Model income portfolios: Annual review

14th January 2015 10:41

by Helen Pridham from interactive investor

Share on

Money Observer's model income portfolios are divided into three categories to reflect investors' initial income requirements as well as their risk profiles.

For investors who need their capital to generate a high income as quickly as possible, we have created two immediate income portfolios which currently yield over 4% net of tax. The balanced and growing income portfolios yield just over 3%.

All portfolios are expected to produce an increasing income and some capital growth. However, the immediate income portfolios are designed more with capital preservation in mind, while the growing income portfolios provide greater potential for capital growth but may be more volatile. The balanced income portfolios are intended as a middle way.

The emphasis of the portfolios on UK and global equity funds remained during 2014 and the changes made were due to manager changes or soft closure of existing holdings to new investors.

Medium risk income

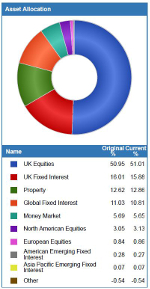

Golf - immediate income

Performance to 1 January 2015:

5.1% over one year, 43.6% over three years.

At the beginning of last year it had been thought that bonds were likely to underperform equities as interest rates were likely to go up, however low inflation and slow growth proved more supportive for bonds than expected. We have held bonds in this portfolio to reduce its volatility as well as to provide some secure income, but we will be keeping a close eye on this holding in the coming months to ensure it remains appropriate.

The second best-performing holding in the portfolio over the past year was , which has benefited from the revival of the domestic economy and renewed interest from investors looking for alternative sources of income.

Over the three-year period, the best performance was produced by , partly thanks to its high yield, which is supplemented by selling short-dated options on its holdings. Another strong performer has been which was added to the portfolio in January 2013 to replace .

Golf Portfolio three-year performance chart

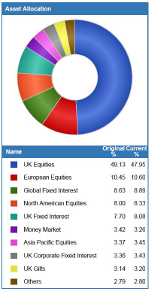

Hotel- balanced income

Performance to 1 January 2015:

5.8% over one year, 42.7% over three years.

We are less satisfied with the performance of (previously Liontrust Income) which was a replacement for after that fund was soft closed to new investors in April 2013.

Since the Liontrust fund was converted to a global fund, its performance has been less than impressive. We have therefore decided to replace it with which is already held in two other of our income portfolios and returned over 8% last year.

Another disappointing holding in this portfolio over the past year has been . Nevertheless, its dividends have continued to increase as they have done for the past 30 years and we still like the contrarian investment approach of its manager Alastair Mundy. Over the three-year period it has also performed well for the portfolio so we have decided to retain it.

Hotel Portfolio three-year performance chart

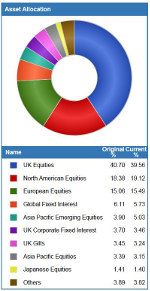

India - growing income

Performance to 1 January 2015:

8% over one year, 55.5% over three years.

There have been no changes in this portfolio's holdings over the past year and only one since inception. This was in April 2013 when Trojan Income was taken out of the portfolio after it was soft closed to new investors.

It was replaced by Liontrust Global Income. However, due to the disappointing performance of this fund, we have decided that this should also be replaced. It is being substituted by Artemis Global Income which is already held in four other model income portfolios.

The second strongest performance in the portfolio in 2014 was produced by , which we decided to retain despite the departure of its previous manager Neil Woodford. We are delighted that new manager Mark Barnett has proved as competent as we had hoped.

India Portfolio three-year performance chart

Higher risk income

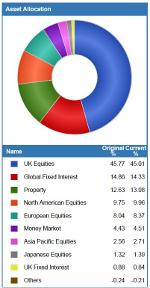

Juliet - immediate income

Performance to 1 January 2015:

7.9% over one year, 49.4% over three years.

The Schroder fund had undergone a change of manager whose experience we were unsure of, while Miton UK Multi Cap Income was soft closed to new investors. The two new holdings have both made valuable contributions to the portfolio's returns during the year.

A significant contribution was also made by Henderson UK Property, which returned over 11% in 2014. This fund was added to the portfolio in October 2013 to boost its income and provide greater growth opportunities. Commercial property has been recovering well over the past year as prospects for the UK economy have improved.

We are now making a further switch to the portfolio. is being replaced by . Given the shifting global economy, we believe it is now safer to hold a fund that has flexibility to invest across the whole bond spectrum. This does mean there is a slight drop in income but we feel capital preservation is more important.

Juliet Portfolio three-year performance chart

Kilo - balanced income

Performance to 1 January 2015:

5.4% over one year, 56.8% over three years.

Then Rathbone Income and were included as replacements for Miton UK Multi Cap Income and which were soft closed to new investors. We are happy with the positive contributions that all three of the new holdings have delivered during the year.

The holding we are now replacing is . A reason for the fund's disappointing performance last year was its bias towards smaller companies, which fell from favour in 2014. Its long-term manager John McClure also died earlier in the year and the running of the fund was taken over by two of his colleagues.

Their ability to replicate McClure's past successes remains untested and for this reason we have decided to transfer to . It has been managed since inception in 2006 by David Horner and David Taylor who are small company specialists.

Kilo Portfolio three-year performance chart

Lima - growing income

Performance to 1 January 2015:

8.5% over one year, 66.7% over three years.

Most of this trust's returns take the form of capital growth as it is not specifically income oriented, although it does aim to generate dividend growth. Its presence in the portfolio is mainly intended to provide a growth kicker, producing gains that can be withdrawn to supplement income if required.

There have been two changes in the past year. At the beginning of the year, Artemis Global Income was brought in to replace Schroder Global Equity Income and in April Troy Income & Growth was brought in to replace JOHMC UK Equity Income, which was soft-closed to new investors.

We have now decided to make another switch by replacing Unicorn UK Income (as we have done in the Kilo portfolio) with PFS Chelverton UK Equity Income.

Lima Portfolio three-year performance chart

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.