How to "beta" the market in October

26th September 2014 11:55

by Lee Wild from interactive investor

Share on

October once struck fear into even seasoned investors. It has gained a reputation as one of the most volatile months, and with good reason - think the Wall Street Crash of 1929 and Black Monday in 1987. But volatility need not be an investor's enemy. In fact, for those with a healthy attitude to risk, it can be your friend.

Of the 10 largest one-day falls since the FTSE 100 (UKX) was established in 1984, seven have occurred in October. And, according to City bible The UK Stock Market Almanac, the average return during the month since 1970 is a paltry 0.3%.

That, however, has changed in recent years, and since 1993 the market has only fallen four times in October, making it the second-most reliable month. Its average return is much improved, too - at 0.8% it's the fourth best performing month of the year.

October 2013 was certainly eventful. With the US government shutdown, debt ceiling crisis and possible collapse of the Italian government, stockmarkets were all over the place. But it was also Interactive Investor's busiest month of the year, with equity volumes up over 42% on September.

This year will be no less interesting, with the Federal Reserve making its final $15 billion of asset purchases, paving the way for interest rate rises in 2015. "Even if markets continue to be positive over the coming months we think volatility is bound to pick up post Fed QE and possibly pre-ECB QE," says Deutsche Bank strategist Jim Reid.

How to play October volatility

Savvy investors need not fear risk, but instead make it work for them. To do it involves an understanding of the concept of beta, a measure of volatility, or systematic risk, of either a particular stock or sector versus the market.

A beta of 1 implies that a company's share price will trade in line with the market. Under 1 and it will move less than the wider market, above 1 and it will be more volatile. A beta of 2, for example, suggests that if the market rose by 3%, the share price of this company would jump by 6%.

Safety-first investors will naturally be drawn toward low-beta sectors like Utilities and Nonlife Insurance. But to outperform a rising market, traders need high-beta stocks typically found in hot sectors like banking, mining and house-building.

A selection of FTSE 100 stocks with high beta:

| Company | Ticker | Beta |

| Kazakhmys | KAZ | 2.5 |

| Barclays | BARC | 1.8 |

| Rio Tinto | RIO | 1.7 |

| Royal Bank of Scotland | RBS | 1.7 |

| Ashtead | AHT | 1.7 |

| Persimmon | PSN | 1.6 |

| GKN | GKN | 1.6 |

| Source: Reuters | ||

Low Beta:

| Company | Ticker | Beta |

| SSE | SSE | 0.3 |

| Severn Trent | SVT | 0.4 |

| United Utilities | UU. | 0.4 |

| Unilever | ULVR | 0.5 |

| Imperial Tobacco | IMT | 0.5 |

| Centrica | CNA | 0.6 |

| RSA Insurance | RSA | 0.6 |

| Sources: Reuters | ||

It's in the timing

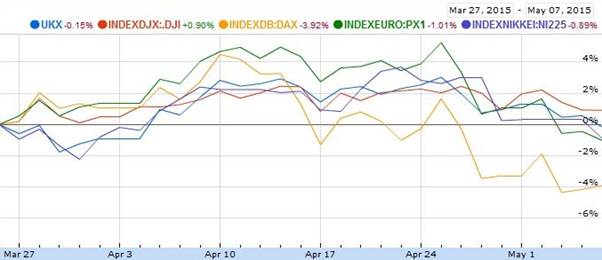

According to the Almanac, the FTSE 100 rises for the first two weeks in an average October, then fall back, before ending the last few days with a flourish (SEE CHART). In fact, with investors gearing up for a seasonally strong run-up to Christmas, the last trading day of October is the fifth most fruitful trading day of the year and the most profitable last day of any month.

Source: The UK Stock Market Almanac

Playing stock market volatility is not for the faint-hearted, but this chart does at least give a clue as to how share prices typically behave during the month. We've identified a few of the events which could cause wild swings in sentiment, but there could be others lurking, both good and bad. Either way, there's a strategy here for both risk-on (high-beta) and risk-off (low-beta) investors.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.