Engineers are oversold

31st October 2014 11:18

by Lee Wild from interactive investor

Share on

London-listed engineers have had a tough couple of months. Concerns about global economic growth forecasts, particularly in China, Brazil and the Eurozone, have dented enthusiasm for shares in domestic manufacturers, and the sector is down over 11% since the end of August. But this, according to UBS, is an overreaction and has created a number of buying opportunities.

"While the outlook is somewhat more tepid, we do not see it as that different to the last 1-2 years," say analysts Mark Fielding and Robbie Capp. "The group has not significantly benefitted as leading indicators have risen and we don't see recent declines as that big a factor either."

"With valuations at the lower end of the post credit crunch range versus the UK market and the global peers we see the group as attractive. Steady trading over the next 3-6 months should drive outperformance."

Of course, conditions are not as optimistic as they were, and UBS has trimmed earnings forecasts for the 18 engineers it covers. Organic growth forecasts for 2015 come down from 5.6% to 4.3%, similar to estimates for this year. But a weaker pound - sterling is close to a one-year low against the dollar and down by about 10 cents since July - means EPS forecasts come down by just 1%.

And there's a strong valuation argument, too. The price/earnings (P/E) ratio for the UBS group of engineers is down about 15% this year, close to a 10-year average in absolute terms and approaching 4-5 year lows on a relative basis. A 27% premium to the FTSE All-Share index earlier this year has shrivelled to just 7% now, and a 10% premium to European peers and swung to an 8% discount.

But that seems unfair. The UBS group of companies has generated EPS growth at double the rate of the UK market and European industrial peers over the last decade. Many of them "could have significant attractions as M&A targets," too, says the broker.

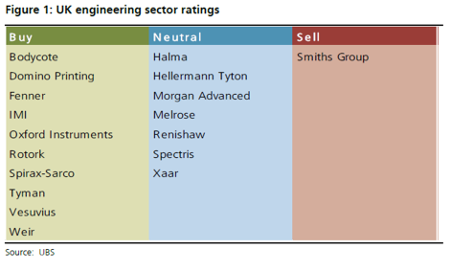

"We upgrade to Buy (oil price fears overdone)," reckons UBS. "We downgrade Morgan to Neutral (uncertainty created by CEO change). Other top picks we would highlight are , , and . Over the 3Q updates we see the potential for positive reactions at Rotork and Spirax-Sarco, and expect a solid update from Bodycote."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.