The future for oil prices

14th November 2014 17:09

by Harriet Mann from interactive investor

Share on

Oil prices have plunged recently to four-year lows. The repercussions have been felt throughout the exploration and production (E&P) sector. On Friday, the International Energy Association (IEA) said the market had entered a "new chapter," raising expectations that depressed prices are here to stay.

Brent Crude settled at sub-$77 a barrel on Thursday following weaker data out of China, and as a drawdown in US supply proved insufficient to ease the downward pressure. It's now quite possible that oil prices will suffer their longest run of weekly declines since 1986, warned Mike van Dulken, head of research at Accendo Markets.

"While oil continues to weigh on the energy sector and the economies of China and the eurozone move in fits and starts, there is little motivation for investors to continue their pursuit of Wall St and drive equities much higher for the time being," said head of derivatives at Interactive Investor, Mike McCudden.

Since the mid-way point of the year, oil prices have been faltering. But the IEA's reduced demand outlook last month really sped up the sell-off, says Eric Knutzen, chief investment officer at Neuberger Berman. He pins the fall on weakness in the eurozone, China and Japan, which has dragged down demand expectations from 1.3 million barrels a day in June to just 700,000. And geopolitical issues, which some thought would have driven up prices due to uncertain supply, have been offset by supply from North American shale fields.

It's little wonder that many point the finger at the US and Saudi for deliberately driving the price lower to hit Russia in the pocket. Moscow's involvement in both Ukraine and Syria hardly endears itself to either producer.

"So there is actually just too much of the stuff around, that's the real problem," he told Interactive Investor.

Other factors putting pressure on the price include the strong dollar and the upcoming Organisation of the Petroleum Exporting Countries (OPEC) meeting in a fortnight, which Goldman Sachs reckons will highlight the changing nature of its reaction function.

While some analysts expect OPEC will agree to cut production later this month, Graham-Wood, founding partner of HydroCarbon Capital, questions what incentive the group of the largest oil exporters would have to limit their supply.

"I'm not sure whether it really is in their best interests to cut production to get the price up. The difficulty is that around the OPEC table everyone has a different agenda, for example Venezuala needs about $160 per barrel to break-even, so wants it as high as possible. But none of them want to cut the production to get the price up enough. Why should OPEC feel the need to cut production because all they are going to do is feed market share to America in particular and other people who don't have a view on oil prices."

As a group, OPEC produces 31 million barrels per day, so production would need to cut by a long way to reduce supply and alleviate price pressure.

Graham-Wood reckons shrinking oil production by 1.5 million barrels per day and actually sticking to new production quotas would help increase oil prices back up to $100-$110. "It is in OPEC's gift, but I am not sure if they will do that. They want to show the rest of the world a bit of a bad time for a little while."

While he doesn't see prices rising in the short-term, he notes that there will be buyers soon as they are holding off to find as cheap a price as possible. Coupled with the improving American economy, Graham-Wood does not see slowing global growth, especially in China, as an issue, expecting demand to pick up in the second half of next year. He does, however, maintain his bear position.

"There is no reason why the oil price should pick up from here in the very short term unless there is decisive action from OPEC."

Such a bad thing?

But are lower oil prices a bad thing? For energy producers, yes, but not necessarily for global growth.

Lower fuel dampens inflation, argues Knutzen, which drives consumer confidence by increasing spending power. It also lowers the cost of manufacturing, boosting manufacturing-based economies like China. And GDP growth in the US could rise by 0.4% each year if oil prices are maintained at these lower levels, he adds.

Interactive Investor's editor Lee Wild has highlighted some of the sectors and companies which should benefit from low oil prices.

But weak prices throw up problems, too, due to their predictive function, Knutzen adds.

"In the current environment of extremely easy monetary, the fact the inflation remains relatively low and that commodity prices including oil have fallen so much is troubling from the standpoint of signalling the potential for deflation and/or recession. At a time when central banks have fewer tools at their disposal, it's unclear what they will do if economies do not turn the corner," he says.

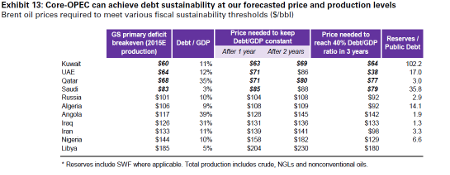

And low oil prices clearly harm oil producers, from E&P companies to the regions that rely on the commodity for economic performance, like Russia, Venezuela and Ecuador, Nigeria and Angola. Knutzen reckons that if prices stay below $80, the economics of oil production will suffer, especially in the deep water sector where exploration costs are higher with greater risks.

"It highlights, however, a key insight for us: the importance of focusing on low-cost producers. We believe that many existing North American shale fields are profitable with oil below $80 or even $70 a barrel. And we continue to emphasise that there are 'haves' or 'have nots' in the space, making security selection key."

What should investors look out for?

Malcolm Graham-Wood says readers should look for three things when deciding whether to invest in the sector. Firstly, the cost of production per barrel should be low - an onshore company in a low tax region, for example .

All companies should be fully-funded and not have to go to the market to raise extra cash. A 2015 drilling plan that would be economic at $70 per barrel would be helpful, too. That crosses off projects with high cost developments like offshore.

" and both come into the category of good developments that go at these prices. Companies like with some exciting wells to drill next year raised money already this year, which is good," he said. "You need to be cashed up, in possession of decent oil, and an exciting exploration programme which works at $75 or less."

Large diversified companies with multiple revenue streams also lower the volatility of an investment. Knutzen points to strong balance sheets and high dividends.

"Among energy stocks, large integrated players are seen as less volatile given their multiple revenue streams, balance sheet strength and high dividends. Exploration and development companies may face more turbulence given their leverage to prices, although low-cost producers could be attractive. Natural gas producers could also become appealing, having sold off with oil stocks despite largely unchanged natural gas fundamentals. Finally, "mid-stream" players, which transport oil and gas, typically do not take commodity price risk and have long-term contracts for revenues, and may provide a happy medium for some investors.

"More broadly, we believe investment decisions should be made on an individual sector and security basis, taking into account exposure to energy prices from a cost perspective, counterbalanced by the potential for greater demand in some regions and countries. In essence, the particulars should continue to be based on individual research decisions," he adds.

Outlook

Knutzen reckons lower oil prices will be self-correcting, with Brent staying within the region of $80-$95 for the next year. Graham-Wood sees the low price environment continuing for the next six months, but points out that while there isn't a base price at the moment, a $50 barrel is unlikely.

"After that it depends very much on whether demand will pick up and how the supply goes. If it stays at the current price or goes lower for the next few months, investment will cut back. So you will see some of the American production coming off the market, which in itself will alleviate the supply problem for a bit. It's not the end of the world, but we have got a difficult time to come."

Goldman Sachs reckons oil prices will be weakest in the second quarter of 2015 at $80 a barrel, but pencils in $85 for the first quarter of 2015 and the second half, as a result of OPEC's loss of pricing power.

Further ahead, the expansion of shale will slow in 2016-2018, lifting some of the pressure on the price of oil, allowing it to rise, Knutzen says. "This easing growth, combined with additional delays in international development and potentially higher demand due to lower fuel prices, could help oil return to structurally higher prices in a year or two."

So, it appears we are in for a period of low oil prices. That's not what the majors want to hear, but they’ll pull through. In the meantime there are generous dividend yields to be had. And for those investors seeking an element of risk in an otherwise diversified portfolio, there are, as we have seen above, a number of small explorers which fit the bill.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.