Direct Line rewards shareholders, again

3rd March 2015 14:46

by Lee Wild from interactive investor

Share on

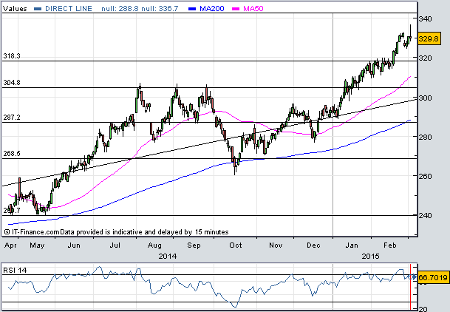

If evidence were needed that investors are chasing income, is it. Shares in the motor insurer have almost doubled since the business was spun out of in 2012, yet they still offer a dividend yield of more than 8%, including special payouts.

Despite falling car insurance premiums and increasing regulatory pressure, the owner of insurer Churchill and breakdown cover firm Green Flag is growing profits and delivering impressive returns to shareholders. As well as a 4.8% increase in regular payouts last year worth 13.2p per share, the company will have paid out 14p in special dividends following a promise of another 4p alongside these full-year results.

"The first and second special interim dividends have resulted from the build up of surplus capital, in part reflecting the group's disciplined approach to underwriting over the last few years," explains the firm. Policy remains to increase the dividend annually in real terms. At 329p, the historic yield is 4% without specials and 8.2% with.

And it can easily afford the payout. "After deducting these dividends, the board considers that the group is strongly capitalised with a risk-based capital coverage ratio at the upper end of its target range. It also has an ‘A’ rating with stable outlook from its credit rating agencies," it adds.

There'll be another special once the company has sold its overseas business. Spanish insurer Mapfre is paying €550 million (£430 million) in cash for Direct Line's Italian and German operations, with most of the net proceeds heading back to shareholders.

Otherwise, given the transition to a Solvency II environment - a new, harmonised EU-wide insurance regulatory regime - the company "is likely to next consider any return of capital alongside the full-year results for 2015."

Direct Line has met or exceeded all four targets for 2014 - group combined operating ratio was up 0.2 percentage points to 95%, which means premiums easily exceeded claims; a commercial combined operating ratio of 98.8% beat the target of less than 100%; costs were cut by 5.6% to below the £1 billion target; and return on tangible equity rose 80 basis points to 16.8%.

Gross written premium from ongoing operations were down 3.8%, but up 0.4% in the fourth quarter compared with 2013, while operating profit was stable at £506 million and pre-tax profit jumped by 12% to £456.8 million.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.