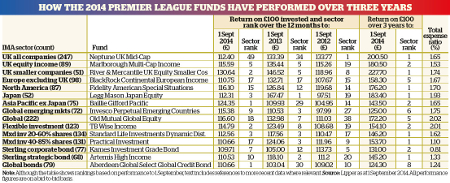

Consistently great mixed asset funds - Premier League 2014 annual review

13th November 2014 15:21

by Rebecca Jones from interactive investor

Share on

Flexible Investment sector: TB Wise Inocme

Managed by: Tony Yarrow

With assets under management of £51.5 million, is one of the smallest players to make it into our Premier League.

Despite its diminutive size, however, the nine-year-old fund delivered the second-highest returns in the 128-strong flexible investment sector over the three years to 31 August 2014.

Tony Yarrow, founder of Wise Investments, has managed the fund since 2005. Drawing on his 25 years of fund management experience, Yarrow set out to create in Wise Income a "go anywhere" income fund - a vehicle that could invest in anything, anywhere, if the opportunity was right.

"I like to think of it as a strategic income fund, akin to a strategic bond fund that can move around in terms of duration and go up and down the quality curve, depending on where the manager thinks it is in the cycle; that's what we try to do, just with every asset class," he says.

He invests mainly in other investment funds and trusts and his top holding is in the F&C UK Real Estate Investment Trust at 7% of his portfolio. He also owns direct equity, including at 3.5% of the portfolio, as well as bonds, property and cash.

The manager says he targets funds and companies the market has "fallen out of love with," but whose prospects are strong.

These include his largest single equity holding , whose share price plummeted over the summer due to concerns over legal action in China.

"It's interesting to look at the way the UK equity market is behaving at the moment, because it seems that anything that disappoints gets absolutely murdered; investors are very twitchy, so there is a big opportunity simply looking at things other people don't like," says Yarrow.

Mixed Investment 40-85% Shares sector: Practical Investment

Managed by: Sean Ashfield

Another fund retaining its Premier League title is . Launched in 1941, the fund is one of the oldest open-ended investment vehicles in the UK. It has also been managed by the same family since inception: Sean Ashfield, the current manager, is the grandson of its founder.

Over the past five years the fund has delivered consistent top-quartile performance, trouncing both sector and benchmark every year since 2010. Despite a wobbly period between 2007 and 2009, the fund also has an excellent long-term track record, delivering 142% in the 10 years to 30 September compared to 87% from the sector.

Ashfield took over the fund in 2009. Throughout his tenure he has maintained the fund's emphasis on capital preservation and growth while also delivering income, with the fund boasting one of the highest yields in the sector at 3.4%.

He has also stuck with investment trusts as the fund's main asset: as at 29 August, 34 of the fund's 42 holdings were investment trusts, with the largest holding in the , the fund's parent company, at close to 9% of the portfolio.

A staunch value investor, Ashfield prefers to buy investment trusts that are at historically wide share price discounts to their net asset value, although "confidence in the expertise of the management and its ability to achieve better than average performance over the years" is also essential.

The manager also invests in direct equity holdings (1%) and bonds (less than 1%), and currently holds 2.4% in cash.

Mixed Investment 20-60% Shares sector: Standard Life Investments Dynamic Distribution

Managed by: Jacqueline Kerr

Replacing is , which has entered the league following a very strong three years in which it has returned more than any other fund in its sector.

According to Jacqueline Lowe, who has managed the £251 million fund since its launch in February 2006, SLI's "focus on change" investment philosophy is the main driver behind its stellar performance.

"Our investment strategy lies at the heart of everything we do at SLI. Our 'focus on change' philosophy, which focuses on five key questions to frame our investment ideas, is key to maintaining our robust and repeatable investment process, as it provides a common investment language that we use across all asset classes," says Lowe.

Dynamic Distribution is largely an in-house fund of funds, with SLI's highly rated one of Lowe's largest holdings. The fund also has holdings in and Absolute Return Global Bond Strategy funds.

Commercial property, which Lowe can invest in both through listed vehicles and directly, currently occupies 15% of the fund's portfolio and is one of Lowe's favoured asset classes.

Despite a period of underperformance over the past six months, Lowe says she is confident that the fund can maintain its strong long-term performance.

Browse Money Observer's Nov 2014 Premier League review