Shell takes drastic action after huge earnings miss

29th January 2015 13:45

has ushered in the oil majors' much-anticipated fourth-quarter reporting season, and it's fair to say it's not the best of starts. Profits were way below forecasts, guidance for the year is uninspiring, the dividend is unchanged and more detail is needed on the $15 billion (£9.91 billion) cut to capex over the next three years. CEO Ben van Beurden is not overreacting to low oil prices, but admits that if push comes to shove there's scope to take the red pen to spending again.

Previously celebrated for his decision to sell a chunk of Shell's portfolio on taking the helm in January 2014 and before the collapse in oil prices, van Beurden is desperate to celebrate last year's successes. That included generating $25 billion free cash flow, returning $15 billion to shareholders - $3 billion in the last quarter - and the early completion of its $15 billion divestment target.

But with the oil industry facing big problems and little sign of improvement in the foreseeable future, expect big cost cuts and a huge cut in capital investment, possibly over and above the $15 billion currently slated.

"Shell has options to further reduce spending, but we are not over-reacting to current low oil prices and keeping our best opportunities on the table," van Beurden explains.

Up 12% on the last year, fourth quarter earnings of $3.26 billion was 22% below JP Morgan's guidance of $4.17 billion. Lower oil prices offset improved downstream results, an improved upstream operational performance and high margin liquid production volumes. Basic EPS excluding identified items like impairments, restructuring costs and disposal profits, rose 13% on the year to $0.52, nearly half the $0.92 generated in the previous quarter. Cash flow from operating activities rose from $6 billion to $9.6 billion quarter-on-quarter.

Divestments of $2.5 billion were made in the quarter and oil and gas production fell 1% on the year to 3.2 million barrels of oil per day. Strip out one-offs and volumes rose 7%. Capital investment fell to $7.8 billion from $9.7 billion, taking full-year investment to $23.9 billion.

If the price of Brent crude stays at around $50 a barrel (bbl) - currently $48.8/bbl - Fred Lucas, an analyst at JP Morgan, expects Shell's exploration & production (E&P) business to be loss-making in the first quarter of 2015, given it was close to break-even at $77/bbl. Income from E&P was $149 million, significantly under Lucas' $787 million expectations.

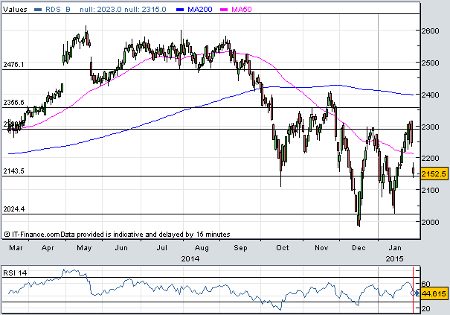

Ahead of an afternoon presentation by Shell's top brass, Lucas repeated his 'neutral' stance on the shares, which fell 4% on these numbers to 2,061p. Industry expert Malcolm Graham-Wood is unsurprised by the news and thinks that operationally 2014 "was a pretty good year".

"Shell are trying to tread carefully, weighing up the temptation to slash capex without overdoing it, in their words 'stepping up the drive for greater capital efficiency whilst being careful not to overreact to the recent fall in oil prices'," he explains.

"They intend to cap organic spend at 2014 levels with the option to further reduce the number if market conditions worsen, a $15 billion fall in capex over the next three years isn't actually that bad in the circumstances."

And while Shell’s dividend is unchanged, it is at least paid in dollars, and the strength of the greenback has positive implications for UK shareholders.

“The latest payment will be around 13% higher than the same one last year thanks to a stronger dollar and a slightly higher payout,” says Justin Cooper, CEO of Shareholder solutions at Capita Asset Services. “If the dollar continues at this level, we could see a 9% currency impact on today’s announced payout climb above 10% by the time the second quarter dividend is paid.”

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks