Why has Acorn Minerals tripled?

19th September 2014 13:19

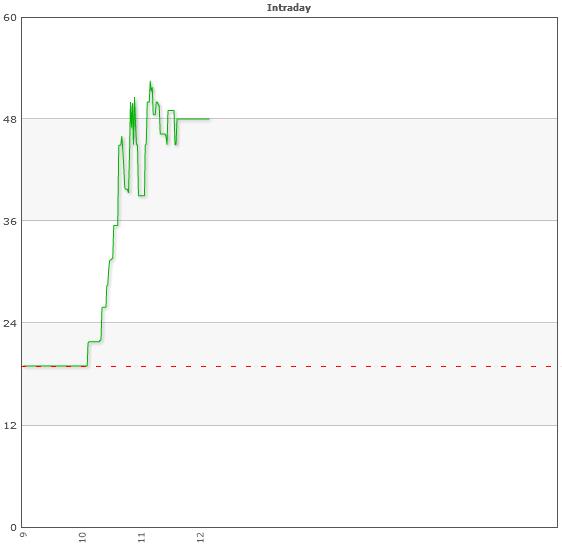

Wonder why Acorn Minerals' (ACO) share price is up 152% on Friday? So did we, which is why we got in touch with the company's financial advisor Shore Capital.

Apparently, there's talk on the bulletin boards that a company is about to reverse into the London-listed cash shell. No smoke without fire? We'll see, but there should be some comment from the company soon to correct what is currently a disorderly market.

There was certainly excitement in April when Acorn said it was buying Gulf Energy Limited, which would have constituted a reverse takeover. Acorn shares were suspended, but began trading again three months later when management called off talks following a period of due diligence.

At the end of March, Acorn had £1.3 million of cash and no debt, largely reflected in Thursday's closing price of 19p. They're now trading as high as 52.5p.

Acorn is run by accountant and industry veteran Tony Brennan, and experienced corporate finance guys Charles Goodfellow and Nigel Fitzpatrick, currently on the board at waste-to-energy firm PowerHouse Energy Group (PHE). It floated in October 2012, raising over £1.5 million at 20p. It wanted to invest in either conventional or alternative energy projects, or mining and energy infrastructure projects with an enterprise value of as much as £50 million.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks