BPI undervalued

2nd March 2015 11:44

by Lee Wild from interactive investor

Share on

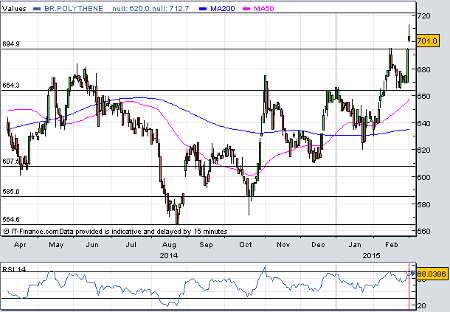

said in December that its full-year results would "comfortably" meet current market expectations. Well, in fact, they beat them easily, and management is optimistic about 2015, too. Analysts have responded by upgrading forecasts and, despite rallying by a quarter since August (see chart), shares in the plastic packaging firm still look good value.

Sales fell in the UK, Europe and North America, and group revenue was down a couple of percentage points at £499 million. But operating profit before restructuring costs jumped by 11% to £26.7 million, driven by a 29% surge in UK earnings to £11.2 million and 13% gain in mainland Europe to £16.3 million, although the weak euro hit reported results there. Operating profit less interest rose 14% to £25.1 million, over £1 million ahead of consensus forecasts.

"This has not happened by accident as management has put a lot of effort into improving the operational performance of the business and, together with an astute investment programme in all of its key geographies, further productivity gains should be realised in the coming years," says John Lawson, an analyst at Investec Securities, referring to a sixth year of profit growth at BPI.

Gains on this side of the Atlantic easily offset a dip into the red in the US following a well-flagged delay in a major installation. But things should improve there this year. "We anticipate a much better year in North America, continued progress in the UK, and another good performance in Europe and we look forward to the remainder of 2015 with confidence," says chairman Cameron McLatchie.

Order books are similar to a year ago, and McLatchie expects good demand from the agricultural sector in the coming months. Total volumes were up just over 1% to 274,000 tonnes despite products becoming thinner, and operating profit per tonne rose by about 10% to almost £100 per tonne.

Clearly, the team is confident enough to increase the dividend by 10%. There is a one-off payment of £11 million to reduce the company's pension deficit, although net debt is still forecast to be just below £30 million at the end of 2015. It was lower than expected in 2014 at £24.1 million as delays on several major projects meant major spend on plant and equipment slips into this year.

Investec has increased its forecasts for underlying pre-tax profit this year by 4% to £27 million, giving adjusted earnings per share (EPS) of 70.6p. Next year it's £28.4 million and 73.6p, respectively. That puts BPI shares on a forward price/earnings (PE) ratio of less than 10. "Still undervalued," says Investec. At its new 800p target price, the shares would still only trade on a modest 11.3 times earnings.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.