Only Co-op fails Bank of England stress test

16th December 2014 11:06

All of the UK's major banks have passed the Bank of England's tough new stress tests, but it was close for both and , and the Co-operative Bank failed miserably. This means that all but the Co-op need not submit new capital plans or raise extra cash, and that Lloyds should begin paying dividends this year.

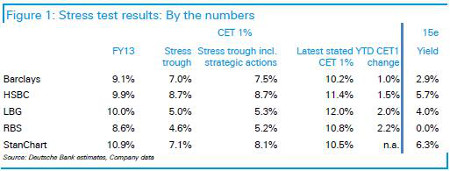

"This stress test did not reveal capital inadequacies for five out of the eight participating banks, given their balance sheets at end-2013," said the Bank of England early Tuesday, referring to , , Nationwide, Santander UK and . All remained above the 4.5% hurdle rate, or Common Equity Tier 1 (CET1) capital threshold.

"The PRA Board (Prudential Regulation Authority) judged that, as at end-2013, three of the eight participating banks needed to strengthen their capital position further. But, given continuing improvements to banks' resilience over the course of 2014 and concrete plans to build capital further going forward, only one of these banks was required to submit a revised capital plan."

That, of course, is the Co-op. Saddled with billions of pounds of sub-prime mortgages, it would be incredibly vulnerable in a severe economic downturn. Indeed, the central bank said that the Co-op's CET1 capital resources would likely be exhausted in the hypothetical stress scenario. That's why a new plan includes a reduction in its risk weighted assets (RWAs), especially historic residential mortgage assets susceptible to severe stress, of about £5.5 billion by the end of 2018.

And this was certainly a tough test. The economic scenario assumed a prolonged period of stagflation, with house prices down 35%, a plunge in commercial real estate, unemployment at 11.8%, inflation at 6% and interest rates up by 4 percentage points.

"In shape terms, probably the toughest for LBG and RBS given their exposure to domestic property, least challenging perhaps for Barclays given its defensive loan book," says Deutsche Bank.

"That banks passed this test despite capital ratios up to 2% lower than they are today is important. Add to this the substantial de-risking of balance sheets delivered in 2014 by asset sales, rising property prices, and AT1 (Additional Tier 1) issuance and a picture of a much stronger outcome in next year's test emerges unless the hurdle rate or severity of the test increases materially."

RBS finance chief Ewen Stevenson admitted there was still "much work to be done" to improve the resilience of the lender's balance sheet, but that it remained on track to hit its CET1 capital ratio targets of 11% by end 2015 and at least 12% by end 2016.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks