Adventurous investment trust tips: Global and regional

22nd September 2014 10:23

by Fiona Hamilton from interactive investor

Share on

A lack of market volatility and a weak dollar hindered our 2013/2014 tips, chosen to do well in either bearish or bullish markets. Nevertheless, we are sticking with our formula and many of the trusts that have rewarded investors in previous years.

As in previous years, we have picked two trusts for each of eight different sectors, plus two specialist selections. The adventurous choices are for those who believe stock markets in the region concerned will offer opportunities for strong gains over the next 12 months, but the conservative choices are for investors who want some market exposure but prefer a relatively conservative stance.

Below, Fiona Hamilton profiles our adventurous selections for the year ahead.

Global

James Anderson warns investors to avoid if they are worried by volatile returns.

The lead manager of this £2.6 billion leviathan invests on a minimum five-year view, holds huge stakes in favoured companies and does not adjust selections or the trust's mid-teen gearing to take account of macroeconomic variables.

Instead, Anderson buys firms capable of "explosive growth", is prepared to pay "high multiples of immediate earnings, because the scale of future potential and returns can be so dramatic" and accepts that some calls will go wrong.

The portfolio may suffer painful setbacks, as it did in 2008, but Anderson asks to be judged on the trust's five- and 10-year returns, and on its outstanding success. This ultra-low-cost trust is our adventurous global choice once again.

The dominant theme in SMT's portfolio is the underestimated power of technological change, which Anderson says is transforming sectors such as healthcare, carmaking and utilities.

Another is China and emerging markets. The emphasis is on opportunities in China, such as internet giants Tencent and Alibaba. The third theme is the western financial system and its flaws.

Anderson hopes for the emergence of "great and disruptive technology companies in finance, as in healthcare and energy".

He decries those who are de-risking their portfolios by replacing equity exposure with the likes of bonds, gold and forestry.

"We are thrilled by the opportunities for rapid, highly profitable and long-lasting growth that are available to the great companies that it is our responsibility to identify and own," he says.

Japan

has outperformed the rest of the Japanese sector consistently over the past five years, so it remains our adventurous tip, despite its premium rating.

John MacDougall, manager since 2007, has succeeded by focusing on small companies with entrepreneurial, shareholder-friendly managers and the potential to do well regardless of the overall state of the Japanese economy.

This may be because they are disrupting or rationalising existing industries or because they are creating new opportunities such as online activities. Returns have been enhanced by double-digit gearing.

Shin Nippon's open-ended counterpart, , also managed by MacDougall, is similar. It has lower costs and investors need not worry about a widening discount.

But it is not geared and cannot invest in some of the trust's smaller holdings, while its three- and five-year returns have not matched Shin Nippon's.

Europe

remains our adventurous European trust, despite its demanding rating. That's because manager John Bennett has produced highly impressive returns since taking charge at the end of 2010.

He has done this by concentrating HEFT's portfolio down to less than 60 shares and taking substantial bets on sectors he expects to do well.

His biggest call has been a large stake in the pharmaceuticals sector, which has already served the trust well and which he expects to continue to outperform as scientific advances bring new medicines to market. Bennett dabbled successfully in banks earlier in the year but quickly took profits.

Having benefited from no exposure to utilities, he has started to rebuild the trust's stake in this sector. However, he continues to avoid telecoms because he thinks technological advances, regulation and competition are eroding pricing power.

Looking ahead, he warns that "the money-printing experiment will end badly at some stage". However, he hopes there is at least a year or two before the expected downturn, and he has kept the trust 8% geared.

Asia

is a well-established Asian and emerging markets investment group. Its Singapore-headquartered team focuses on building long-term stakes in well-managed companies, which are frequently revisited. Its trusts tend to lag in strong bull markets but are generally resilient in more diffcult ones.

focuses on much smaller companies than its only direct rival, , and has handily outperformed every other Asia ex Japan trust over the past five and 10 years. It suffered a steep setback in the latter half of 2013, but should do well again as Asian markets pick up.

Its managers say Asian smaller companies have fallen back to relatively attractive valuations in terms of price/earnings and price-to-book ratios. As a result, most of the trust's 9% gearing is deployed. It remains our adventurous choice.

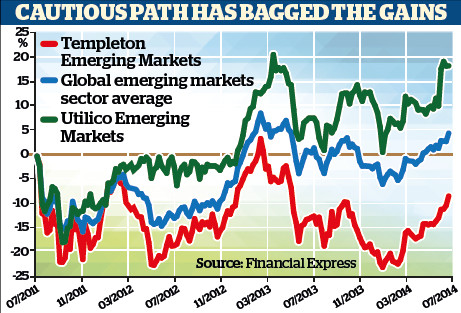

Emerging markets

, the giant global emerging markets trust celebrating its 25th anniversary this year, returns as our adventurous choice. Its net asset value returns have picked up well this year after going through a diffcult patch.

Hong Kong-based Mark Mobius, 78, has been lead manager since launch. He dismisses worries about his succession on the grounds that he has a bevy of experienced lieutenants supported by a 52-strong team of emerging market professionals who are dispersed globally.

Despite its £1.8 billion market capitalisation, the trust has a high-conviction portfolio of around 50 shares, selected using a value-oriented approach with a focus on long-term prospects. Turnover is low, gearing negligible and charges competitive.

Mobius expects emerging markets to continue to achieve significantly higher economic growth than developed markets. He seeks to maximise returns through substantial weightings in financials, energy, and the consumer discretionary and information technology sectors.

Hong Kong/China, Brazil, Thailand and India together account for two-thirds of the portfolio. Indonesia, Turkey, Pakistan and Russia around 5% each.

"The focus remains on companies that are best able to ride out the short-term political and economic storms, and benefit from the effects of strongly growing economies and the growing spending power of increasingly wealthy populations," Mobius says.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.