Oil Services slump throws up bargains

19th December 2014 15:43

by Lee Wild from interactive investor

Share on

A slump in oil prices on the scale witnessed in recent months is dramatic, yes, but not uncommon. Brent crude is trading below $60 a barrel for the first time in over five years, but it troughed at $40 in December 2008. Within two years it was back above $100 where it stayed for the most part, until September.

But the days of $100-a-barrel oil are probably over and, understandably, oil sector share prices have crumbled. Yet, it's not just the exploration and production companies that have fared badly. Oilfield services firms, the guys who supply them with all the kit and know-how, have been wiped out, too.

And no wonder. Research by US oil services giant Baker Hughes confirmed recently that US oil companies have idled more rigs than at any time in nearly two years. The number fell by 29 in a week to 1,546, the lowest since June. And cuts in spending are becoming more commonplace. has already said it will spend 20% less in 2015, and others are expected to follow suit. As much as a trillion dollars of projects are at risk, say experts.

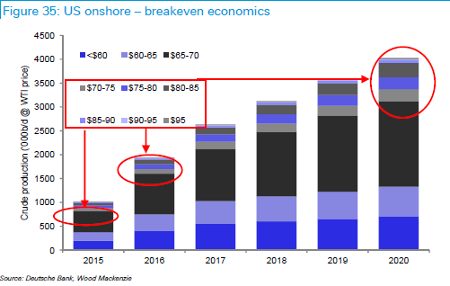

According to industry consultant Wood Mackenzie, a West Texas Intermediate (WTI) price of around $65 a barrel is the point at which a meaningful proportion of potential growth could be disincentivised (see table below).

(click to enlarge)

Obviously, British suppliers like Amec Foster Wheeler (AMFW), , and are under the cosh (see chart). Wood fell 13% in just three weeks, the best performer, while Petrofac slumped by 41%. Prices have rebounded slightly - Santa rally or something more sustainable? - but the sector still trades on a 2015 price earnings (PE) of just 9, which, according to analysts at Deutsche Bank, already prices in a severe recession in sector earnings. It says:

We view current levels as a reasonable starting point for long-term investors to begin building positions in asset light engineering service companies.

Rival broker Citi agrees. "While the free falling oil price impacts all companies in the OFS space, we see it creating opportunity as high quality names become devalued."

But if this sell-off continues to offer value, where should investors look?

"Avoid stocks with operational risk, low balance sheet flexibility and significant earnings downside," says Deutsche. "Stay asset light (engineers) vs asset heavy (seismic, drilling) and look for a combination of low risk backlog, [free cash flow] and healthy balance sheet," advises Citi.

(click to enlarge)

Amec Foster Wheeler, formerly AMEC, remains "the standout opportunity," according to Citi's Mukhtar Garadaghi. It's one of the more defensive engineering names, benefiting from a diversified revenue stream - about 44% of the business is non-oil & gas - while the integration of the recent Foster Wheeler acquisition will deliver benefits.

We see material upside to announced cost synergies ($75m+) in 2015/16. Free cash flow yield of 10% is another attraction, and should allow continued growth in dividends (currently dividend yield of 6%). We reiterate our Buy on AMEC as valuation remains undemanding at 8x 2016E PE, a 20% discount to global peers.

Deutsche is less sure, downgrading its stance to 'hold'. The broker has concerns about "resilience of Greenfield oil & gas work and the contribution of Foster Wheeler where earnings have typically shown greater cyclicality in downturns, margins continue to disappoint and backlog has softened in recent quarters."

Instead, the Germans like the robust margin outlook at Wood Group where directors have been heavy buyers of the shares at between 565p and 573p. Balance sheet flexibility is a key differentiator in 2015, the broker says, which is why it thinks this engineering contractor is in the best position to create value through additional M&A. Look for a yield of over 6% in 2016, too.

Citi agrees, and admits exposure to relatively defensive oil and gas spend and good near-term visibility is attractive. However, a lot of Wood's growth comes from US onshore, and some experts reckons spend on shale exploration could plunge by 30% next year. Expensive deepwater and oil sands projects also look vulnerable, another area where Wood has tended to do well. That’s all in the price, though, so Wood gets a Neutral rating.

Elsewhere, Citi puts the boot into accident-prone Petrofac, which has issued three profits warnings in the past year. A record backlog should underpin its core Engineering & Construction (E&C) operation near-term, but there are worries elsewhere.

…the offshore and Integrated Energy Services (IES) divisions should remain dilutive to returns in the near and medium term. We see risks around asset impairments (IES), working capital recovery and the company’s decision to continue investing heavily through the down-cycle. While the stock trades at sector average multiple, our revised EPS estimates are 10% below consensus in 2015/16.

IES and likelihood of further operational issues there are causing sleepless nights at Deutsche, too. So are risks to the company's cashflow - Petrofac is still spending big and persisting with expensive dividend payments, despite falling earnings. And, although the share price has recently hit a five-year low, the broker sees "little scope for a re-rating and potential for the company to face some difficult strategic decisions."

And finally, Hunting.

Last month, chief executive Dennis Proctor said business had not been affected by the falling oil price, and that he looked forward to another year of growth. But Brent Crude has slumped by another 30% since then and the Baker Hughes rig count stats are a worry. That's why Deutsche advises against putting new money into the stock.

It is hard for us to justify a positive view on the downhole equipment sub-sector at present ahead of an anticipated rig count deterioration.

And, given Hunting trades at a premium both to US land peers and the broader European Oilfield services sector, investors might wish to bide their time before piling in. "Wait for a better entry point and better visibility around US capex medium-term before becoming more positive," advises Deutsche.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.