Time to buy this hot sector

27th November 2014 13:07

by Simon Thompson from ii contributor

Share on

A standing dish

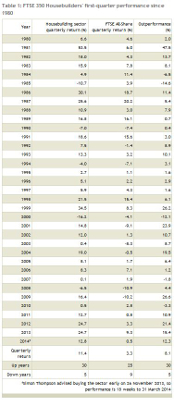

As regular readers of my columns will be all too aware, I have a keen interest in stockmarket history. It pays to do so as over the years I have uncovered a large number of profitable stockmarket trends and ones that have the habit of repeating themselves year in, year out. One of the most reliable of which, and one that has clearly stood the test of time, is the tendency for the UK housebuilding sector to rally strongly in the first quarter each year.

I first discovered the phenomenon while carrying out some quantitative research over a decade ago. At the time I noted: "On average, you would have made a healthy 8.1% profit over the first three months of the year by investing in the housebuilding sector... and anyone possessing the Midas touch by calling the top in each of those first quarters would have made an average three-month return of 15.7% since 1992." I also noted that the strategy was relatively low risk, because in "only two of the 12 years have produced negative returns".

But once a trading pattern establishes itself, more often than not the profits made from following the trend can be quickly arbitraged away as more and more market participants become aware of it. It's therefore worth pointing out that the factors I identified driving the sector returns all those years ago are the same ones at work today. Moreover, if anything the trend has become stronger, rather than weaker, even though more investors are aware of the bumper gains to be made.

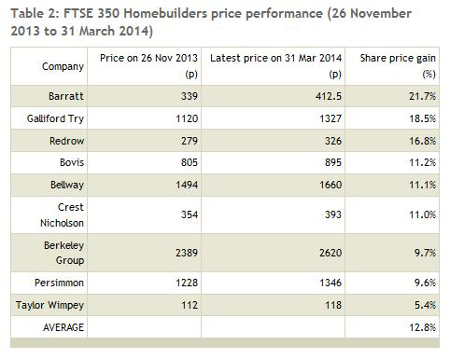

It was more of the same last year when I suggested jumping the gun and buying into the home builders in the last week of November. At the time I saw little reason to wait until the start of January to take our positions. It paid off as the 12.8% average share price gain on the nine homebuilders in the subsequent 18 weeks (performance to 31 March 2014) absolutely smashed the 0.5% rise in the FTSE All-Share index in the same period.

Déjà vu?

The only question I have this year is not whether we should jump the gun now and buy into the sector in expectation of another profitable run up - I see no reason again to wait another four weeks given that I expect equity markets to continue their recovery from the growth scare in October - but whether the economic back drop is favourable enough to justify the risk?

On that score I feel that it clearly is which is why I have maintained a buy recommendation on both (450p) and (130p) since including shares in both companies in my 2014 Bargain share portfolio in February. I updated those companies in yesterday's column ("Bargain shares updates", 24 November 2014).

Firstly, with the twin effects of falling fuel and food costs subduing UK inflation, and private sector wage inflation running at twice the rate of the UK's consumer price index on a quarter-to-quarter basis, then for the first time in many years millions of UK consumers, and homeowners, are seeing real pay rises. And it's likely to continue given that the unemployment rate has fallen dramatically and, at below 6%, is at its lowest level since the 2008 financial crisis.

At the same time the steady increase in the employment rate - as a share of the population it is now approaching levels not seen since the 1960s, according to economists at JPMorgan Asset Management - and net migration, is underpinning demand for housing. So with the homebuilders either unable to ramp up supply due to an antiquated and pedestrian planning system, or simply unwilling to do so for commercial reasons, then the supply:demand imbalance is highly supportive of the profit recovery we have witnessed across the new build sector.

Moreover, money markets are now predicting that the first Bank of England base rate rise will occur later in 2015, rather than mid-year, so offering further reassurance to mortgage payers. I still feel this is an optimistic view, as does chief market strategist Stephanie Flanders at JPMorgan who anticipates "one or more interest rate increases from the middle part of the year". But neither of our views on the timing of the first rate rise really matter for my favoured first-quarter housebuilders rally as what counts most is what the vast majority of financial participants believe will happen as that affects the pricing in the interest rate futures markets. And they currently believe the first hike will be in the latter part of 2015.

