Which way next for FTSE 100?

24th October 2014 15:49

by Lee Wild from interactive investor

Share on

Stockmarkets have crept back higher after a brief, albeit still official correction. But the FTSE 100 (UKX) is now approaching a key technical resistance level at about 6,440, and we’ll find out over the next few trading sessions whether this recovery has legs, or whether it is a rally built on sand?

European equity markets are discounting an outlook for the economy that is "more pessimistic than warranted," says the team at Barclays.

"The European equity risk premium is now near the highs seen during the sovereign debt crisis and the financial crisis. Relative to credit markets too, European stocks are now more cheaply priced than any time in the last decade," it writes (see chart below).

"Both measures suggest that equity investors are pricing in an adverse economic outcome in the euro area. Internally, measures of risk aversion also appear high, with the premium paid for low volatility sectors at extremes. Similar levels in the past have marked important bullish turning points for the market. These have also been good times to buy cyclical risk."

(click to enlarge)

"In the past, such levels of risk aversion from a sector perspective have marked important turning points for the stock market (May 2013, August 2012, August 2011, March 2009 and November 2002). All these times were, in hindsight, bullish turning points for the market. These times were also great opportunities to buy cyclical risk."

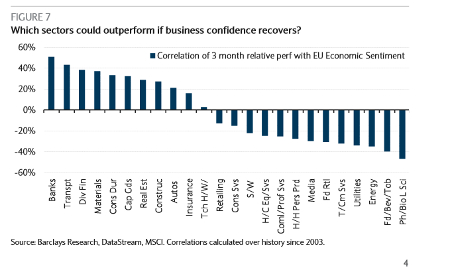

If Barclays is right, some sectors will clearly do better than others. A string of disappointing data has caused cyclically oriented sectors to underperform defensives recently, but looking back through history, this level of disappointment is unlikely to persist, reckons the broker.

The equity risk premium is the extra return that investors demand over and above a risk free rate to invest in equities as a class. Thus, it is a receptacle for investor hopes and fears, with the number rising when the fear quotient dominates the hope quotient."Blogger and New York professor of finance Aswath Damodaran

Money supply growth is also on the up, thanks in part to the European Central Bank (ECB), which should at least ensure than PMIs keep improving.

"At the very least, expectations have been adjusted downwards, given the downward revision to consensus 2014 GDP forecasts. This should mean that the 'bar' for the next set of data is lower, making positive surprises more likely."

The Autos sector looks "particularly attractive," with both volumes and pricing recovering; Media, Tech, Transportation and Steel stocks "also look interesting," while "The earnings outlook for banks is improving supporting their recent outperformance."

(click to enlarge)

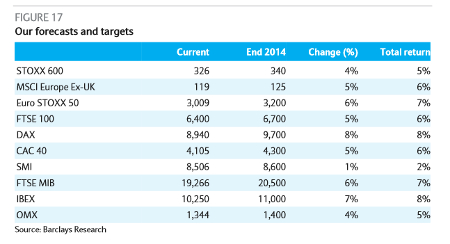

Barclays has tweaked its year-end European indices forecasts, too, but still predicts further growth this year:

(click to enlarge)

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.