Ben Graham's checklist for hunting high-quality value stocks

26th November 2014 11:47

This is the third article in our series on how to screen the stockmarket for winners. Last week we introduced the father of value investing - Benjamin Graham - and investigated some of his early techniques for finding bargains trading below their liquidation value.

This week we'll investigate how Graham's philosophy evolved and how he increasingly turned his back on deep bargain hunting in his latter years towards a more systematic approach to finding higher-quality value stocks. His last work was on a system that's become known as his Deep Value checklist which some broker studies have shown returned up to 50% on average per stock in a one year holding period... read on to learn more.

Teaching men to fish empties the nets

But Graham spent much of his life as a Finance Professor at Columbia University, preaching his gospel to his students who all learnt well enough to drain the good bargains from the market. This led to leaner and leaner pickings for bargain hunters as the years went on. Warren Buffett himself famously moved on from bargain investing claiming they were "cigar butts" only good for "one last puff" of profit before being stubbed out.

The portfolio approach

Perhaps as a result, Ben Graham's approach became more oriented towards finding the quality stocks in the value bucket. He also became more systematic in his approach even going so far as to almost dismiss the value of stock picking altogether:

"Try to buy groups of stocks that meet some simple criterion for being undervalued - regardless of the industry and with very little attention to the individual company. It seems too good to be true, but all I can tell you after 60 years of experience, it seems to stand up under any of the tests I would make up."

Graham's Last Will

Towards the end of his life, Graham, wrote an article for Barron's magazine titled "The Renaissance of Value" which was read by an aeronautical engineer called James Rea. Rea contacted Graham and forwarded him his quantitative research work on the stockmarket. This led to a three-year working relationship between the two leading up to Graham's death which culminated in the publication of some 50 years of backtesting on the most effective screening criteria for the US market. This methodology has become known as "Graham's last Will".

The idea was to create an automated system for finding the stocks with the highest reward potential for their risk. They developed a 10 point checklist, split into two groups of five. The first five aimed to find 'cheap' stocks with strong return possibilities (using low P/E, high yields etc), while the second five aimed to find 'low risk' stocks (not much debt, consistent profitability, good liquidity etc).

1-5 (Return potential)

1. Earnings Yield of at least twice the investment grade bond yield

2. P/E ratio less than 40% of the highest P/E ratio the stock had over the past 5 years

3. Dividend yield of at least 2/3 the investment grade bond yield

4. Stock price below 2/3 of tangible book value per share

5. Stock price below 2/3 of Net Current Asset Value

6-10 (Risk reduction)

6. Total debt less than book value

7. Current ratio greater than 2

8. Total debt less than 2 times Net Current Asset Value

9. Compound earnings growth over the last 10 years at least at a 7%

10. No more than 2 earnings declines in the last 10 years.

The checklist scored stocks with 1 mark for each test passed, with the highest possible score obviously being 10/10.

Did it work?

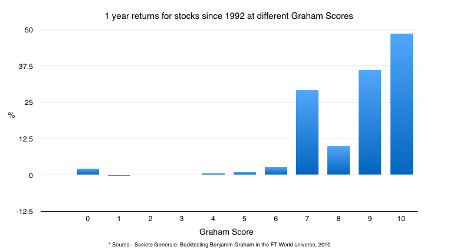

The 10 rules apparently produced market-beating returns for five of the six decades that Ben tested it on. While subsequent testing by Henry Oppenheimer from 1974 to 1981 found that using just rules 1, 3 and 6 would have generated annual returns of 29%. The most recent study by Societe Generale backtested the strategy since 1992 which found that the group of stocks scoring 9 and 10 on the list returned 37.1% and 48.7% per year respectively.

Before anyone gets too excited, though, it's worth noting that there are rarely more than a handful of stocks that score 9 or 10 by this checklist. In the entire European and US stockmarkets there are only two stocks that score 9 or better. So a more modern approach is to look to build portfolios of stocks that score better than 7.5.

UK Graham qualifiers

At Stockopedia.com, we are scoring the entire UK stockmarket according to Graham's Deep Value Checklist and have been tracking the performance since earlier in the year. There are currently only 13 stocks in the UK market qualifying for Ben Graham's Deep Value checklist in the UK market which have a score of 7.5 or better. The largest five stocks on the list include , , , and while the full list and smaller caps qualifying can be found at the site.

| Ticker | Name | Mkt Cap (£m) | Graham score | P/E | Stock Rank™ | Sector |

| VCT | Victrex | 1,493 | 7.5 | 19.6 | 71 | Basic Materials |

| ELM | Elementis | 1,241 | 7.5 | 17.3 | 87 | Basic materials |

| HTG | Hunting | 1,015 | 7.5 | 15.9 | 76 | Energy |

| FXPO | Ferrexpo | 418.8 | 8 | 1.87 | 64 | Basic Materials |

| ITE | ITE | 413.3 | 8 | 9.46 | 73 | Industrials |

The evolution of Graham's approach away from stock picking should give confidence to investors who seek to implement rule-based investment processes such as his. Given the starkly poor results of most private investors who try to select stocks for themselves, Graham's methods may be a signpost to an alternative, and quite possibly more successful approach.

About Stockopedia

Interactive Investor's Stock Screening series is written by Ed Page Croft of Stockopedia.com, the rules-based stockmarket investing website. You can click here to read Richard Beddard’s review of Stockopedia.com and learn more about the site.

● Interactive Investor readers can enjoy a 2 week free trial and £50 discount to Stockopedia using the coupon code iii014 - click here.

● To learn more about Ben Graham and his deep value investing strategies, you can download the free Stockopedia book, How to Make Money in Value Stocks.

It's worth remembering that these and other investment articles on Interactive Investor are simply for generating ideas and if you are thinking of investing they should only ever be a starting point for your own in-depth research before making a decision.

*No fee for publication is involved between Interactive Investor and Stockopedia for this column.

About the author

About the author

Edward Page Croft is the CEO and founder of Stockopedia.com. His background is in wealth management and engineering, having worked as a private client broker at Goldman Sachs before founding Stockopedia.

He graduated from Oxford University with first class honours and is a Zend Certified PHP Engineer. Edward writes regularly for This is Money, Business Insider and the London Stock Exchange's Private Investor Magazine. He is the author of several ebooks including "How to Make Money in Value Stocks".

Editor's Picks