In the circumstances, it's hardly surprising that mortgage lenders have been offering record low discounted and fixed rate deals to homeowners - at the expense of the returns offered to savers, I would hasten to add - so much so that home buyers can currently finance their interest payments for little as 1% a year on a two-year discounted mortgage deal, or just 2.5% a year on a five-year fix. In turn, these miniscule interest rates are supporting affordability.

Sound reasons for a first-quarter rally

True, there is no getting away from the fact that there will be uncertainty ahead of the general election in May 2015 and the possibility of another hung parliament. But the major homebuilders are aware of this and have already anticipated sales weakness from customer nervousness ahead of the election. They will undoubtedly try to get forward sales in by the end of April to maintain an uninterrupted production schedule. And let's not overplay the possibility of a change in government.

Indeed, chief executive of Barratt Development, Mark Clare, was a member of the Lyons Housing Commission, led by Sir Michael Lyons who was commissioned to carry out an independent review of housing for the Labour Party. Mr Clare believes the Labour Party supports its conclusions and, if the party wins the election, is likely to focus on the affordable end of the market.

In a perfect world, the government would fund local councils and housing associations, but given the country's high and growing indebtedness then the private sector listed housebuilders will have an important role too, according to analysts at Charles Stanley stockbrokers. In turn, this "implies a positive back drop for state land sales, and improvements in the planning approval process." If this scenario plays out, this would be good news for one of my other housing market plays, Aim-traded brownfield land developer and housebuilder (58.5p).

And let's not forgot either why my favoured first quarter rally phenomenon occurs. Namely, the reporting season for housebuilders, which starts during late February and early March, guarantees investors a continuous stream of newsflow from the leading players (and generally positive news at that). Combine this with general media attention on the spring housing market (this is the time of year most of us prefer to move house), and we have the ingredients in place for further share price gains especially as investors remain focused on the potential for substantial capital returns as bumper land banks are converted into home sales. Leading players Barratts, (1,495p), (2,459p) and Taylor Wimpey all now have schemes in place to payout special dividends to shareholders over the next few years.

Strong tailwind

There is also another reason why the sector outperforms the general market in the first quarter: this time of the year is when investing in "cyclical" or "value" stocks does well. These companies are very sensitive to changes in macroeconomic conditions, so with the UK economic outlook still very positive despite the difficulties faced by our European cousins, this is providing yet another tailwind for the sector.

Importantly, the valuations are not too punchy yet with the major players priced as modestly as 1.4 times book value (Barratt's), on ratings as low as 8 times earnings estimates (Berkeley), and offering prospective dividend yields as high as 6.3% (Persimmon). And with some of the players either breaking out to all-time highs (Bellway), or on the cusp of doing so (Persimmon), there is a favourable technical set-up too.

Furthermore, because I believe the current UK stockmarket rally will continue into the first quarter next year, it's fair to assume the nine FTSE 350 housebuilders will do well too. In the circumstances, I would recommend jumping the gun and buying them now before other investors have the same thought come the new year. My aim is to hold the shares until the end of March.

The nine housebuilders in the FTSE 350 to buy are: Barratt Developments, (1,829p), Berkeley, (832p), (356p), (1,151p), (270p), Persimmon and Taylor Wimpey.

If I had to reduce my list to just four of five shares, I would choose Barratt Developments (low price to book value and above average forward dividend yield), Persimmon (high dividend yield), Taylor Wimpey and Bovis Homes (hidden value in substantial land banks), and Bellway (low PE ratio and low end of range on a price-to-book value) as my favoured five plays.

I would also point out that Berkeley has most to gain from the re-election of a Conservative-led government given its heavy London bias, but it is the most exposed to a cooling of the capital's housing market and any negative sentiment towards a 'mansion tax' given the price bracket of its properties.

- Simon Thompson's book Stock Picking for Profit can be purchased online at www.ypdbooks.com, or by telephoning YPDBooks on 01904 431 213 and is being sold through no other source. It is priced at £14.99, plus £2.75 postage and packaging. Simon has published an article outlining the content: 'Secrets to successful stockpicking'