10 AIM shares for consistent dividend growth

27th February 2015 13:40

by Andrew Hore from interactive investor

Share on

Companies that consistently grow their dividend also tend to provide investors with capital growth. Although many AIM companies do not have a long track record there are some that have grown their dividends over a decade or more. Some of these have even paid more in dividends than their flotation price.

Some of the best examples of how a growing dividend can signal a strong performer are former AIM companies that have graduated to a premium listing. Social housing maintenance and care services provider joined AIM in 1996 at 10p a share. Its maiden dividend was 0.2p a share and in the period since then it has paid more than 61p a share in dividends.

joined AIM in 1999 and raised money at 50p a share, although a share split means that the adjusted flotation price is 15.625p a share. Domino's has paid out 88.3p a share since 1999 and the recent announcement of a final dividend of 9.69p a share takes the 2014 total to 17.5p a share.

As well as paying these dividends to shareholders, both Mears and Domino's share prices are trading at more than 40 times their issue prices.

These are exceptionally good performances but they show that paying dividends does not hamper the growth of the business. It is a rare company share price that does not have a blip at some point, but the ten companies in the table have been able to absorb those disappointments and still outperform AIM - the FTSE AIM All-Share index has fallen over the decade - and most outperform the FTSE All-Share index, which is 50% ahead over a decade, too.

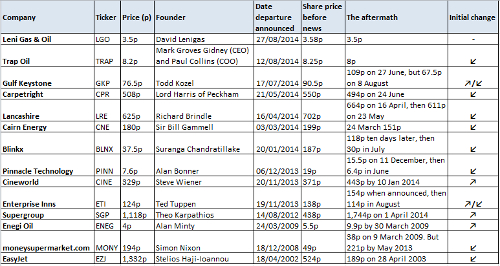

(click to enlarge)

The latest dividends for the ten companies in the table are totals for the full year and some of them will have paid an interim dividend for the current year. Most have increased their dividends each year. maintained its dividend at 10.5p a share for three years, while did not increase its dividend in only one year.

James Halstead and Nichols both moved to AIM from the Main Market and they have long track records going back many decades. There are also newer businesses in the table, such as Alternative Networks and First Derivatives.

In order to pay these growing dividends over an extended period the companies need to be cash generative or they could not continue to pay them. Many of these companies have also used additional cash to buy back shares, which helps the share price performance.

The companies have not necessarily increased their profit every year, but the underlying growth in profit over the decade enables them to continue to push up their dividends in times when earnings drop.

Too many managements' see share issues as free money because they do not pay a dividend and it means that they do not have to borrow money and pay interest. The discipline of paying a dividend is good for a company.

A long track record of dividend growth is not a guarantee of success, though. Pawnbroker Albemarle & Bond consistently grew its dividend until it ran into financial difficulties and eventually went bust last year. Anyone who bought the shares when the pawnbroker floated at 12p a share will have received many times that amount in dividends, although it will have been little consolation for the company's subsequent failure. In 2013, the total dividend was 12.75p a share.

Wine retailer also has a record of growing its dividend, although it did stall in 2008-09. The disappointing current trading means that it may not increase in the short-term. Despite the recent fall in the share price it remains one-quarter higher than ten years ago and in that period more than £1 a share of dividends have been paid.

Ten for consistent dividend growth

Alternative Networks

has not been hampered by being an AIM Award winner. Last year, it won transaction of the year for the £39.4 million purchase of cloud-based managed services provider Control Circle. The telecoms and managed services provider has consistently paid growing dividends since joining AIM in February 2005 via a placing at 100p a share. It has a policy of growing its dividend by at least 10% a year and moving towards 15% annual growth.

A forecast 2014-15 dividend of 16.3p a share is covered 2.1 times by earnings.

Brooks Macdonald

Wealth manager has made strong progress over the past decade despite the tough markets. Discretionary funds under management are rising and have nearly reached £7 billion. There is a further £1 billion of property assets, advisory funds under management of £457m and third party assets under administration of £225 million. Interim figures will be published on 11 March.

A forecast 2014-15 dividend of 30p a share is covered 2.9 times by earning.

First Derivatives

Financial software and consultancy provider paid its maiden dividend of 1.1p a share back in 2004 and has grown its business organically and via acquisition. The latest purchase is US-based predictive analytics software provider Prelytix, which supplies software to analyse real-time advertising and social media data. This should help the group to expand outside the financial sector. The initial payment is £4.9 million in cash and shares. Arden has edged up its 2015-16 operating profit forecast from £16 million to £16.3 million, although earnings per share are unchanged at 50p.

A dividend of 13p a share is forecast for 2014-15, which is covered 3.2 times by earnings.

James Halstead

Commercial floorcoverings manufacturer expects another record period of trading in the year to June 2015 - revenue is 6% ahead in the first half. The Euro's weakness hampers exports but the lower oil price has reduced energy and raw materials costs. Net cash was £38.5 million at the end of June 2014 leaving scope for additional special dividends - Halstead has paid 18.25p a share in special dividends over the past decade including 7p a share two years ago.

A forecast 2014-15 dividend of 11p a share is covered 1.4 times by earnings.

Nichols

Soft drinks maker continues to grow despite losing litigation relating to rights in Pakistan to licensee Gul Bottlers, which could lead to a cash outflow of £10 million. Net cash was £32.9 million at the end of June 2014. Sales, particularly of Vimto, grew faster than the market last year. The 2014 figures will be announced on 5 March.

A forecast 2014 dividend of 23p a share is covered 2.3 times by earnings.

NWF

Agricultural feeds, fuel and food distributor NWF was hit by the weak feed market at the interim stage. Fuels and food distribution both improved their contributions but over all interim profit was lower, although that shortfall could be made up for in the second half. NWF plans to diversify its product range in the feeds sector which will help to offset tough trading conditions for the dairy farmer customer base and provide longer-term growth.

NWF is a relatively poor performer in the table, but the share price is five times the level it was at the beginning of 2000.

A forecast 2014-15 dividend of 5.5p a share is covered 2.2 times by earnings.

Personal Group

Insurance and employee benefits company has historically grown steadily, but the new management team is accelerating growth through acquisitions and organically gaining additional customers. Personal provides employee benefits advice to more than 2 million employees of around 550 organisations in the UK.

A forecast 2015 dividend of 20.4p a share is covered 1.5 times by earnings.

RWS

Patent translation services provider RWS reversed into shell Health Media at the end of 2013 and it started paying dividends when it announced its maiden interim results. Anyone who invested when the original shell floated will still be nursing a loss, but the RWS reversal price was 112.54p - 22.51p after the recent share split. RWS has paid out more in dividends than this reversal price.

A forecast 2014-15 dividend of 4.95p a share is covered 1.6 times by earnings.

Wynnstay Group

managed to maintain its profit in the year to October 2014 despite pressure on margins and weaker feed demand due to the mild weather and falling milk prices. Improved profit from retail - agricultural stores and Just for Pets - offset a lower agricultural contribution. Trading remains tough, but management is still increasing the dividend by 10% a year.

A forecast 2014-15 dividend of 11p a share is covered 3.3 times by earnings.

Wynnstay Properties

Commercial property investor Wynnstay Properties has a portfolio that is 100% let, although a number of leases are coming up for renewal. The historic dividend was covered three times by earnings and the interim has been increased from 4.2p a share to 4.5p a share, even though earnings slipped from 15.4p a share to 12.7p a share due to higher interest charges. This is not an indication that the total dividend will be raised. The NAV was 466p a share at the end of September 2014.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.