Freedom: But at what cost for North Sea oil explorers?

12th September 2014 17:17

by Lee Wild from interactive investor

Share on

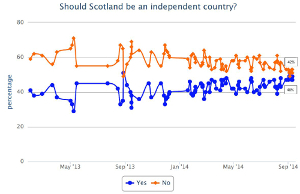

For those investors just back from a two-week break on the moon, Scotland heads to the ballot box next Thursday 18 September to vote on whether it should remain part of the United Kingdom. A couple of shock polls have just put the nationalist 'Yes' camp in the lead, sending sterling crashing and stockmarkets into a panic. The latest poll from whatscotlandthinks.org (see below) shows it's going to be close.

Many of the big issues have been covered extensively; things like which currency the Scots would/could adopt, what to do with nuclear warheads based north of the border, division of national debt, even what the new flag would look like (the blue will apparently be replaced by an awful combo of black and yellow!).

But North Sea oil and how the revenue will be split has received relatively little coverage. It is, however, of significant interest to a crop of junior oil and gas explorers, many of whom have significant interests in the region and could potentially face years of uncertainty if the Scots decide to go their own way.

"Mr. Salmond has banged on about income from North Sea Oil and Gas and, whilst it is true that the industry has got many years of activity left yet, he has failed to admit that it is an industry in decline," writes consultant and political commentator Howard Wheeldon.

Both and have backed North Sea oil veteran Sir Ian Wood's (of Wood Group) claim that SNP-leader Alex Salmond's North Sea forecasts are far too optimistic. Expect annual oil revenue of £5 billion, rather than the £7 billion claimed by Salmond, he says. "What's more, the rundown impact will begin to be felt by 2030, which is only 15 years from now," adds Wood.

Junior explorers

"We highlight fiscal uncertainty and a potential maritime border dispute as our key concerns," wrote Westhouse Securities recently.

Of course, any fiscal changes would take time to implement, and Westhouse doubts there'll be any "radical, unfavourable changes" given the dependency of Scotland on the oil industry. But the chance cannot be ruled out.

Here, Westhouse analysts Jamal Orazbayeva and Mark Henderson run through the North Sea stocks in their universe and assess prospects for each:

EnQuest (ENQ LN; Neutral; TP: 138p/share)

All of producing and development (P&D) UKNS assets, except for Alma/Galia development, are in the "Scottish" part of the North Sea. Alma/Galia is in blocks 30/24b & 30/24c, in the area that could potentially be disputed, but based on the last officially agreed border, is in "British" waters. Our 138p/share target price includes 6p for Tunisian and Malaysian producing assets and 40p risked value for Alma/Galia. The P&D assets located in the "Scottish" part of the North Sea are assigned 124p/share and we also adjust for the estimated net debt position of 76p/share.

Ithaca Energy (IAE LN; Buy; TP: 190p/share)

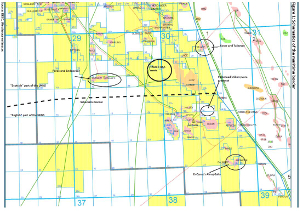

All of P&D UKNS assets, except for two gas assets (Anglia and Topaz) and onshore Wytch Farm field (combined value of 7p/share in our NAV), are located in the "Scottish" part of the North Sea. Ithaca's investment thesis is driven by its major development project, Greater Stella Area, which is located in blocks 29/10b and 30/6a (see map). Our 190p/share target price is based solely on the P&D assets.

Parkmead (PMG LN; Buy; TP: 400p/share)

All of UKNS assets, except for seven blocks in the Southern Gas Basin and two licences in the Central North Sea (containing two large exploration prospects, Skerryvore and Ardnamurchan), are located in the "Scottish" part of the North Sea. Skerryvore is in the area that may be disputed, but according to the last officially agreed border, it is in "British" waters. If we break down our 400p/share target price, c.253p is assigned to assets located in the "Scottish" part of the North Sea, around 42p to Southern Gas Basin assets in the "British" part of the North Sea and around 14p to assets in the Netherlands (the rest is cash and other assets).

Faroe Petroleum (FPM LN; Buy; TP: 200p/share)

All of assets are in the Norwegian North Sea and the Southern Gas Basin of the UKNS (or "British" part), except for Blane and Curlew South which are in the "Scottish" part of the North Sea. Only Blane is included in our valuation and we carry it at around 10p/share in our 200p/share target price. In that sense, we would not expect FPM to be directly affected by any uncertainty triggered by a potential "Yes" vote.

We reiterate that at this stage we do not change our ratings and valuations for any of the above mentioned companies.