Stockwatch: An overlooked share that's growing fast

20th January 2015 08:31

by Edmond Jackson from interactive investor

Share on

With markets currently exposed to some big risks it's worth being alert for "special situations" i.e. shares whose prospects are more likely independent of the general trend. While this doesn't mean they won't be affected by a market sell-off, they should be relatively resilient.

One such example is AIM-listed , a litigation finance specialist. Its commercial concept is not new but a listed, dedicated leader in this field is certainly novel and a latest trading update reflects continued strong performance. New investment commitments were $150 million (£99 million) in 2014, over three times 2013's level, with management boasting a 60% net return on invested capital.

I drew attention at 132p last May, acknowledging that the shares had been volatile - reflecting concern that profits could be lumpy, and with litigation finance not well-understood. The price is currently 123p and some aspects of dis-connect with investors continue, but one can’t help note the strength of business evolving.

These legal specialists take a view on the outcome of cases, providing finance to one party in a dispute and taking a share of the outcome in return for "monetisation" before the case concludes. It can help for example in commercial situations where legal challenges could delay funding or a takeover; and firms may prefer to conserve cash for investment and dividends. Individuals may be deterred from legal action simply by the costs involved. So this type of funding definitely has a role when society is generally becoming more litigious. Not surprisingly, Burford's origins are in the US, although it is domiciled in Guernsey and has an office in South London.

Company is quite an "outsider" to the London stockmarket

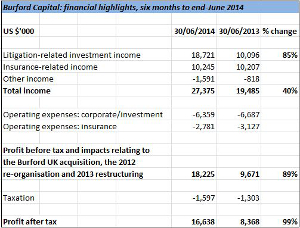

But the business is evolving an impressive track record and looks well-positioned. Accounts show that since listing in October 2009, total annual income of a mere $5.3 million in 2010 grew to $60.7 million in 2013, with $34.1 million normalised pre-tax profit in 2012 rising to $42.5 million in 2013. The interim results to end-June 2014 cited an 89% increase in like-for-like pre-tax profit to $18.1 million based on a 40% rise in income to $27.4 million - the litigation portfolio showing an 85% increase in income as activity expanded.

Cash generation leapt 93% to $42 million and $62 million new capital was committed, a five-fold increase over the same period in 2013 and boding well for 2015. Furthermore, in August the company raised $150 million equivalent via an issue of retail bonds, to be deployed in litigation cases. A first interim dividend of 1.74 cents per share was paid last December and for 2013 there was a 5.23 cents total dividend, representing an historic yield near 3%.

Profit view is after re-organisation charges, and low tax

The consolidated income statement on page 22 of the 2013 annual report (this LSE link is best) shows how the $42 million normalised pre-tax profit was before deducting a $26.5 million re-organisation charge in respect of 2012 with a further $2.7 million costs/fees in 2013, and an $11.2 million amortisation charge relating to the Burford UK acquisition.

The $0.5 million net tax charge related mainly to Burford being domiciled in Guernsey where it is exempt from tax, and appearing to minimise other tax liabilities, making it elusive to define a truly comparable sense of profit. With 204.5 million shares issued, earnings per share worked out in the region of 8p equivalent, i.e. an historic price/earnings multiple of about 15 currently. This rating may appear fair enough, although business momentum implies EPS should grow nicely hence the multiple will drop. Burford is also of a modest size - e.g. market cap just over £250 million - where growth can usefully impact capital value.

Senior management appointments underline prospects

It's notable how several experienced individuals have opted to join Burford - this strengthening of the management team was confirmed last November. A chief operating officer was appointed with a background in fund management, also a global chief marketing officer and a head of UK business - last May - who was credited with materially increasing the volume of potential UK business over the six-month period.

The chief executive characterised these appointments as reflecting Burford's development from a fund into an operating company: "five years of exceptional growth since we founded it." Admittedly this was a period of general recovery from the 2008 financial crisis and 2009 recession, when quantitative easing in the US and UK helped business activity. The only proof how "contra-cyclical" is Burford will be its results over another downturn. Yet litigation and finding cost-effective ways to implement it will persist. This is a "niche" service albeit an essential one, and where Burford is industry leader.

Net asset value of 114p/share equivalent, may limit downside

Should deflation chronically undermine equities, Burford's end-June balance sheet had $353.3 million net assets of which 62% comprised litigation-related investments, and there was no debt. This implies net assets per share of 114p equivalent which is good support in terms of the risk/reward profile, although note 10 in the accounts does not clarify the valuation basis to such "investments". You are left assuming it means capital committed, but its true value depends on the outcome odds. If management has applied good judgment then this implies a higher net asset value than the published balance sheet.

Non-executive directors have significantly increased their holdings

So despite reasons why Burford shares remain over-looked by the market, its commercial momentum is worth following and implies useful upside potential. My view appears supported by two non-executive directors’ buying: last September, a purchase of 50,000 shares at 123p to own 200,000 shares; then in October another non-exec adding 60,000 shares at 122p to own 160,000 shares.

For more information see burfordcapital.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.