Conservative investment trust tips: UK, private equity and specialist

23rd September 2014 14:54

by Fiona Hamilton from interactive investor

Share on

A lack of market volatility and a weak dollar hindered our 2013/2014 tips, chosen to do well in either bearish or bullish markets. Nevertheless, we are sticking with our formula and many of the trusts that have rewarded investors in previous years.

As in previous years, we have picked two trusts for each of eight different sectors, plus two specialist selections. The adventurous choices are for those who believe stockmarkets in the region concerned will offer opportunities for strong gains over the next 12 months, but the conservative choices are for investors who want some market exposure but prefer a relatively conservative stance.

You can also view our global-focused conservative trust tips, while our adventurous choices in both UK-based and global-oriented sectors are here. We also have tips from a number of experts.

Below, Fiona Hamilton profiles our conservative selections for the year ahead, including choices in the UK, as well as private equity and specialist sectors.

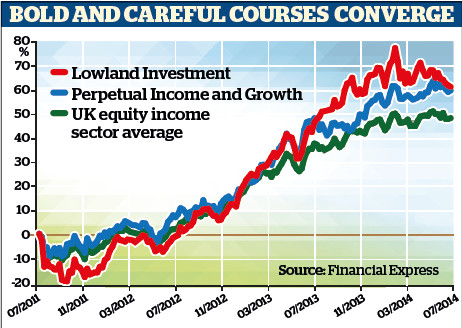

UK mainstream

Mark Barnett, Invesco Perpetual's head of UK equities, is far less bullish than James Henderson, the manager of our adventurous choice in this sector . Barnett has more in larger companies, very little in small caps and substantial weightings in pharmaceuticals and tobacco.

Barnett has an impressive record, particularly as manager, since 1999, of . PLI remains our conservative UK choice.

Its portfolio returns have been well above average over the past three years, it has generally held up well in diffcult markets and future returns should benefit from the replacement of its debenture loan with cheaper, more flexible borrowing facilities.

Its subscription shares passed their final exercise date in August and will no longer dilute returns. Charges will hopefully be trimmed in the current review.

Barnett says: "The strategy remains largely unchanged, with a strong preference for companies with a proven ability to grow revenues, profits and free cash flow in this low-growth world, coupled with management teams fully aware of the need to deliver sustainable long-term dividend growth."

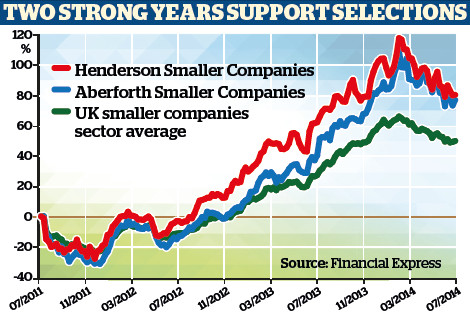

UK smaller companies

is managed with a strong value bias, has more exposure to smaller companies and carries much less gearing. Its shares trade on a below-average discount to net asset value but offer an above-average yield.

After a poor run from 2005 to 2012, it has picked up. Its focus on very small companies trading on below-average valuations seems well suited to less bullish markets. It is this year's conservative choice.

The trust warns that smaller companies have enjoyed a strong five years and that returns in 2014 are liable to fall short of those in 2013, but it retains confidence in its holdings.

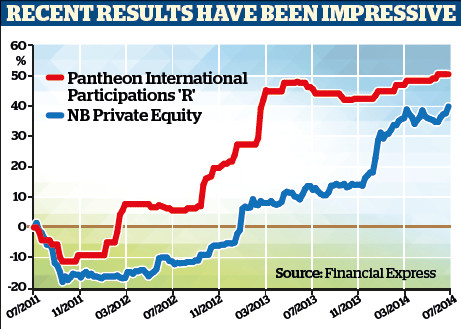

Private equity

We think there is scope for a re-rating at , which offers a 4% yield. The trust is similar to , our adventurous choice in this sector, in that it is a fund of funds with substantial exposure to the US, and therefore to the dollar. However, its portfolio mix is very different.

Investments in other private equity funds have been reduced to 35% of the portfolio, while 28% is in equity co-investments and 36% in debt investments.

NBPE's manager, NB Alternatives Advisors, has good credentials in debt securities, and the income from the debt securities means the yield is fully covered.

The trust's portfolio is well diversified. Industrials, healthcare and technology are the largest sectors, at around 16% each.

Following a spurt of investments in June, NBPE is 14% geared. It also has substantial forward commitments, which are matched by undrawn cash and credit facilities.

The shares are priced in dollars, but have been quoted on the London Stock Exchange since June 2009.

Specialists

is this year's conservative choice. It invests in social infrastructure contracts, returns on which are relatively predictable, substantially index-linked and largely underwritten by government agencies. The trust targets a growing yield and medium-term capital growth.

Its portfolio is well diversified, with 28% linked to education, 23% to transport, 20% to energy and 11% to health. Sixty two% is invested in the UK, 22% in Europe and 11% in Australia.

Most of its concessions are operational, but 7% of the portfolio is in projects under construction that should appreciate in value on completion. More than 20% are free of external debt and have a weighted average life of 24 years. INPP's cash flow is projected to rise steadily until 2031, funding dividend rises.

The trust's basic management fee is similar to that of its peers. The premium on the shares is below the sector average.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.