Best yields in utilities sector

29th January 2015 12:47

by Lee Wild from interactive investor

Share on

Over the past few months, water companies have been slowly accepting Ofwat's determination of allowed revenues for 2015-2020. Having received plans for both prices and costs over the next five years, the industry regulator has decided that prices must fall and spending increase. That means dividends to shareholders will not be quite so generous this time around.

Former bid target had historically paid the fattest dividend of the three-listed UK water companies, but a new deal with Ofwat agreed this week sees bills come down and £6.2 billion invested over the period.

As well as a review of its financing plan - it includes increasing the proportion of debt at floating rates and tweaking net debt-to-regulated capital value (RCV) through a £100 million share buy-back - Severn Trent has cut the dividend for 2015/16 by 5% to 80.66p, down from 84.9p in the year to March 2014. After that, the dividend will grow annually at no less than RPI until March 2020. It had been RPI+3% through the previous regulatory period.

It's not a bad result for Severn or its shareholders considering most analysts had pencilled in a 10% cut to the payout. At 2,174p, the shares still yield 3.7%, on a par with and .

Analysts at JP Morgan continue to see the UK water sector as a target for M&A, and also play down the political risk given that management has cut bills and ranks as the country's lowest priced water company. "We do not think that the upcoming UK general election ought to be a barrier to M&A," says JPM. "However, SVT is now trading in line with our price target, and that includes a 60% probability of takeout at a 35% premium to RCV."

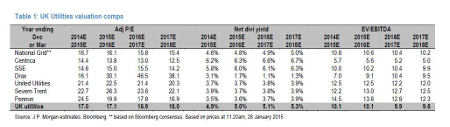

(click to enlarge)

There are also doubts about what premium Severn would attract in any bid situation. A £5 billion bid was turned down in 2013, and the company is worth only slightly more than that now. And as Investec Securities points out, the average premium to RCV paid in M&A transactions over 2010 to the present is about 30%.

"In our view, the current share price at a 24% premium to RCV is a reflection of this trend," says the broker. "If bids do materialise, they may in fact turn out to be lower than has historically been enjoyed by the sector. At the current share price, a 35% premium to RCV bid (as seen for Severn Trent in 2013 by the LongRiver/Borealis consortium) would imply only 10% upside - hardly a game-changer."

According to the table supplied by JPM (see above), income investors would be better off looking at and , both generating a dividend yield of around 6%.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.