, is expected by many to be introduced this year, although some brokers like Numis Securities doubt the plans will go ahead. But it is these changes to regulations that are making companies like attractive as potential acquisition targets - private equity firm Permira could be interested.

Although the industry faces many uncertainties, these could provide an attractive entry point to an under-fire sector. Interactive Investor takes a look at four companies well set to outperform the rest.

William Hill (WMH) - 343p

UBS analyst Jarrod Castle hopes that second half trading removes some investor wariness over fixed-odds betting terminals (FOBT). Even though uncertainty remains, Barclays' research suggests that William Hill is the most likely of these four companies to boost its market share over the next year.

With uncertainty over UK regulations, William Hill is in a prime position with its Australian exposure, which is doing well. Net revenue there rose 7% in the first half and operating profit nearly doubled.

But success was not limited to Down Under. The UK retail business is showing good cost control, expecting to spend just half of the 4% it had planned to. It is also benefiting from roll-out of its new Eclipse machines, says UBS.

Ahead of potential new FOBT regulation, William Hill has shut 109 shops. "However, it is still to be seen what measures the government institutes and we would expect William Hill to adopt strategies to offset the additional impact these measures may bring," said Castle.

Although the analyst has downgraded expected earnings per share (EPS) for both 2014 and 2015 by around 1%, he still reckons the stock is a 'buy', with a 390p target price. The shares trade on 12 times 2014 earnings, much less than peers.

Betfair (BET) - 1,096p

While it's not unreasonable to think violating accounting rules will leave a company in the doldrums - not only with its share price but in market sentiment too - seems to have emerged from its dividend controversy smelling of roses.

Betfair admitted earlier this year that it did not have enough distributable reserves to pay dividends between 2011 and 2013 following rule changes by the Institute of Chartered Accounts in England and Wales.

But this didn't seem to concern analysts, with Numis calling its first-quarter update "outstanding" and Barclays keeping it as its "top pick" in the gambling sector. The record quarter saw the internet betting exchange bang in best-ever profits, chasing its share price to six-month highs.

"Betfair is executing its strategy very well in our view," said Numis. "Products like 'price rush' have been launched and promoted as promised and have exceeded our expectations. We believe Betfair is set for an excellent year, continuing to exploit the combination of a unique liquid exchange and sports book," added the broker, retaining its 'add' recommendation and 1,250p target price.

But Irish broker Davy says management is right to remain cautious about the medium-term outlook. "Point of consumption tax is now imminent in the UK and that brings with it uncertainty regarding potential competitor behaviour," it said.

After the update, Numis upgraded its full-year earnings before interest, tax, depreciation and amortisation (EBITDA) guidance to £103 million from £98 million, boosting its EPS to 72p. The broker reckons growth will be steady at the company, with EPS expected to rise to 74.5p in 2016 and 82p in 2017. On that guidance, Betfair is trading on 15 times forward earnings.

888 Holdings (888) - 126p

Another bucking industry trends and reporting record results is 888 Holdings. Half-year revenue jumped 13% to $225 million, adjusted cash profit leapt 27% to $49 million and pre-tax profit was up 25% at £36.5 million.

These impressive results, which led Investec Securities to upgrade guidance, were largely driven by the company’s enhanced mobile offering, exposure all gambling firms are trying to improve and take advantage of. The gambling company offers not just a gaming experience, but an "interactive experience" through its entertainment destinations. Its casino performance was strong in its last quarter results, with its poker business bucking the industry trend and Bingo seeing a turnaround.

And Investec reckons 888 will be able to "navigate" the POC tax when implemented in December so as not to threaten the customer's gaming experience, a virtue not all companies are given. But with the POC tax imminent, private equity firm Permira has touted the company as a buy-out target and said it may even bid itself.

Although Investec reckons EPS will fall by a fifth next year, it expects a recovery the year after and another big jump in earnings in 2017 to 17p 9(13.6p in 2013). 888 trades on a forward price/earnings multiple of 14.4 times.

With a 'buy' recommendation, Investec thinks the share price could reach 190p.

Playtech (PTEC) - 707p

Gaming software developer is the only featured company not to deal directly with the end consumer. Instead, it provides software for casinos, poker rooms, bingo games and sports betting on the web.

Trading for the six months to the end of June was ahead of expectations, with revenue up 21% to €214 million and adjusted cash profits up 28% to €97.6 million. EPS was up and the dividend was given a boost, despite the recent £100 million special dividend. So a solid update by anyone's standards.

And management expects this positive streak to continue, betting that it can beat its previous full-year expectations.

Panmure Gordon is bullish, too, with a 'buy' recommendation and 800p target price, especially with its new Ladbrokes Digital operation fully operational and growth in new licences.

With a forward EPS of 53.6 euro cents, the stock is trading on 15.5 times forward earnings.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.