Get excited about Alibaba IPO

18th September 2014 10:21

by Lee Wild from interactive investor

After months of speculation, Chinese ecommerce giant Alibaba (BABA) will finally list its shares in New York on Friday in what is likely to be the biggest IPO of all-time.

Such is demand for the shares, executive chairman and founder Jack Ma has already increased the offer price to between $66 (4,041p) and $68 (4,163p) per share, from $60-$66 just a week ago. Confirmation is expected tonight. That will raise as much as $25 billion (£15.32 billion) and value the business at up to $168 billion.

According to many analysts, however, the company could be worth substantially more.

Walter Price, manager of , is among the bulls. "We have a favourable view of Alibaba - it is one of the most successful internet companies in the world and the leader in ecommerce by far in China," he says.

"It is not a household name (in the US), like the previous mega deal, , so demand should not be as tight. Of course it is a household name in China and Hong Kong and retail demand could be very large there. The valuation seems reasonable at the proposed level."

Given that Alibaba shares will not feature in many benchmarks, index-oriented investors are unlikely to buy much, adds Price. "This, in turn, means the retail investor has a chance to get some of the offering."

$100?

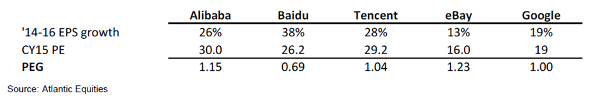

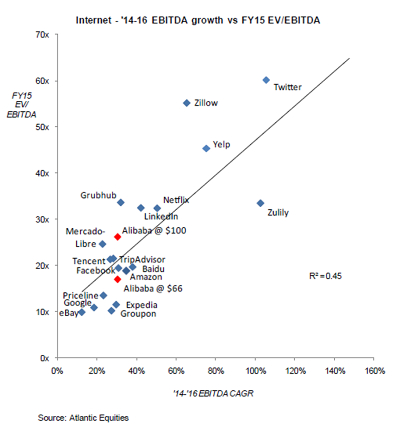

James Cordwell, an analyst at Atlantic Equities, certainly thinks Alibaba shares could be worth $100. To get there he uses a forward price/earnings (PE) ratio of 30 for the calendar year 2016, in line with local peer Tencent (a bit like Facebook) and search Chinese engine , and hardly aggressive for profitable tech stocks. It also implies a PE-to-growth (PEG) ratio of 1.1, "reasonable," reckons Cordwell given he forecasts earnings per share (EPS) compound annual growth rate (CAGR) for 2015-2017 of 26%.

"On a DCF (discounted cash flow) basis our target requires a mid-teens 10yr FCF (free cash flow) CAGR, achievable if Alibaba doubles its share of Chinese retail over this period," he says.

In the year to March 2014, Alibaba generated revenue of RMB 52.5 billion ($8.5 billion/£5.2 billion), up 52%, and made a pre-tax profit of RMB 31 billion ($5 billion/£3.1 billion), double the previous year's total. Cordwell reckons sales will rise 37% and profit by a third this year, backed up by recent strong quarterly numbers. Expect EPS of $2.24 this year, $2.85 in 2016 and $3.54 after that.

Alibaba makes most of its money from Taobao - the eBay-like operation that actually forced the American firm out of China in 2006 - and Tmall, which is more like Amazon. Between them, they have over 80% of the Chinese ecommerce market.

The company has said it wants to aggressively expand in the US and Europe once it gets the float away. In truth, it's more likely to go after markets elsewhere in Asia, Africa and Eastern Europe before targeting the big guys.

So, the shares don't look hideously overvalued and could do well. Some, however, may be wary of Chinese companies, especially those dominant in just one market. But there are ways to gain exposure to what could be an exciting and profitable theme without as much risk.

Alternative route into Alibaba

We mentioned Yahoo back in April. Remember, the American firm paid $1 billion for a 40% stake in Alibaba in 2005. It has cashed-in almost half, but still owns 22.4% of the company, worth as much as $36 billion. Unfortunately, the taxman will grab over a third of that, but the US firm is left with over $23 billion of stock. That's more than half the firm's current market capitalisation of $42 billion. It’s promised to sell a third of its Alibaba shares, netting $5 billion after tax. A share buy-back looks likely.

Yahoo is clearly one way in ahead of the IPO, although the shares trade on almost 40 times forward earnings. But there's another option if you think that Yahoo has already priced in the Alibaba effect.

Even Yahoo's lottery win is small fry compared to Softbank Corp. A 36.7% stake, bought by the Japanese mobile carrier for $20 million in 2000, could be worth over $54 billion now! But it also has other assets that investors like, making Softbank a great Alibaba play.

On Friday afternoon, the waiting will be over.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.