Barclays leaves City unimpressed

3rd March 2015 12:17

by Lee Wild from interactive investor

Share on

Profit fell by a fifth at last year as the high street bank set another pile of money aside to cover likely fines for the foreign exchange rigging scandal and payment protection insurance (PPI) mis-selling. Boss Antony Jenkins takes his first bonus since 2012, though, perhaps reward for better than expected adjusted numbers.

Strip out a further £1.25 billion provision for the ongoing investigation into fixing FX rates, £200 million for PPI, and £935 million revaluation of the education, social housing, and local authority (ESHLA) loan portfolio, and pre-tax profit was actually up 12% at £5.5 billion.

And fourth-quarter adjusted profit beat forecasts, but only just. According to Investec Securities' definition of underlying profit, the bank made £1.04 billion in the three months, 3% ahead of consensus estimates. That's because both costs and impairments were a bit better in the quarter, offsetting a 9% fall in quarterly income to £6.02 billion, which was a little light.

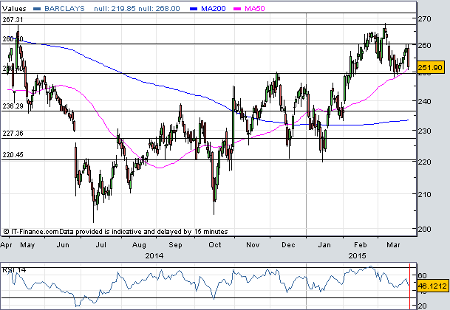

However, profit had been 25% ahead of expectations in the second quarter and 6% in quarter three. Clearly, this quarter's more modest beat is not enough of a catalyst to maintain upward share price momentum. Barclays shares were down 3% mid-morning at 255p, but are still up 23% since October.

And Jenkins, whose £1.1 million bonus takes his total pay to £5.5 million, is talking up Barclays' chances. "Barclays today is a stronger business, with better prospects, than at any time since the financial crisis," he says. "While our work in transforming the bank is not complete, our performance in 2014 gives us confidence that we are on the right track."

As well as divisional performance, the bank has managed to take out almost £1.8 billion of operating costs. And there's more to come in 2015, reckons Jenkins. The bank also aims to target a 40-50% dividend payout ratio after flagging a dividend of 6.5p for last year.

"The statutory result is weak reflecting £2 billion of "below the line" charges, so tNAV (Tangible Net Asset Value) falls 2p QoQ to 285p," explains Investec. "As such, despite recent strong performance, the stock trades on only 0.9x tNAV, but we expect disappointment today."

Still, the Common Equity Tier 1 (CET1) ratio - a key measure of a bank's financial strength - was up a fraction quarter-on-quarter to 10.3%. Selling the Spanish business in January makes it 10.5% now.

Elsewhere, the investment bank (IB) did well in the final quarter, turning a £137 million loss at the end of 2013 into a £35 million profit this time. Africa also grew three-month profit, up 12% to £228 million. Both divisions beat forecasts.

Analysts at Deutsche Bank believes settlement of FX and mis-sold mortgage securities claims should reduce uncertainty and help with visibility on payouts and cost of equity.

"On our numbers Barclays is trading at 9.0x and 8.4x 2015 and 2016 Core EPS and 0.9x TNAV for a 2016 target Core ROE above 12%," says the broker. "The target ROE looks within reach given last year's 11% and an outlook statement which confirmed that 1Q15 run rate IB revenues are on track to 'approach' 1Q14's £2.1 billion, roughly equating to a 26% QoQ increase relative to 4Q14." Deutsche reckons Barclays shares are worth 295p.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.