Five favoured funds and trusts for emerging market exposure

9th December 2014 09:07

In our quarterly multi-manager series we reveal the funds and trusts selected by a panel of leading multi-managers.

Rather than build their portfolios by investing in individual stocks or bonds, these managers invest largely or exclusively in investment funds, leaving them well placed to identity future winners.

One of our experts has thrown his lot in with emerging markets, while two others also have favoured funds in that region.

Below, our managers give us a selection of five to choose from.

Other areas of positive interest for our panel this quarter were investment trusts and global equities, while they believe fixed income is best avoided.

Max King, portfolio manager, Investec Asset Management multi-asset team

Unlike some of our multi-manager panel experts, Investec's Max King is decidedly bullish on global emerging markets.

For general exposure he highlights the , which he says has a long-term record of consistently beating its benchmark index by over 2% a year, after fees.

King especially likes the team's "on-the-ground" research approach, which he says helps to free them from the distraction of daily market news and 'noise'.

Those looking for more targeted emerging market exposure could consider the , which King is particularly keen on. Managed by the "shrewd and highly regarded" Asian equity manager Matthew Dobbs, it returned 13% during the six months to the end of October - a torrid time for emerging markets.

"There are few funds that cover smaller companies in emerging markets, but Dobbs took up the daunting challenge because he saw an exceptional long-term opportunity and wanted to invest in it himself. With the tide in his favour, the performance should be even better," says King.

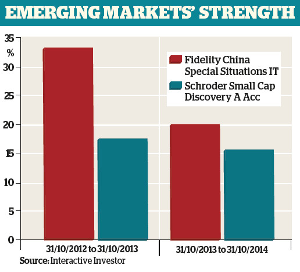

He is less keen on single country funds as, he says, "by the time they are launched, the best of the opportunity is usually over." However, he would make an exception for , the investment trust formerly run by star manager Anthony Bolton and since April by Dale Nicholls.

"Poor performance accompanied by almost gleeful schadenfreude followed the launch, but Bolton is having the last laugh. The net asset value now stands 33% above the issue price, and the shares trade at a generous 13% discount to net asset value," he says.

John Ventre, portfolio manager of Old Mutual Spectrum fund range

As a distinct opportunity within emerging markets, John Ventre identifies state-owned enterprises (SOEs) in China.

Formerly a no-go for foreign investors due to high levels of government corruption, SOEs are soon to go through radical reforms that will encourage them to pay dividends to shareholders instead of diverting profits to "dubious political sweeteners".

To capitalise on this opportunity he recommends the managed by Jonathan Pines who, unlike most other Asia managers, is willing to own SOEs.

"Pines' quality-adjusted approach to valuing companies means he's able to assess when an SOE is cheap enough to be worth the risk," says Ventre.

Ayesha Akbar, multi-asset portfolio manager, Fidelity

As in the previous quarter, Akbar remains bearish on emerging markets, stating that commodity weakness and dollar strength - two of the reasons she favours equities - are still weighing on these markets significantly.

However, she adds that this can be a good time for stockpickers. She likes , which she says looks for companies providing good growth prospects for the medium term.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks