City view: Best time to buy oil stocks since 2009

5th December 2014 15:38

by Harriet Mann from interactive investor

Share on

Since the middle of the year oil prices have lost over $40 a barrel (bbl), and as sentiment turned ugly the last of the downgrades followed suit. But for long-term investors with a horizon of over 12 months, this could provide a perfect entry point to "sensible" oil plays, says Numis.

Brent fell to $69/bbl on Friday afternoon, down from $110/bbl less than six months ago. Mirroring this trend, the Numis analysts reduced their price guidance from $100/bbl to $80/bbl. So why are they advising investors open their portfolios to oil?

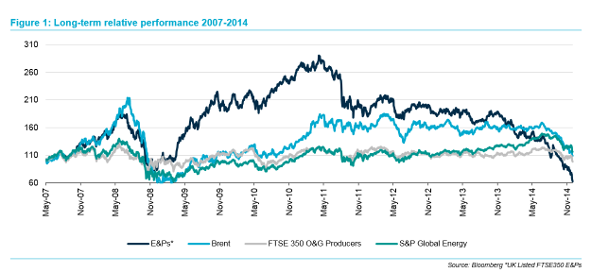

E&P companies are known for outperforming the market as oil prices rise but underperforming at stable levels, says Numis, arguing that now is the perfect time to lock in. In fact, they reckon there hasn't been an investment opportunity like this since 2009, which was followed by two years of outperformance with returns from E&P mid-caps averaging 150%.

"We believe we are close to the bottom of the current cycle and that generalist fund managers will look to close their underweight stance and move towards a consensus 'neutral/overweight' in the coming months," explains Numis. "We believe investors should be looking to buy E&Ps when the oil price is well within the cost curve and the commodity market is pricing in minimal scarcity or supply risk premium."

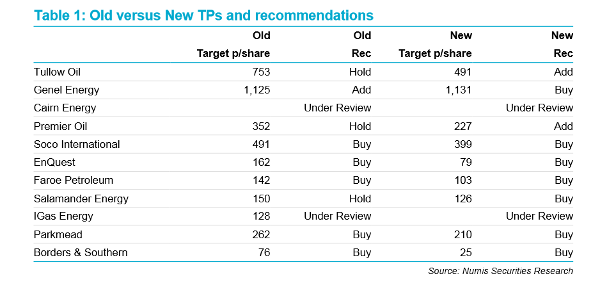

The recommendation changes, see table below, include from 'hold' to 'add', from 'add' to 'buy', from 'hold' to 'buy' and from 'hold' to 'buy'.

As we reported last week, Panmure Gordon still reckons OPEC will decide to cut its production to increase prices, but at a larger rate than if it had already done so to compensate for the delay. However, Numis also sees the tightening of supply being driven by US shale in the short term - as it will be uneconomic for US shale companies to maintain the number of rigs that are in production - and the abandonment of non-OPEC projects - like ultra-deep water, oil sand, Arctic and small-field developments.

"This will inevitably have a negative impact on non-OPEC supply growth expectations two-five years out and drive the next oil price cycle," said the analysts. "With oil price well within the top-end of the crude oil cost curve and with minimal scarcity or risk premium in the price we see this as an opportunity to add to E&P exposure."

However they do not rule out a change to OPEC production targets, warning that a ramp-up in Libyan production, Iranian sanctions and lower fourth-quarter output from China could impact short-term oil prices.

"Taking a longer-term view, we believe investors should be looking to buy sensibly-managed, resource rich E&Ps when the commodity price is well within the cost curve. We believe that investors need to be selective and gain exposure to high quality resource portfolios that would appeal to strategic buyers even if the current oil price was to prevail. Genel is one of our top picks given this investment filter."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.