Services sector remains UK's growth engine

29th January 2015 08:59

by Lee Wild from interactive investor

Share on

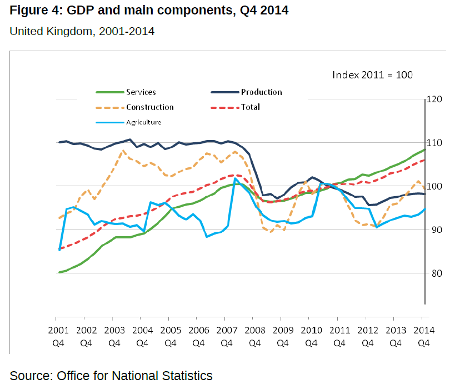

Britain's economic recovery remained firmly on track last year, although fourth-quarter statistics could have been embarrassing without a big contribution from the country's dominant services sector.

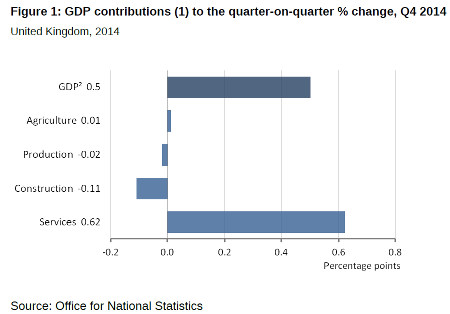

GDP grew by 2.6% over the full-year, the strongest performance since 2007. But Office for National Statistics (ONS) figures revealed growth of just 0.5% quarter-on-quarter in the final three months of 2014. That's down from 0.7% in the third quarter and weaker-than-expected.

However, recent surveys had softened up the market for a less riveting end to the year, and economists believe a second estimate, due on 26 February, will be revised higher, probably to 0.6%, says Barclays.

Clearly, the services sector was the key driver. It grew by 0.8% during the three months, equalling its performance in the previous quarter and contributing over 0.6% to total quarterly growth. Output from services during the fourth quarter is now 7.9% above its pre-economic downturn peak at the beginning of 2008.

Three of the four main services units grew during the period - distribution, hotels & restaurants; transport, storage & communication; business services & finance - while government & other services was flat.

Admittedly, only distribution, hotels & restaurants actually grew faster than the third quarter. It was up 1.3% during the fourth quarter, almost double the 0.7% reported in the previous period, mostly driven by the retail sector.

However, declines in the other segments of the services industry were only small. Interestingly, there were gains for computer programming and consultancy services in the transport unit and for architectural & engineering activities in business services & finance.

Elsewhere, output decreased by 1.8% in the construction sector, while soft utility output early in the quarter snipped industrial production by 0.1%. A downturn in mining and quarrying there hurt, too.

"For 2015, we expect average growth of 2.7%, 0.1pp higher than last year's growth," says Barclays. "Risks are somewhat tilted to the upside concerning private consumption, but policy uncertainty around and after the elections could hold investment up more than we expect."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.