Geopolitical headwinds force rejig in balanced portfolio

17th September 2014 09:40

by Helen Pridham from interactive investor

Share on

There has been considerable uncertainty over the past quarter as a result of political tensions, notably in the Ukraine and Iraq, as well as concerns about economic growth.

The UK stockmarket drifted downwards for much of the quarter, although it picked up again towards the end of the period.

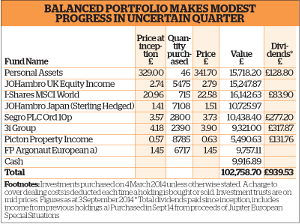

Although only four of the eight holdings in the portfolio lost ground, Roddy Kohn, principal of Kohn Cougar, feels that our balanced portfolio, which he manages, has suffered "a poor quarter" due to a variety of factors including its asset allocation. "There were more negatives than positives," he comments.

To view the balanced portfolio's holdings and trading chronology, click here.

Asset allocation success

Despite the portfolio being overweight international equities, he points out that its underweight position in the US was detrimental to the performance, with the S&P 500 returning 5.5% in dollar terms.

Developments in Europe have prompted Kohn to make his first switch since the portfolio was set up six months ago. European markets in general fell, and the euro also fell 2.7% against sterling over the period, which exacerbated the negatives.

Kohn explains: "The Russian issue coupled with deflation worries has weighed heavily on European markets." These events contributed to a 5% fall in the price of .

As a result, Kohn has decided to sell his holding in Jupiter and replace it with .

He says that the rationale behind the switch was that the majority of the Argonaut fund is hedged into sterling, whereas the Jupiter fund is unhedged.

This means the portfolio returns will still be generated in euros but the hedging will remove the majority of the currency risk.

Kohn's move came just before the European Central Bank decided to cut its main interest rate to an historic low of 0.75% due to weakening growth in the eurozone, causing the euro to fall further.

Large-company bias

The Argonaut fund is run by Oliver Russ, an experienced European equity fund manager. It invests in 30-55 high-yielding European stocks, predominantly in large and mega-cap companies.

There is also a covered call option strategy to enhance the income. This strategy generates option premiums, at the cost of giving away some growth, usually 5-15% above the current share price. The fund's target yield is around 5%.

Another significant drag on the portfolio was an 8% fall in the share price of , although this negative return was somewhat offset by a dividend payment. 3i Group is an investment company that invests mainly in medium-sized private equity companies globally, as well as in infrastructure projects and corporate bonds.

Kohn explains that the main reason for the fall in 3i's share price was profit-taking by investors following the group's strong results, after the success of the restructuring plan put in place in 2012 by the new chief executive Simon Burrows.

At the time of the last review, the trust's premium to net asset value had risen to a heady 19%. It has now fallen back to 7%; but despite the fall in the share price as a result, the group's net asset value has actually risen by 9% over the last three months.

Kohn is happy to keep his holding in 3i because he believes the strategy being employed by the management will continue to deliver shareholder value. He points out that the group is still in the process of streamlining its portfolio and is exiting positions at considerable uplifts to book value.

Japan

The star performer over the period was , which returned 7.4%. According to its manager, Scott McGlashan, the Japanese stockmarket has been experiencing a "stealth rally" in recent months.

Although there have been some mixed news about the Japanese economy, McGlashan believes the market remains very cheap and there are signs that domestic pension funds are finally ready to increase their equity allocations.

He thinks that the chances of market falls from current levels are very limited, while the upside potential is substantial.

To Kohn's continuing dismay, gilts had a very strong quarter. He has regarded gilts as overvalued for some time and has been underweight for a number of years.

He says he doesn't intend changing his stance any time soon, but he acknowledges nevertheless that the portfolio's underweight fixed interest position has been detrimental to its relative performance.

Property

Conversely the portfolio is overweight property and whilst Kohn feels that this has been a good asset allocation call, both and had quiet quarters. Segro fell by 2.5% and Picton was up 0.8%.

"Kohn says "The fundamentals for property remain sound, and as both our selections are REITs they will tend to be volatile over short periods; however, we want to continue to hold."

Kohn believes the portfolio will benefit from its underweight position in bonds "in due course". He says that compared to other major asset classes equities continue to offer better value.

"The threat of increasing interest rates in the US and the UK, coupled with the prospect of further quantitative easing in Europe and Japan, creates an unsettled investment environment.

"We expect markets to become more volatile as "D" day approaches (when rates do need to rise), whenever that may be; however, our view is that if we hold on tight we should come out the other side in fine fettle."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.